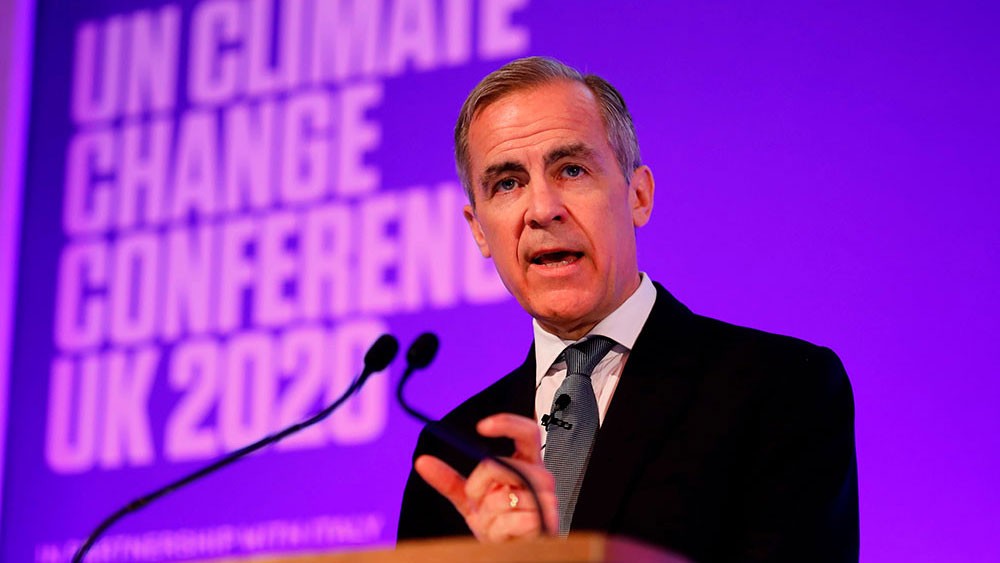

As COP 26 finance adviser and UN special envoy Mark Carney made clear at the IFAC and ACCA Climate Week event in September 2020, the accountancy profession is essential to the world achieving a low-carbon economy.

The contribution of individual accountants to the transition will obviously depend on their role, but there are few activities that accountants undertake that do not require them to think about climate impacts and their financial consequences.

The transition to a net-zero world capable of keeping global warming to no more than 2°C higher than pre-industrial levels requires climate-literate accountants who can:

- advise their clients and employers on the risks, liability and reputational damage arising from corporate activity that contributes to climate change

- support the strategic, operational and financial assessment of climate change, and steer their organisation towards the opportunities that decarbonisation brings

- provide management and investors with the information they need to understand the current and prospective impact of climate-related matters on an organisation and its financial position.

Running out of time

The MSCI’s Net-Zero Tracker gauges the progress of most of the world’s public companies (it covers around 99% of the global equity universe) toward reducing emissions. It shows that without any change in their current emissions, listed companies will deplete their remaining emissions ‘budget’, based on meeting the Paris Agreement’s target of limiting global warming above pre-industrial levels to 1.5°C, in just five years and three months. Companies have 21 years before they use up the emissions budget to limit global warming to a less ambitious 2°C.

Climate change can be taken into account in valuations only when companies have incorporated climate-related risks in their financial performance

Net-zero emissions commitments give a clear signal of intent to achieve the targets of the Paris Agreement, but there is significant work to be done. In particular, companies need to put in place targeted strategies, to set robust short and medium-term goals, and to ensure, where possible, that future investments are clearly aligned.

A growing suite of climate tools is available to businesses. Climate Action 100+, an investor-led initiative, has put in place a net-zero company benchmark to help track business alignment with the Paris Agreement. And more than 40 asset managers, including Vanguard and BlackRock, have signed up to the Net Zero Asset Managers Initiative, pledging to make their portfolios net zero by 2050 or earlier.

In his 2020 annual letter to the world’s CEOs, BlackRock boss Larry Fink called on all companies ‘to disclose a plan for how their business model will be compatible with a net-zero economy’. With the cost of capital for fossil fuel options increasing, capital markets have started to make decisions about the transition to renewable and sustainable energy. Financial capital is seeking solutions to reduce greenhouse gas emissions.

Meanwhile, driven by the significant threat of climate-related stranded assets, the Network for Greening the Financial System – a grouping of 83 central banks and financial supervisors – is assessing its members’ role in ensuring the resiliency of the financial system and the solvency of financial institutions (see its March 2021 publication Adapting Central Bank Operations to a Hotter World).

Finance teams provide the information needed to drive decisions and allocate capital, and typically interface with the capital markets

Missing information

A major challenge for investors and the capital markets is that climate risk disclosure globally is inadequate. For climate risk to be fully reflected in company valuations, every company, bank, insurer and investor needs to disclose their climate-related risks on a standardised basis. Company valuations in a world that complies with the 2°C temperature rise maximum will likely be very different given the potentially significant implications for future cashflows.

Climate change can be fully taken into account in valuations only when companies have incorporated climate-related risks in their financial planning and performance. As climate is increasingly integrated into corporate decision-making and reporting, valuations will better reflect the actual and potential climate impacts.

Accounting and finance professionals have a critical role in achieving global net-zero emissions. In particular, CFOs and finance teams provide the information needed to drive decisions and allocate capital, and typically interface with the capital markets. Accounting for Sustainability’s Net zero – a practical guide for finance teams highlights the key activities of finance teams in helping to achieve net zero in their organisations.

Measure and monetise

We heard from KPMG at IFAC’s March 2021 meeting of the professional accountants in business advisory group that a significant challenge in climate-risk assessments and disclosures is that climate impacts are not quantified and monetised.

Quantification helps to drive medium and long-term planning, and is where accountants involved in financial planning and analysis can significantly contribute – by providing financial-related information about profits and valuations that reflect climate-related risks and events.

Unless companies quantify climate risks and opportunities, they will find it hard to compare climate change against their wider enterprise risks, while investors will be unable to make informed decisions about the allocation of their capital.

Accountants also need to be aware of the critical link between internal financial planning and external reporting. Carbon pricing is essential to understanding climate risk and a company’s economic outlook. Consequently, carbon pricing assumptions from internal financial planning need to carry through to financial reporting.

Pivotal commitments

It may have been slow to start, but a low-carbon transition is under way. It will change how economies operate, creating not just uncertainty but also significant opportunity.

Governments and businesses are rapidly setting net-zero emissions targets. Some jurisdictions such as the EU, US and China are setting increasingly aggressive targets. To date, about 140 governments and at least a fifth of the world’s 2,000 biggest listed companies have made net-zero commitments.

However, these ambitious commitments disguise the reality: business as usual remains prevalent.

Unless companies quantify climate risks and opportunities, they will find it hard to compare climate change against their wider enterprise risks

Inconsistent use of carbon pricing assumptions in asset and liability valuations for accounting and public disclosure hides from investors the potential for adverse effects of lower asset values, higher impairment losses, shorter estimated useful lives, and earlier asset retirement costs.

More than marketing

Understanding and communicating how their company is becoming net-zero compatible will be part of any finance leader’s conversations with boards, investors and other stakeholders. They will need to explain risks and opportunities, targets and KPIs, prioritisation of capital investment, and financial impacts, including how climate change relates to accounting estimates and judgments used in the preparation of financial statements and reports.

For climate reporting to move beyond being a marketing exercise to providing information that boards and investors need to enable decarbonisation, accountants need to be part of the equation and rise to the occasion.