How do you make sure that your public sector accounts are capturing the real value of assets and liabilities? Accrual-based accounting is how.

Take the example of building a well to serve a rural community. Under cash accounting, the construction costs are recognised in year one, but after that the well disappears from accounting view. There are no records to indicate whether the well is doing what it should or if it needs maintenance. Nor is there any information on funds available to build more wells.

The situation is completely different under accrual accounting, where the well is assigned a value based on its working condition. Accrual accounts accordingly provide useful information for decision-makers to understand where additional resources should be allocated to finance the replacement of vital assets.

This well scenario is a real example, from Tanzania, cited in a new report issued by ACCA and the accountancy profession’s global body IFAC (International Federation of Accountants). The report, Is cash still king? Maximising the benefits of accrual information in the public sector, draws on extensive research, including interviews and roundtables with experts with experience of implementing accrual accounting.

The trouble with cash

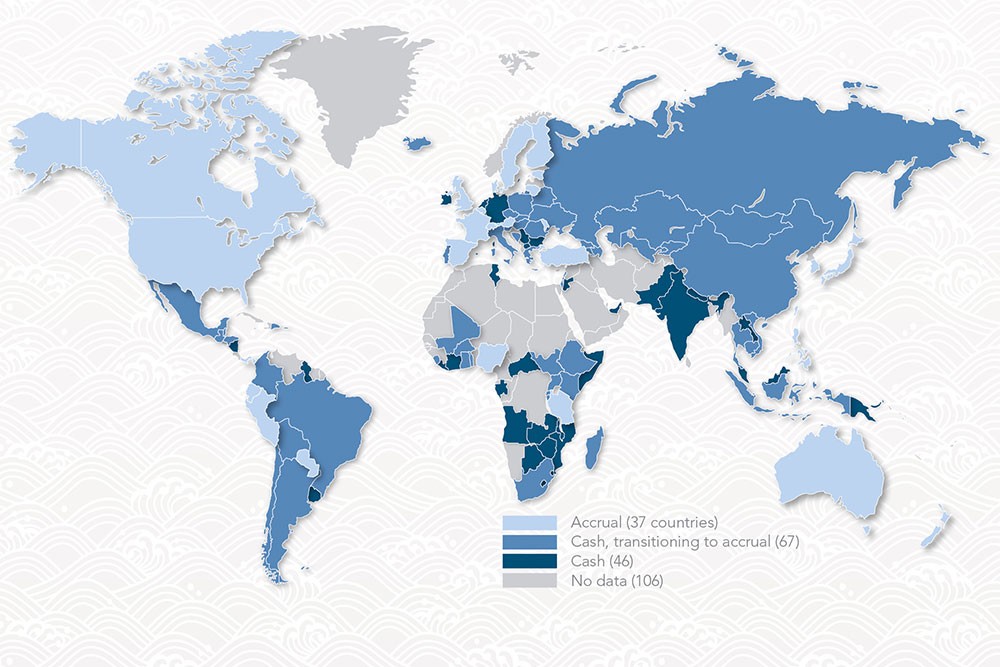

The report acknowledges that cash accounting, which was applied in 2018 by 75% of all governments in some form, has its uses, but warns: ‘Cash accounting doesn’t present the most accurate picture of a government’s financial health, nor does it enable decision-makers in the public sector to adequately plan for the development, delivery and maintenance of the services, programmes and infrastructure on which people rely.’ That, in turn, leads to a breakdown of trust in governments.

Accrual accounting has none of these weaknesses. As well as providing useful information on assets, it shines a brighter light on liabilities, such as pension schemes. If holes are appearing, they should become apparent. Accrual accounting allows governments to take decisions that support their goals without burdening future generations with unmanageable debt.

Encouragingly, according to the 2018 International Public Sector Financial Accountability Index, 65% of governments surveyed have implemented accrual accounting or plan to by 2023. This means that about 40% of them are currently transitioning to full accrual accounting. This, as the report points out, is ‘a truly momentous global transition’.

Information generated by accrual accounting can dispel fiscal illusions and avoid perverse incentives

Reap the rewards

The Is cash still king? report offers the following tips for maximising the benefits of accrual information:

- Adopt a ‘net worth’ perspective in setting fiscal rules, remembering that what gets excluded gets exploited.

- Improve asset management by using accrual information to highlight where asset maintenance is inadequate as well as to identify decommissioning/replacement costs.

- Use asset impairments to challenge the performance of public sector projects.

- Direct fiscal policy institutions to assess contingent liabilities and produce recurring fiscal risk reports.

- Use accrual accounting as the baseline for intertemporal balance sheets and fiscal sustainability reports.

- Plan to align the bases for budgeting, reporting and forecasting, as working from comparable bases will provide more current data that can improve forecasts.

- Implement accrual budgeting to put finance at the heart of decision-making, while embedding performance management across government.

Transitioning governments can anticipate enjoying the core benefits of implementing accruals-based accounting. Those advantages include delivering value for money, facilitating public scrutiny and putting finance at the heart of decision-making, and they are all derived from the provision of new, decision-useful information.

Information generated by accrual accounting can dispel fiscal illusions (ie accounting devices that give the illusion of change without any substance) and avoid perverse incentives. For example, governments using cash accounting can be tempted to postpone payments to suppliers or lenders in order to choose the financial year in which transactions appear. In doing this, not only is the financial position misstated, but deferring payments may result in government facing additional interest costs.

Compelling but challenging

The benefits are compelling, but moving from cash to accrual accounting is likely to be a highly complex process. Transitioning governments may benefit from the experiences of those who have gone before. The report has 30 specific recommendations for public officials planning to introduce accrual accounting. These address how to maximise the benefits (see panel) and cover key topics such as setting objectives and planning, engaging stakeholders, creating effective systems and developing skills.

On the subject of skills, finance staff have to produce analysis based on accrual accounting information to help policymakers take a long-term view. Governments will therefore need to increase the number of qualified accountants they employ. They may also need to introduce training programmes (read about ACCA training that would help meet these needs).

Internal training will need to extend beyond the preparers of accounting information to include auditors, members of parliamentary committees and procurement officials, among others. If accrual-based accounts are to have maximum impact, a broad pool of stakeholders will need to be able to interpret the new information they receive.

Policymakers and public sector officials gearing up for the challenge of implementing accrual accounting should remain focused on the benefits awaiting them. Governments that use accruals-based accounts take a longer-term view of their finances than those that rely on a cash basis. Strong balance sheet management supports low borrowing costs, which in turn gives governments greater flexibility to respond to emerging pressures and absorb fiscal shocks. In what seems to be an ever more volatile world, those advantages are well worth pursuing.