‘People just don’t wake up in the morning and think, I’m going to insure myself today,’ says Rashidat Adebisi FCCA, chief client officer at Nigerian insurance firm AXA Mansard. ‘And in Nigeria, there are plenty who believe that their religious beliefs have them covered against mishap or misfortune, superseding the need for insurance.’

‘Awareness is a significant problem; people don’t tend to see insurance in action’

Adebisi knows what she is talking about. After spending two decades in the sector, primarily with AXA Mansard, she has seen the firm evolve into one of the largest insurance companies in the country, moving up the rankings from 97th out of 103 in 2004 to become a top five player with gross written premiums of 69 billion naira (US$148m) as at December 2022.

Scope for growth

Insurance in the African continent is, however, a story of high potential strewn with frustrating barriers. Steady economic growth has led to it becoming the second-fastest growth region globally for insurance (after Latin America). But this hides a more complex story.

Insurance penetration (the ratio of insurance premiums to GDP) in the continent is uneven, ranging from 12.2% in South Africa to 0.4% in Nigeria, according to sigma 4/2022. Even so, it is widely accepted that there is considerable scope for growth – if only the population could be persuaded of the advantages.

‘People want simpler terms and to fill out fewer forms’

While more and more companies are beginning to offer health insurance to their employees, in Nigeria only 3% of people aged 15-49 have any form of health insurance cover. Increasing the penetration rate will mean tackling a number of challenges simultaneously, says Adebisi. ‘Awareness is a significant problem; people are just not aware of what’s available and they don’t tend to see insurance in action,’ she says.

She contrasts this with the heavily insured UK where ‘if you’re watching TV you may see four or five insurance adverts in a few hours. And when there is a disaster, the news will say that millions of pounds were paid out in insurance. But in Nigeria, that doesn’t happen because people are not insured. The government or family step in instead.’

CV highlights

2020

Chief client officer, AXA Mansard Insurance, Lagos, Nigeria

2016

Divisional director, retail solutions, AXA Mansard Insurance

2011

CFO, Mansard Insurance (acquired by AXA Group in 2014)

2005

Executive officer – senior manager/financial controller, Guaranty Trust Assurance, Lagos

2003

Accountant, Rockwool Nigeria, Sango Otta

2002

Customer accounts adviser, Churchill Insurance Group, Bromley, UK

Simplified systems

The process of buying insurance and making a claim also needs to be straightforward and easily understandable, she adds. ‘People want simpler terms and to fill out fewer forms. That’s what we’re working on. We have a large population and it’s not easy to reach everyone from one point, so we need to create a methodology to engage across regions and language barriers.

‘We are exploring ways of reaching people through social media and technology, and adapting our language so it’s simple and understandable.’

A key milestone came in the form of the National Health Insurance Authority Act, which was passed in May 2022. The legislation aims to secure mandatory health insurance for all Nigerian citizens and legal residents, and is intended to drive the country towards the UN’s Sustainable Development Goal of universal health coverage by 2030.

Making a difference

Adebisi began her career in the UK after completing studies in business and accounting at the University of Lincolnshire and Humberside. She worked in various accounting roles before taking a position as a customer accounts adviser at Churchill Insurance Group while finishing her last set of ACCA exams. ‘I could see the difference insurance made to people’s lives and kept wondering why we didn’t have a strong insurance culture in Nigeria,’ she says. ‘So when I went home in 2005, I looked for a job that involved insurance.’

At the time, Nigeria operated a system of universal banking and she joined Guaranty Trust Assurance, a subsidiary of Guaranty Trust Bank, before taking advantage of the partnership between ACCA and the Chartered Insurance Institute (CII) and studying for the CII qualification. ‘That gave me opportunities to work beyond finance,’ she explains.

‘We are building a distribution army of well-trained financial advisers’

The end of universal banking in 2010 led to the creation of a separate listed insurance business, Mansard Insurance. In 2014, its parent company was acquired by AXA Group for just under €200m.

Strategic focus

Keen to keep learning, Adebisi moved to a role in the retail division in 2016. ‘Retail wasn’t something I had done before but I knew I had the financial knowledge and the interest to learn,’ she says. ‘It wasn’t easy – the first year was tough – but it expanded my scope beyond finance, so I had greater understanding of the business as a whole. So, when the role of chief client officer came up at the end of 2019, I wasn’t seen just as a finance person.’

