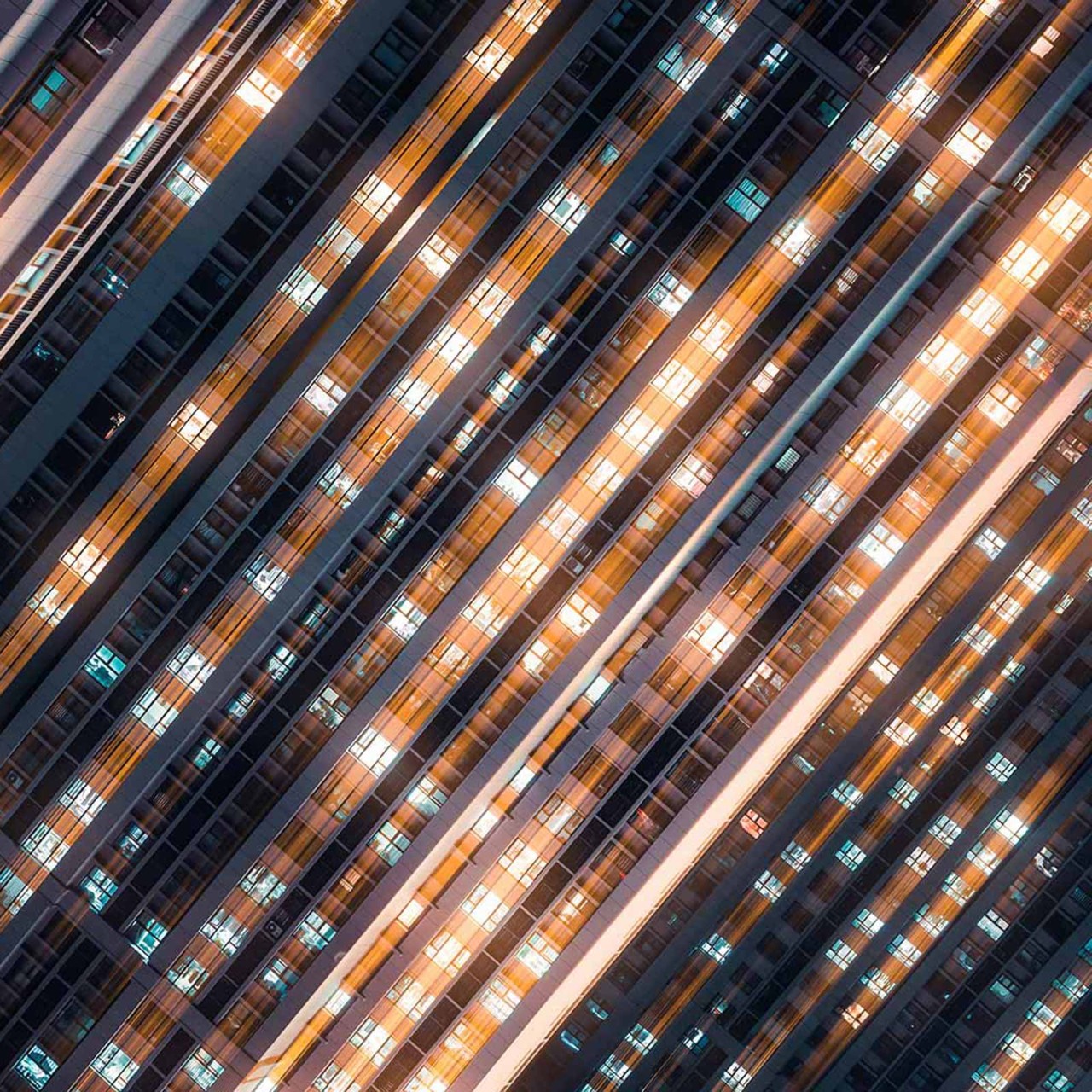

The Middle East is, in truth, something of a laggard when it comes to electronic shopping. While the Gulf Cooperation Council (GCC) countries enjoy global fame as experiential shopping destinations – the newly opened Via Riyadh in the Saudi capital is one of many must-visit venues, stuffed with luxury retail and hospitality, along with personal assistants and porters – the e-commerce market is by no means as impressive.

