There are times in the depths of February when you really do need something to lift your spirits. Nothing does it better than laugh-out-loud nonsense. And nothing creates such nonsense better than politicians coming into contact with business.

Who would have thought that umpteen state governors in the US would one day rise up and denounce financial reporting rules as the work of the devil. Extraordinary. And what has triggered this is the value of companies’ commitments to environmental, social and governance issues, commonly referred to as ESG.

These are not a big deal. Back in 2021 the UK’s main financial reporting regulatory body, the Financial Reporting Council, issued an ESG statement of intent. In January this year it issued an update, which provides a guide of what is required of companies and their auditors. ‘We have integrated ESG considerations across all our supervisory activity,’ it states.

Reports from the same companies are very different when they are filed in the US

The guide is comprehensive and useful. There is much talk of climate change and risk assessments. Indeed, if you look at the climate sections of the annual reports of the great global companies, you find, as you would hope, extensive disclosures and information to enable investors to reach their own conclusions.

Global inconsistency

But, as Carbon Tracker, an outfit that monitors such things, points out, the reports from the same companies are very different when they are filed in the US. By and large the detail disappears. A global oil company like Shell features thousands of words on the subject in the UK, and in the US, nothing, or as they might say, zilch.

This is strange. After all a global company is, well, global. You would have thought the same information would be valuable regardless of the continent the investor lived on.

‘We focus on sustainability not because we are environmentalists, but because we are capitalists’

There has always been a bit of a schism between US regulators and the rest of the world. The US is a lawyer-dominated business culture. The lawyers like to keep financial reporting rules and guidance under their control. In the UK and elsewhere, the preference has traditionally been closer to a principles-based system. A short clear sentence or few was preferred to a library full of legal textbooks.

Great battles

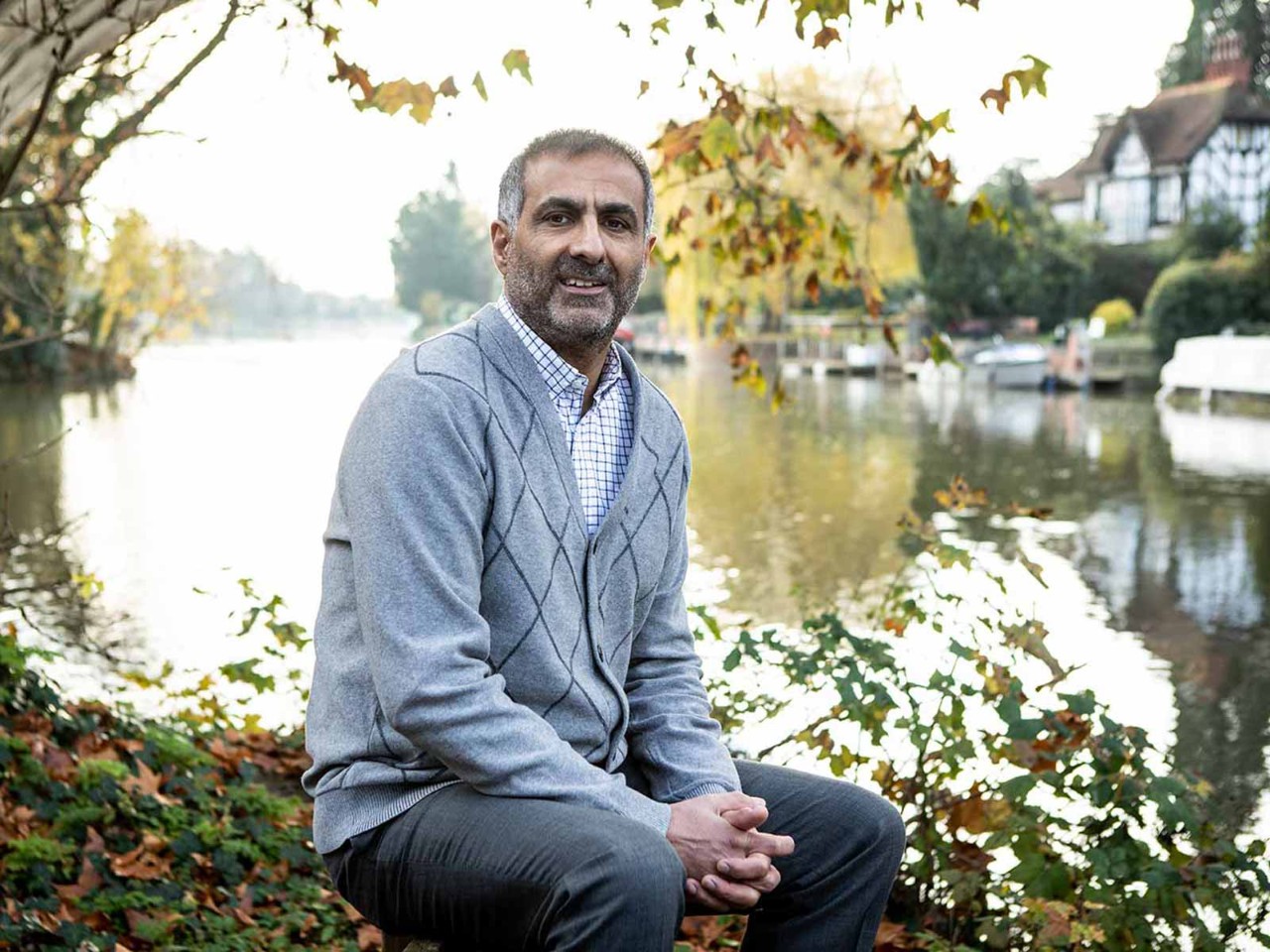

But that is but a footnote to the great battle being waged in the US over ESG. Larry Fink, the CEO of the largest investment firm in the world, BlackRock, writes an annual letter to its investors. Last year’s letter said firmly that ESG was not a passing fad but essential. Companies should adapt or die.

‘Republicans don’t normally line up to punch the chief executive of a giant Wall Street firm in public’

‘We focus on sustainability not because we are environmentalists, but because we are capitalists and fiduciaries to our clients,’ he wrote. That might seem straightforward to you and me, but ever since Fink wrote it, there has been mayhem in the political classes.

As a columnist in the New York Times summed it up last month: ‘Republicans don’t normally line up to punch the chief executive of a giant Wall Street firm in public. In places like Louisiana and North Carolina, however, that’s exactly what’s been happening to Laurence D Fink, the long-time leader of BlackRock.’

Calling anyone who mentions the acronym ESG ‘woke’ is the least of the insults. ‘It is not woke. It is capitalism,’ responded Fink.

Coercion?

But the mayhem continues. The attorney-generals of 19 Republican states have accused BlackRock of putting activism ahead of fiduciary duty. The state treasurer of North Carolina wrote to the BlackRock board insisting it removes Fink from the firm for ‘coercing the world’s companies’ towards a green agenda.

A survey showed that ESG policies were ‘the deciding factor’ when it came to recruitment

All this nonsense enlivens the gloomy weather of February. But in the end, demography should provide the answer. At the end of January, the UK arm of the global accounting giant KPMG released a report on another effect of ESG policies. A survey of several thousand young workers showed that ESG policies were, it said, ‘the deciding factor’ when it came to recruitment, particularly among millennials.

KPMG’s UK head of ESG said: ‘For businesses the direction of travel is clear. By 2025, 75% of the working population will be millennials, meaning they will need to have credible plans to address ESG if they want to continue to attract and retain this growing pool of talent.’

Elderly and apoplectic American lawyers and politicians need not apply.