As the chancellor prepares to set out how he will plug the gaping holes in the country’s pandemic-shattered finances, could a proposed wealth tax provide the answer? It is an intriguing proposition, but one that could well gain traction in the run up to Rishi Sunak’s Budget on 3 March 2021.

In December 2020, the Wealth Tax Commission released its final report on a one-off tax that could raise £260bn over the course of five years. The commission – which includes academics from Warwick University, the London School of Economics and a tax barrister – recommended the chancellor consider such a tax over other proposals, which could include increases on income or spending, typically income tax, corporation tax and VAT.

Introducing a wealth tax without reform to capital gains and inheritance tax could make the UK’s overall tax rates on capital some of the highest in the world

The downfalls

For the record, Rishi Sunak himself ruled out any possible wealth tax in July last year, when he said: ‘No, I do not believe that now is the time, or ever would be the time, for a wealth tax.’ But as the government has proved on many occasions during the pandemic, when the facts change, policy has to change as well.

But if he were to pursue such a tax, there could be push back from a number of different quarters. The commission quotes research that would indicate that those who would most likely be caught up by a wealth tax are those approaching, or at, retirement age.

Some may see this as an opportunity to rebalance intergenerational wealth, while others could argue that it is a tax on those that have saved diligently for their retirement.

Yet others would see this as an attack on entrepreneurs and other ‘wealth creators’, who in turn create jobs and drive the economy forward.

But as Dr Andy Summers, associate professor at the London School of Economics and another co-author of the report, says: ‘Our report provides the first serious look at proposals for a UK wealth tax in nearly half a century. A one-off wealth tax would work, raise significant revenue, and be fairer and more efficient than the alternatives.’

