How are practices faring as the pandemic continues to impact global business?

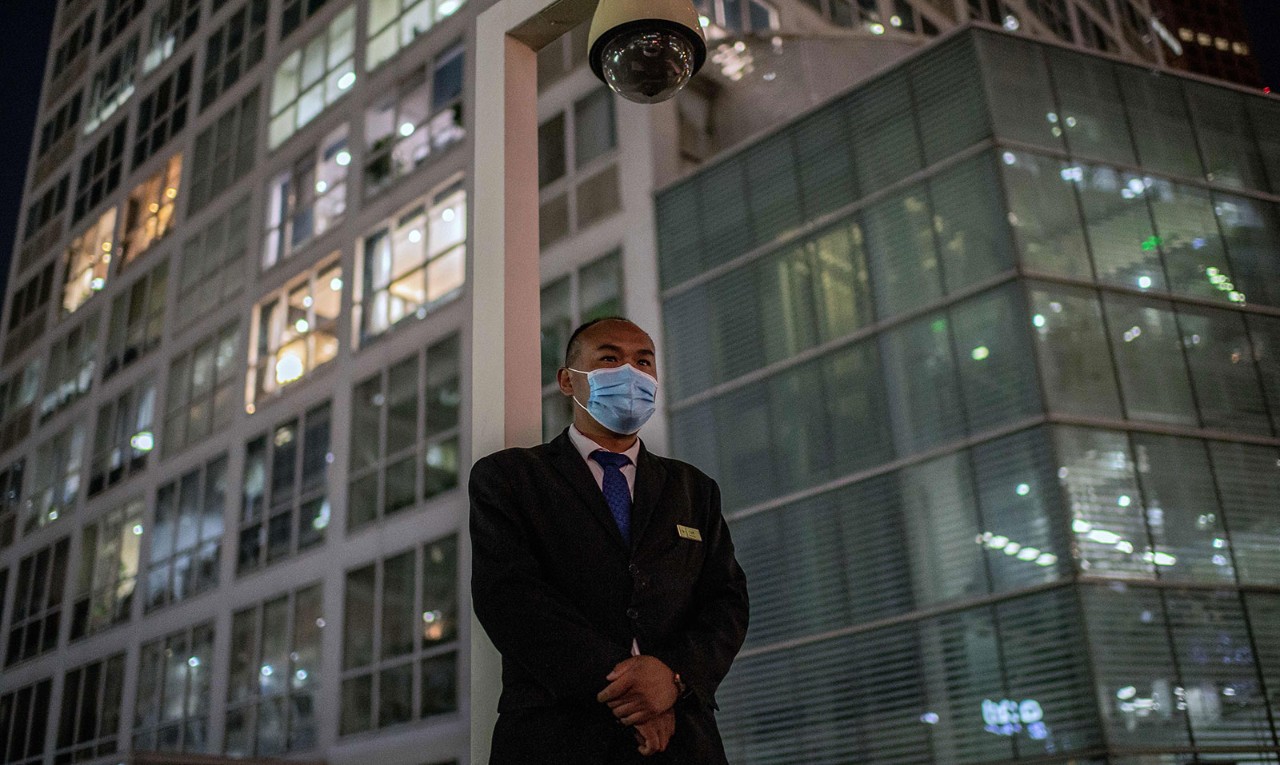

Taurus Lo, director at Jonten Hopkins CPA, which has offices in Hong Kong and Guangzhou, says that at the onset of the pandemic in Asia, a shortage of face masks in Hong Kong, along with pressure from staff to work from home during the peak accounting season, was a daily reality.

‘To avoid transmission of the virus, some colleagues were not willing to visit clients’ offices, while some clients requested no on-site audit work this year,’ Lo says. ‘Our audit team changed their approach by preparing as much of their work as possible in the office first. Our clients appreciated this arrangement.’

To keep staff safe at work, an outsourced cleaning company was engaged to sterilise the firm’s office twice a week, in addition to twice-daily cleaning of common areas by the in-house administrative staff.

We shared the benefit of the government reduction in social insurance with our clients, and reduced related fees for clients experiencing difficulties

Survive and thrive

IFAC, the International Federation of Accountants, has identified six key ways for small and medium-sized practices to evolve post-pandemic:

- Focus on staff. Considering the emotional and psychological toll on your team can boost their loyalty and retention.

- Communicate with clients. This is the best time to reach out and provide support as their trusted business adviser.

- Access external resources. For example, IFAC has a dedicated Covid-19 website covering many practical matters, as well as professional and personal well-being.

- Diversify your services. As the coronavirus upends many small businesses, SMPs can rise up and demonstrate their relevance.

- Review risk management. Having perhaps experienced cashflow issues, SMPs should plan ahead for continuity and disaster recovery.

- Invest in technology. The crisis has highlighted the importance of having a robust IT strategy.

By the second wave of the virus in July, the firm had started work-from-home arrangements, with two teams alternating between periods of home-working and office-working. However, Lo says that efficiency suffered, as tasks requiring the examination of client documents are not conducive to home-working. He also had to navigate a slight fall in the firm’s revenue to meet some clients’ requests for a fee deduction.

‘Looking forward, the firm plans to change to a paperless working environment,’ Lo says. ‘With documents scanned to the server, our staff can still easily assess client documents at home and perform their work without affecting efficiency. I think a digital working environment is the future trend for accounting firms.’

Agile approach

In mainland China, Jason Li, managing partner at PKF China, says his firm took an agile approach. Working schedules were rearranged to suit clients, and arrangements were made with those whose payments might be delayed.

Faced with cost and revenue pressures, the partners channelled their energy into promoting business survival. ‘We focused on cost-saving and developing new clients,’ Li says.

As a result, the firm has managed to keep most of its stable clients, who ‘are still optimistic about the economic development of China’s domestic market’.

Shrinkage and shortage

Vicky Wei FCCA, associate director at SBA Stone Forest in Shanghai, encountered multiple challenges. Not only did clients’ businesses shrink – some retail, food and beverage, and media businesses even made the hard decision to close down operations in China at the peak of the pandemic – internally, there was also a shortage of manpower.

‘Some of our employees were unable to return to the office due to travel restrictions,’ she says, ‘and the lockdown also made it difficult for us to recruit new staff.’

However, equipping all staff with laptops ensured continuity of service, and the firm’s clients and business partners were kept well informed.

‘To get through the tough year together, we shared the benefit of the government reduction in social insurance with our clients, and reduced related fees for clients experiencing difficulties,’ Wei explains. ‘We also updated our renewal process, so this year’s service fees will be retained for most clients.’

Leveraging new online business opportunities in sectors such as retail, the firm provided advisory services to help clients transform their business model.

‘We also held webinars and online lectures putting forward many professional suggestions on finance, tax and human resources to help companies manage the impacts of the pandemic,’ she says.

In-house, a reading project was initiated for managers, who are encouraged to retain the habit for self-development going forward.

With the future still holding many uncertainties, SBA Stone Forest sees Covid-19 not just as a crisis but also an opportunity.

Wei says: ‘This pandemic has accelerated our process to be more focused on advisory services to clients. In the future, we are aiming to expand our upstream and downstream industry chain to find more opportunities, and cooperate with more business partners such as IT companies to develop products to build an integrated SaaS ecosystem.’