That, though, doesn’t mean it can’t ultimately be so. There are, in fact, distinct signs of a major expansion in the GCC’s e-commerce economy that will drive demand for relevantly skilled professionals, including for finance professionals with sector experience.

In 2021, for example, Deloitte ran an e-commerce bootcamp in Saudi Arabia designed to strengthen youth employment opportunities, spark a local startup and entrepreneurship mindset, and attract global and regional players to operate in the kingdom. For the Middle East as a whole, growing the e-commerce economy will also draw in a steady supply of skilled finance professionals to serve it.

‘Only a third of consumers in the Middle East are open to online transactions’

E-resistant

But there’s some way to go before that point is reached. Sebastian Buss, chief marketing officer at EcommerceDB, says there are cultural and technological reasons for the Middle East’s weak online retail market.

Citing the global consumer insights survey of EcommerceDB’s parent company Statista, Buss says: ‘Consumers in the Middle East, roughly 50%, like to touch things before buying them, which hinders e-commerce on the one hand, and promotes malls on the other. This is not the case in strong e-commerce markets such as the US and UK. And while credit card usage is common, only a third of consumers in the Middle East are open to online transactions.’

Internet penetration has also traditionally been a barrier – it stands at 66% of the population in the Middle East, compared with 92% in the US, 90.2% in Europe, 73% in Oceania and East Asia, and 73% in South America. ‘Internet penetration is a ceiling for e-commerce penetration,’ says Buss. ‘If you do not have internet, you cannot shop online.’