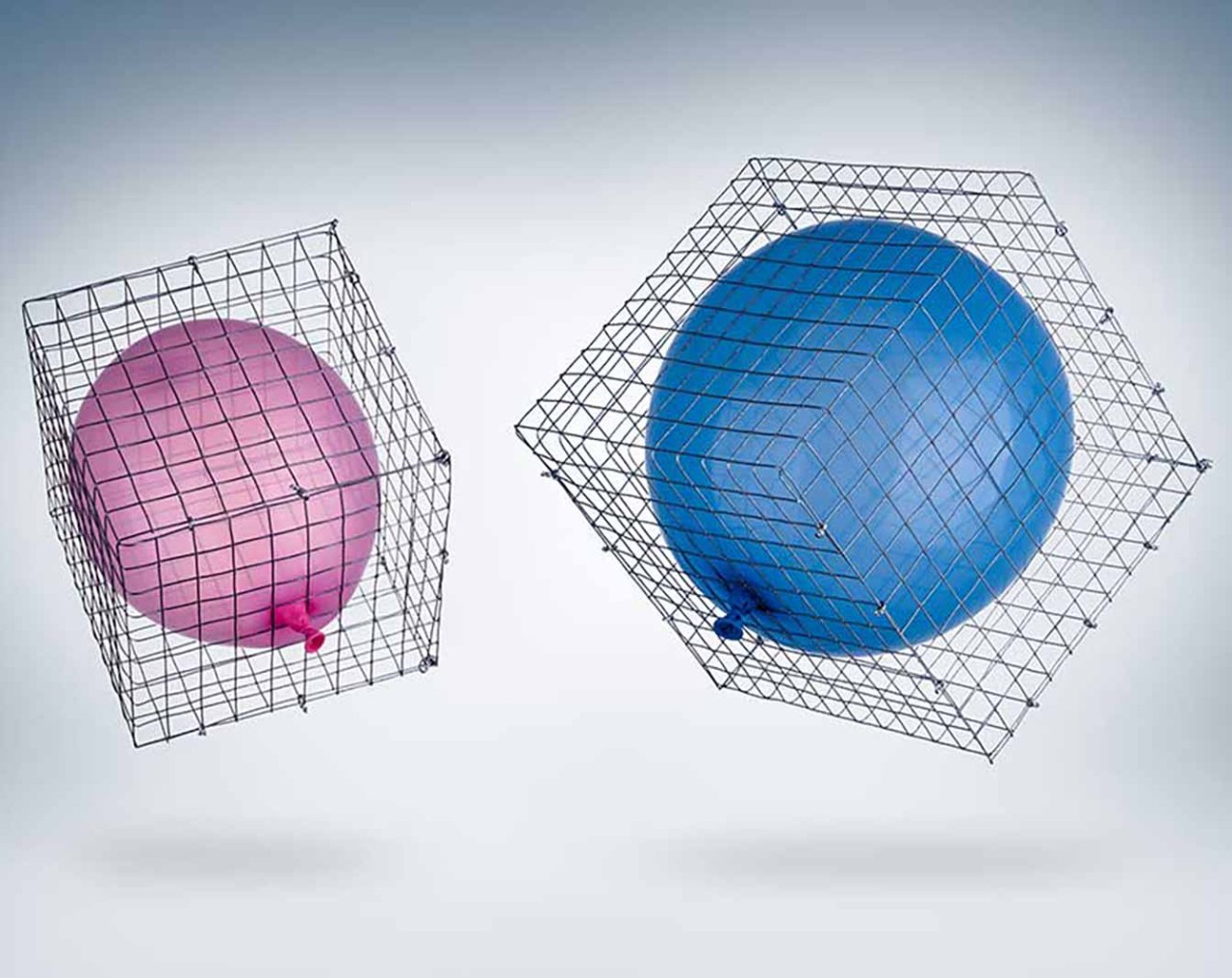

The £260bn would come from a one-off wealth tax on households (typically a couple) with assets worth £1m (or £500,000 per individual), including primary residence and pensions less debts such as mortgages, paid at 1% a year for five years. This, according to the commission, would be the equivalent to raising VAT by 6p or the basic rate of income tax by 9p for the same period. A politically more acceptable threshold of £4m per household would raise £80bn.

One-off taxes have been used after major crises before, including in France, Germany and Japan after the Second World War, and in Ireland after the global financial crisis in 2008. At individual thresholds of £500,000, £1m and £2m, a wealth tax would respectively cover 17%, 6%, and 1% of the adult population.

The commission argues that a one-off wealth tax would be fair, efficient and very difficult to avoid.

- fair because wealth provides ‘opportunity, security and spending power’. Those with the most wealth have the ‘broadest shoulders’ to afford an additional contribution to society in times of crisis

- efficient because, unlike taxes on work or spending, a one-off wealth tax would not discourage economic activity. The administrative costs would also be small as a proportion of the revenue raised

- very difficult to avoid because a one-off wealth tax could not be avoided by emigrating or moving money offshore.

Rounded approach

However, Kayleigh Havard, a tax manager at Saffrey Champness, reminds us that these are only recommendations. ‘What is clear is that the future of tax is up for debate right now, and solutions are needed,’ she says. ‘Change is on the horizon, perhaps starting in the 2021 Budget. But if it’s to be a wealth tax, and if it’s to achieve the primary goal of helping balance the books, then it must be fair, proportionate and recognise the importance of wealth creation to economic growth.’

Jo Bateson, partner with KPMG UK’s Family Office & Private Office team, agrees that the decision of whether to introduce a wealth tax in the UK should not be taken in isolation and instead should be part of a broader review of how the UK taxes capital.

‘Introducing a wealth tax without reform to capital gains tax and inheritance tax would potentially make the UK’s overall tax rates on capital one of the highest countries in the world,’ says Bateson.

Emma Chamberlain, barrister at Pump Court Tax Chambers and one of the co-authors of the report, says: ‘People sometimes say the super-rich won’t pay. My experience is they are happy to pay, as long as the tax is simple to operate, affordable and they don’t feel they are being singled out with penal rates. The trouble is that our current way of taxing the wealthy is far too complicated, leading to avoidance and resentment.’