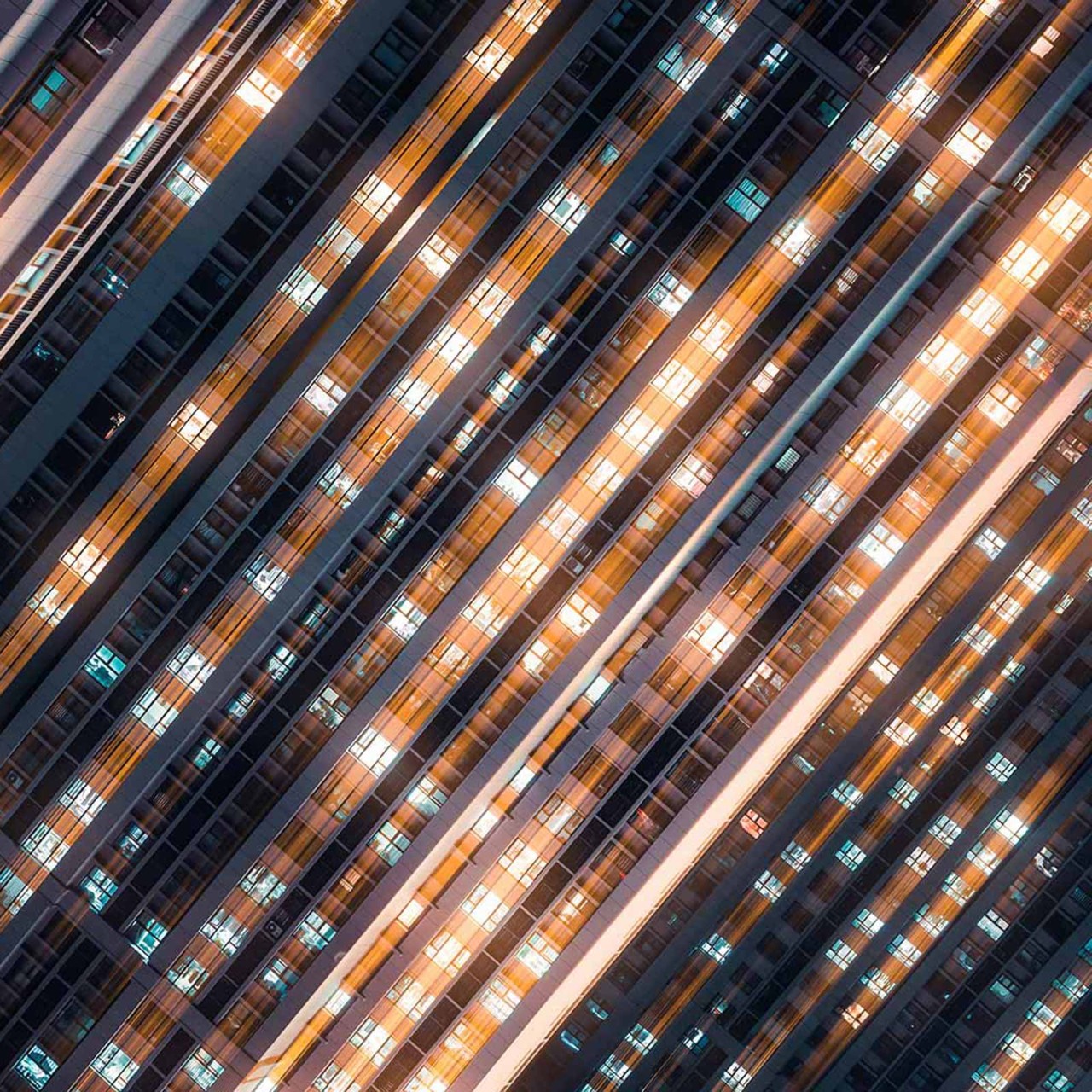

I sometimes feel that I have woken up inside The Midas Plague, Frederik Pohl’s science-fiction classic from 1954. It’s set in a heavily automated US, where production exceeds demand and people are pressurised to over-consume to absorb the excess. Only the truly wealthy can lead simple, uncluttered lives.

I have been analysing a number of CEO compensation packages recently and two things stand out. First, the most popular metric by far is some sort of growth: revenue, profit, margin expansion, whatever. The best way for a CEO to maximise pay is by growing the business. Second, environment, social and governance metrics tend to be a very small driver of total pay and are often subjective rather than numerical.

I challenge readers to name a company where the CEO is directly incentivised to reduce production