On the up

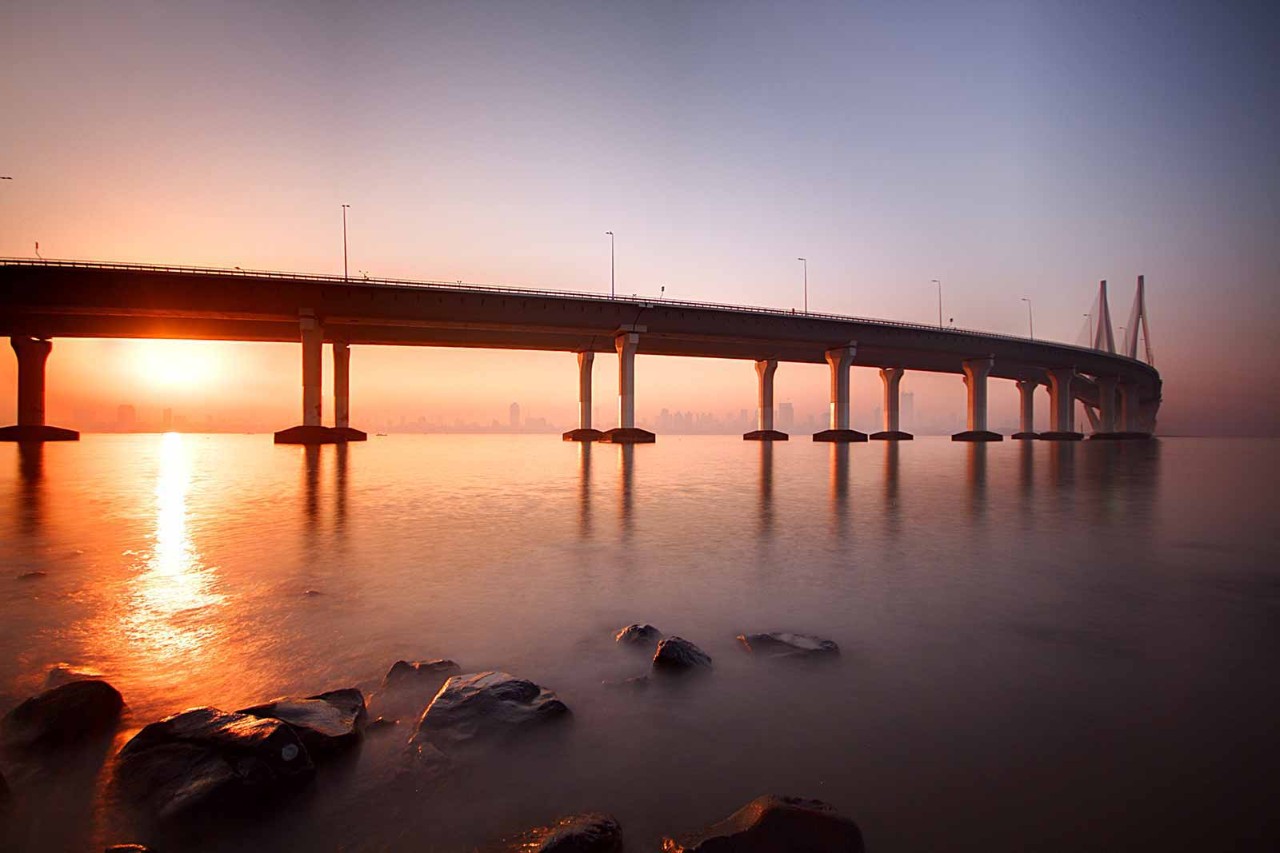

While underdeveloped internet connectivity, particularly in more rural areas and in certain countries, has also been a headwind for online payment solutions and supply chain logistics, there have been seen significant improvements in such infrastructure recently across the Middle East.

Remo Giovanni Abbondandolo, general manager for MENA at Checkout.com, says: ‘Governments and private sector players are actively investing in logistics, which has led to better last-mile delivery networks and fulfilment capabilities. As for online payment solutions, the integration of various payment options, including local and international methods, has made it more convenient for consumers to transact online.’

These infrastructure gains are supported by accelerating digitisation as part of government strategies to diversify hyrdocarbon-based economies.

‘14% of consumers in Saudi Arabia say they shop online at least once per day’

There is also an increasingly enthusiastic market for e-commerce across the Middle East, especially in the wake of the pandemic. Younger, digitally native consumers are spending more time online and demanding convenience, especially via mobile devices. A recent McKinsey consumer sentiment survey projected 19% year-on-year growth in the UAE retail mobile-commerce market to 2025.

Abbondandolo says: ‘In Saudi Arabia, for example, 91% of consumers now shop through e-commerce. Perhaps even more striking is that a staggering 14% of them say they shop online at least once per day. While in the UAE, 96% of consumers now shop via e-commerce, an increase from 89% last year. These numbers are a testament to the rapidly evolving digital economy and the consumer demand for the flexibility and comfort to shop online.’

Expansion

The e-commerce market in the GCC currently accounts for just 1.8% of GDP, according to Alpen Capital’s retail industry 2022 report. However, while the Middle East market overall is a fifth the size of the EU’s and a 14th of the US and Canada's combined, and the UK’s is 13 times the size of the UAE’s, the sector is broadly beginning to flourish, with strong growth in solutions and market entrants.

‘The Middle East e-commerce market is shaped by a mix of key players, including both local and global names,’ says Abbondandolo. ‘International giants like Amazon and Alibaba have made significant inroads into the region, driving competition and innovation. Their presence has helped raise consumer awareness and trust in e-commerce, contributing to market growth.’

‘Both local and global players are vying for a share of the growing market’

Local players in the region include Noon (Saudi) and Desertcart (UAE). Amazon entered the Middle East by purchasing the Arab world’s largest e-commerce platform, Souq.com, in 2017, gradually transitioning the brand to Amazon in the UAE, Saudi Arabia and Egypt. Local players can leverage their understanding of regional nuances, languages and consumer preferences to achieve success, which makes them an attractive prospect for global players seeking a market foothold, says Buss.

Local fintech and logistics startups, such as the finance enabler Tamara, which recently raised US$150m in debt financing from Goldman Sachs, are also playing a crucial role in addressing regional challenges and enhancing the overall e-commerce ecosystem.

As cultural and technological barriers are overcome, forecasters expect online shopping to continue its rapid growth. So, while destination shopping may be here to stay, it is likely to exist alongside its digital counterpart. Abbondandolo says: ‘The playing field in the Middle East is becoming increasingly competitive, with both local and global players vying for a share of the growing market. This healthy competition is expected to drive innovation, improve customer experiences, and contribute to the continued expansion of the e-commerce sector in the region.'