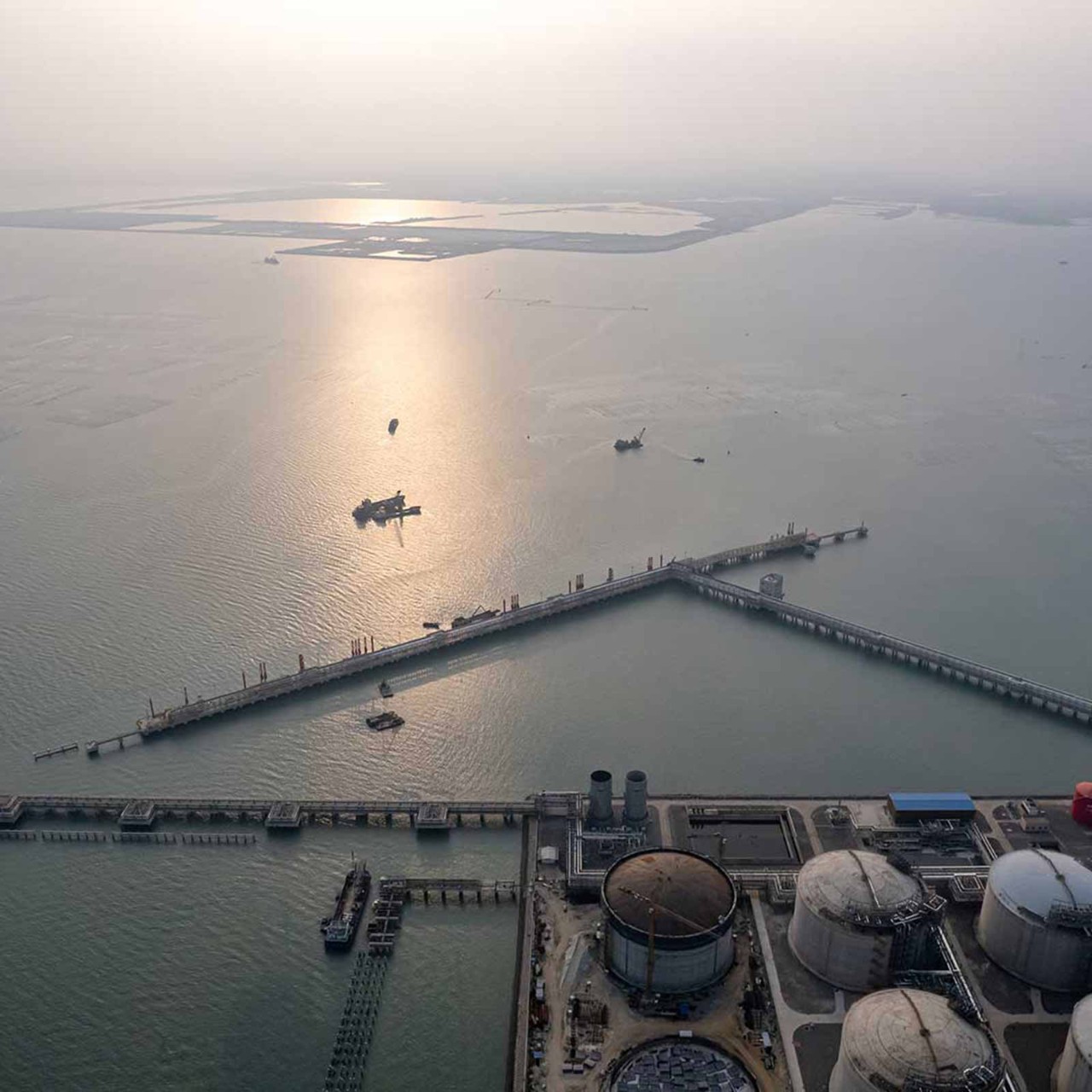

These are exciting times to be in business in Ethiopia. There are many opportunities, especially in agriculture and agro-processing. Agriculture is crucial for us, providing more than 85% of all jobs. Crops of all kinds – cereals, flowers, tea, coffee and many others – can be cultivated all over the country. The energy, aviation, healthcare and tourism sectors are also promising.

The creation of our own stock market marks a turning point in Ethiopia’s economic development

Ethiopia is to launch its own stock market in 2024. This marks a significant turning point in our economic development and competitiveness, offering investors an opportunity to grow their wealth. The creation of the market will build opportunities for finance professionals who can handle transactions for clients.

The audit profession can play a big part in developing the economy by raising companies up. They achieve this by tackling internal control deficiencies in businesses and clearly communicating with senior managers where further improvements can be founded. The country has adopted IFRS, and the number of ACCA graduates is increasing every year, so Ethiopia is in a better position than it was.

I quit corporate for audit because I enjoy accumulating knowledge of so many different industries

I was inspired to become an accountant while I was at the School of Commerce. When deciding on my career path, I wanted to know what skills were in high demand and felt confident that accountants can enhance their career by working across many industries.

I started my career in 1999, as a stock controller at the Ethiopian Telecommunications Corporation. After graduating in accounting, I worked my way up from accountant to regional finance supervisor before switching to the practice side, first at HST General Partnership, now at MSE Auditors Partnership, a member firm of Grant Thornton.

My role involves delivering the proper control of accounts and reviewing our clients’ financial statements. Having verified the accuracy of financial statements and tax filings of multiple companies as an auditor, I have accumulated knowledge of many different industries. It is this aspect of working in practice that drove me to quit my corporate role and become an auditor.

What I enjoy most about my job is examining financial reports, ensuring they are free from error and presented fairly. I like learning from our clients’ complex accounting and reporting issues. I also enjoy recommending action on any deficiencies for a client’s management to work on, which improves the business in the future. I love a challenge and have the ability to put in long hours to deliver assignments on time.

When I decided on a career in finance, my aspiration was to become a good auditor and get my ACCA Qualification. I am proud to have realised both of these objectives.

Tax evasion negatively impacts our ability to provide quality infrastructure, public services and job creation

If had law-making powers, I would take on corruption. Tax evasion has reduced the government’s revenue, which negatively impacts the country’s finances. This in turn negatively impacts its ability to provide quality infrastructure and public services, and create jobs – most of our population are young and unemployed.

If I was not an accountant, I would have become a maths teacher. When I was at high school and doing well in the subject, my dream was to become mathematician and then deliver my knowhow to students, helping them to be good at the subject.

In my spare time I enjoy sports activities and watching movies. I also like reading.