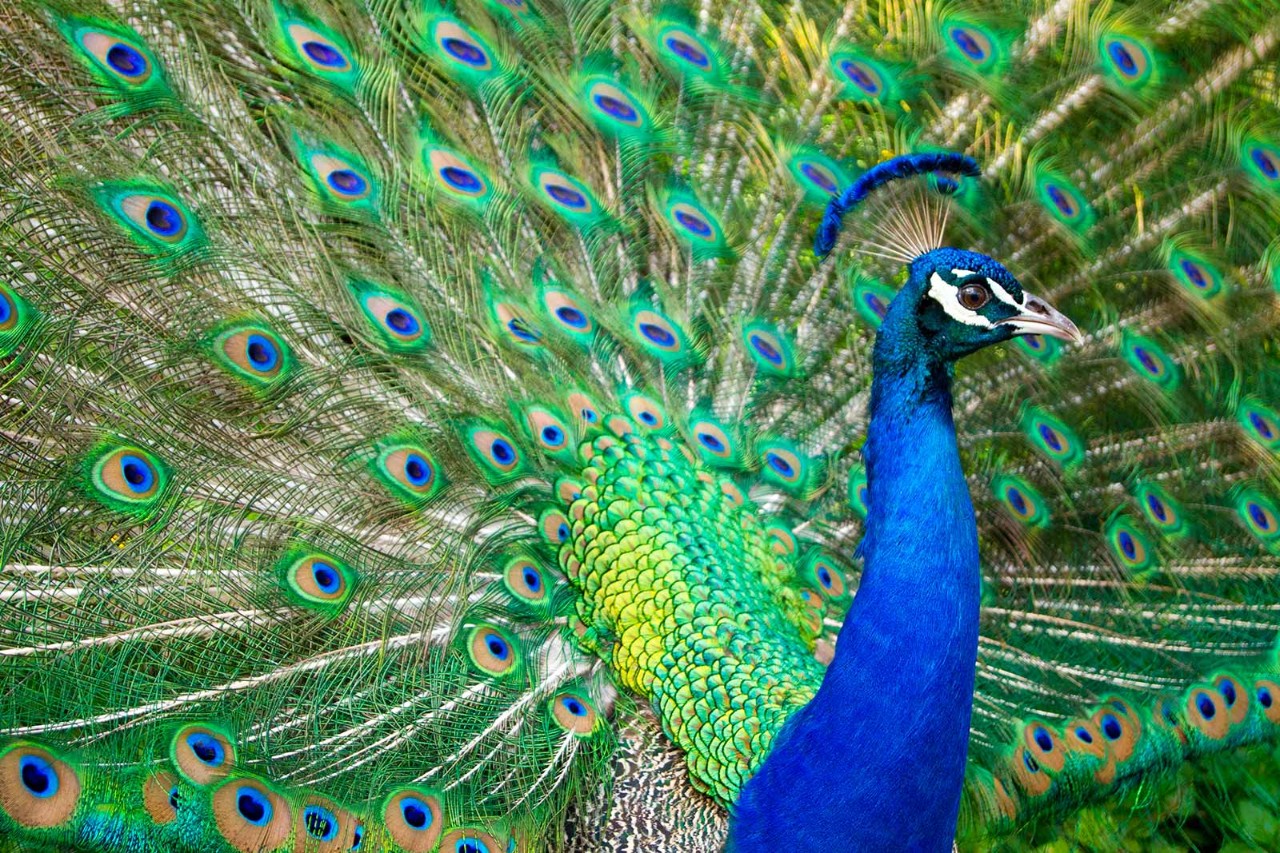

No one seems to know who coined the slogan ‘reduce, reuse, recycle’ but it is at least 50 years old. I think it actually gets more relevant with every year that passes. It is a truism to say that reducing physical output is almost always better for the environment. It applies to consumer goods, chemicals, cement and even to people. Making more of anything requires additional resources and causes more pollution.

I would challenge readers to name a single company where the CEO is directly incentivised to reduce production. There may be riders, such as reducing the energy cost per car, or additional factors such as reducing the output of less profitable products, but the underlying goal is always to make more of the things that make money.

Push and pull

When you step back and think about it, we are simultaneously pressurising companies to be greener and dirtier at the same time. The ‘green’ aspirations tend to be longer term – a greenhouse gas target for 2030 is currently in vogue – and the ‘dirty’ goals tend to be near term and much more lucrative. It is therefore unsurprising that the latter goals get much more executive attention.

Investors place a much higher value on providing services than on selling things

I have no problem with CEOs seeking to maximise profits over time. I really liked the 1970s Goldman Sachs mantra of being ‘long-term greedy’, which seems to have been truncated more recently. Capitalism is built on personal incentives, hopefully inside a robust regulatory framework.

One thing that always struck me when I was an industrials analyst was that investors place a much higher value on providing services than on selling things. Services tend to be higher margin, less cyclical and stickier. Most car companies make more out of selling spare parts than from making cars.

Consider Apple, one of the most valuable companies in the world. It used to be ‘just’ a hardware company, albeit an exceptionally successful one. Today it is pushing more and more into services. It seems to be aiming for a world where consumers, advertisers and partners pay Apple on a recurring basis for the services that the company provides.

Deciding what drives one company’s share price is subjective, but Apple seems to be rewarded for what many investors regard as a higher quality profit stream.

Higher taxes on production seem inevitable as governments find ways to tackle waste

The flaw

I think this has big implications for companies still stuck in ‘sell-more-stuff’ mode. Higher taxes on production seem inevitable as governments find ways to tackle waste. Manufacturing companies genuinely interested in long-term viability need to find ways to transition to a service model. This needs to be reflected in CEO compensation. Incentives that reward ever-rising production are bad for long-term health.

I hope one day to see ‘reduce, reuse, recycle’ as the central theme in a sustainability report. A successful transition to a more sustainable future will, over time, lead to a higher valuation.

Just don’t follow the example of The Midas Plague, where the manufacturing robots were repurposed to consume the excess production.

More information

Find out about the certificate in climate finance jointly developed by ACCA and CFA Institute.