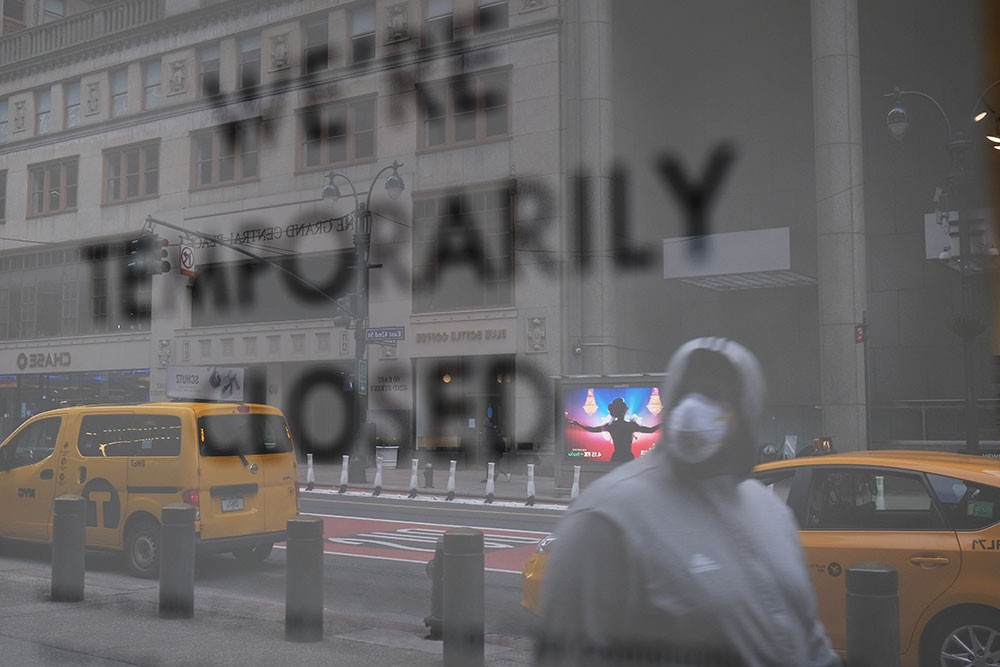

As the US presidential election on 3 November looms, businesses and markets in the US are facing significant levels of volatility as they strive to maintain a steady course in the face of the pandemic, lockdowns and a challenging economy.

There are a number of variables at play, including on-again-off-again stimulus talks and questions around the speed and safety of a coronavirus vaccine.

Ongoing volatility

In March, coronavirus lockdowns put the US economy into reverse. In the second quarter of this year, it contracted by a record 32.9%. Between February and May, more than 14 million people in the US became unemployed and the unemployment rate jumped from 3.8% to 13%, although that figure has come down in the weeks leading up to October.

Business bankruptcies are ‘trending toward a 10-year high’, according to EY. ‘However, due to the unique nature of the pandemic and its underlying cause for the current economic downturn, the effects on different industries, sectors, populations and geographies have been incredibly varied.’

If we do not see a stimulus bill passed before the election, I think we will be poised for a huge tank in the market

The recovery is likely to be just as uneven. Stock markets that boomed under the Trump administration crashed in March before getting back into positive territory in September, despite the broader economic slowdown.

‘Wall Street’s focus at the moment is on any stimulus package Congress is able to pass,’ says Juan Arciniegas, a Miami-based principal at private equity firm 777 Partners. ‘We expect high volatility in the near term as the markets react to news coming out of negotiations in Congress. If a comprehensive bill passes, or even some ad-hoc ones, markets should react positively.’

Economic swings

There is very little that can be said with certainty about almost anything – from when a vaccine for the coronavirus will be available to which party will generate more economic growth.

‘Historically speaking, people think that with a Republican president you have bigger tax cuts for corporations, so the market must experience more growth,’ says Andrew Hill, a financial advisor at Equitable Advisors in Los Angeles. He made it clear that he was not giving financial advice in noting that while that was true during the administration of Ronald Reagan, the S&P 500 index grew more under Barack Obama than under George Bush Jr or Donald Trump. ‘With Trump we saw a lot of growth, but that growth was knocked out during coronavirus.

‘The only thing we can be certain of at this time is volatility,’ says Hill. ‘And if we do not see a stimulus bill passed before the election, I think we will be poised for a huge tank in the market.’

What to expect

There are very few aspects of life that will not be affected by the US election. The question for many is how?

In a paper released this month, EY’s Office of Public Policy outlined scenarios for eight key issues that will be directly affected by the outcome of the election.

- COVID-19: Trump has used executive actions and focused on economic recovery and a return to normality. More of the same could be expected from a second term, even after he contracted the virus himself. Joe Biden has said he would focus on public health first, along with a ‘decisive economic response’.

- Economic recovery and job creation: This will be a key issue regardless of who wins. EY expects big infrastructure packages to become a centrepiece of the next administration along with ‘Buy America’ plans and a push to ensure more domestic hiring.

- US-China relations and trade: Both Democrats and Republicans seem convinced than a stronger line is needed to deal with China. Trump may deploy more tariffs, while Biden may be more likely to seek a ‘multilateral approach’.

- Environment: A Biden win could bring more focus back on environmental action but, given the likely slim majorities on either side, executive actions and agency rules are likely to determine future action.

- Social justice: Trump has set himself up as a law and order president, and social justice reforms are not specifically part of his agenda. Biden has put forward plans to advance racial equity and fund more community policing. Regardless, with protests ongoing across the country, the issue is likely to remain front and centre.

- Health care: Trump is likely to continue working to repeal the 2016 Affordable Care Act (ACA), while a Biden administration is likely to push more expanded access to affordable health care by rising ACA subsidies and tax credits.

- Taxes: Trump has said he will push for more tax relief. Biden wants to increase corporate taxes from 21% to 28%, although he has said that people making less than US$400,000 per year will not see any tax increases. Still, given a federal deficit expected to hit US$3.3 trillion by the end of the year, higher taxes are likely.

- Technology: Social media companies and Chinese technology are likely to remain in the crosshairs of a Trump administration. Biden has put forward a Build Back Better plan that focuses on expanding R&D.

National polls currently show Biden leading Trump, but only a fool would believe that guarantees the Democratic candidate victory. Hillary Clinton also had a clear lead over Trump in the polls for almost the entire 2016 campaign. The only thing that can be guaranteed is that volatility will continue until the election and probably beyond, particularly if there is a protracted period of time without a clear winner.