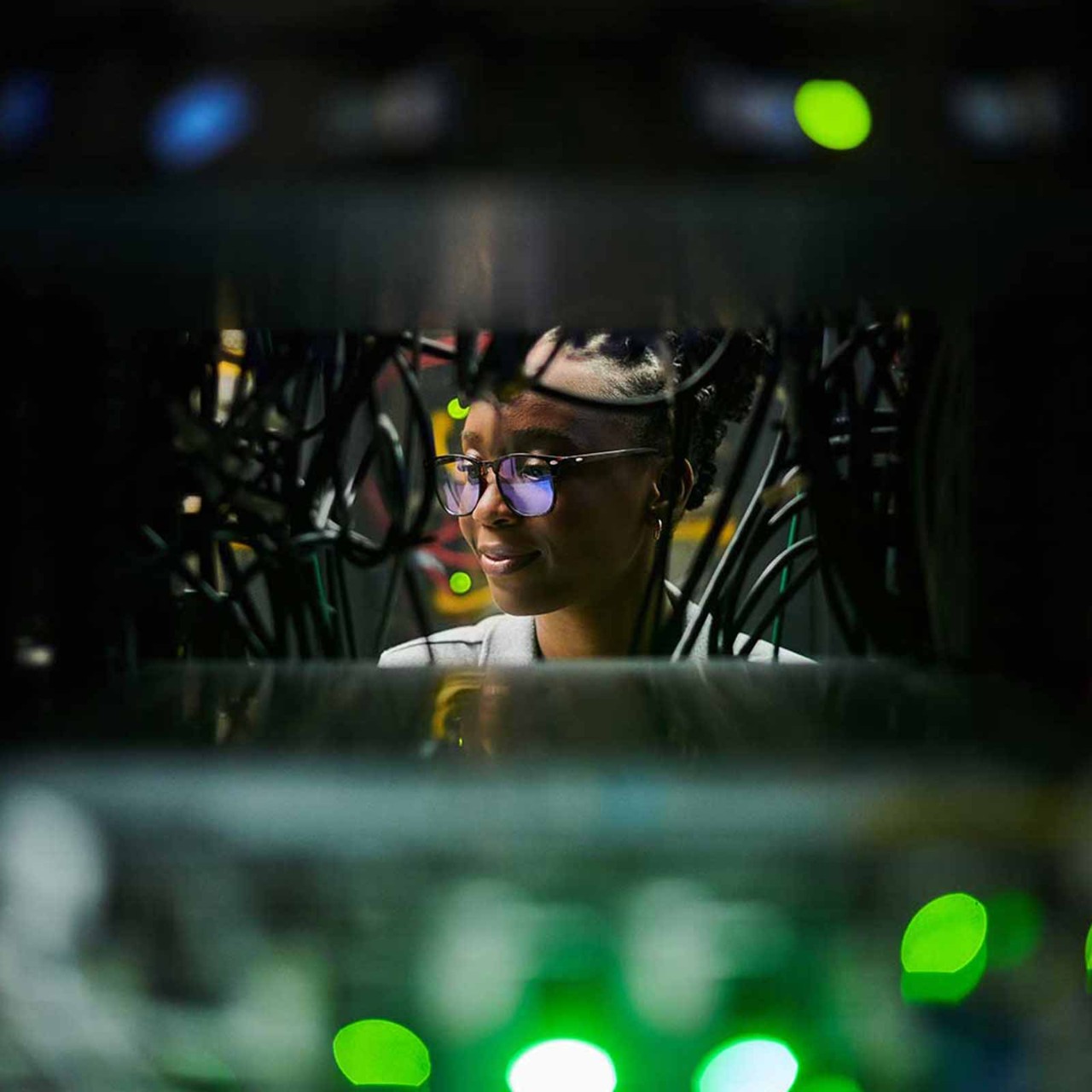

The chief client officer role has a strong strategic focus and she also sits on the AXA African executive committee. ‘My role is to ensure we achieve our ambition of going beyond corporate insurance to become a much more impactful organisation in our country. At the moment, for example, we are building a distribution army of well-trained financial advisers, supported by technology, who can help people with their needs.’

‘ACCA members are not trained only as accountants; we are trained for business’

Problem-solver

The ACCA Qualification, which Adebisi gained during her time in the UK, has been the backbone of her career. ‘I always knew I was going to return to Nigeria, so ACCA seemed the most interesting to me, because it is such a global qualification,’ she says.

‘ACCA members are not trained only as accountants; we are trained for business,’ she says. ‘You know that you might not know everything, but you know how to look for what you need, how to identify the root cause of issues. We know how to solve problems, how to create value, and how to explain to a range of people what’s going on. I’m not a mathematician but I do like the stories that numbers tell – of what’s happened and what could happen.’

She commends the local ACCA chapter as a strong platform to learn, network, share ideas and help drive the growth of responsible financial practice, and as the Nigerian representative at ACCA’s International Assembly and the chairperson of its Nigerian Advisory Council, aims to ‘ensure a strong representation and contribution to the evolution of the ACCA ambition’.

The way ahead

Ultimately, Adebisi believes that Nigeria’s insurance sector is on the right track. ‘Many things have changed during my time here,’ she says, ‘but we still have many things that need to improve.’

She believes strongly that insurance should be a positive story. ‘Our purpose at AXA is to act for human progress by protecting what matters to people. And what matters to people changes as their lives and careers progress.

‘The ambition is to be there for our clients through the different stages of their financial growth. We want to be their partner along the way.’