The effects of Brexit, the pandemic, inflation and the Russian invasion of Ukraine have had dramatic consequences for the UK economy. The International Monetary Fund predicts it will shrink by 0.3% in 2023, and it remains the only major economy not to have returned to its pre-pandemic levels. The government’s debt interest payable hit £6.7bn in January 2023, the highest figure for that month since records began.

This is the environment that finance professionals in the public sector must contend with, having already had to cope with a long period of government austerity measures triggered by the financial crisis of 2007–08. When an organisation is dependent on a struggling public purse, finding solutions to the growing financial problems is a daily challenge.

‘We’re now prioritising the priorities’

Erosion by inflation

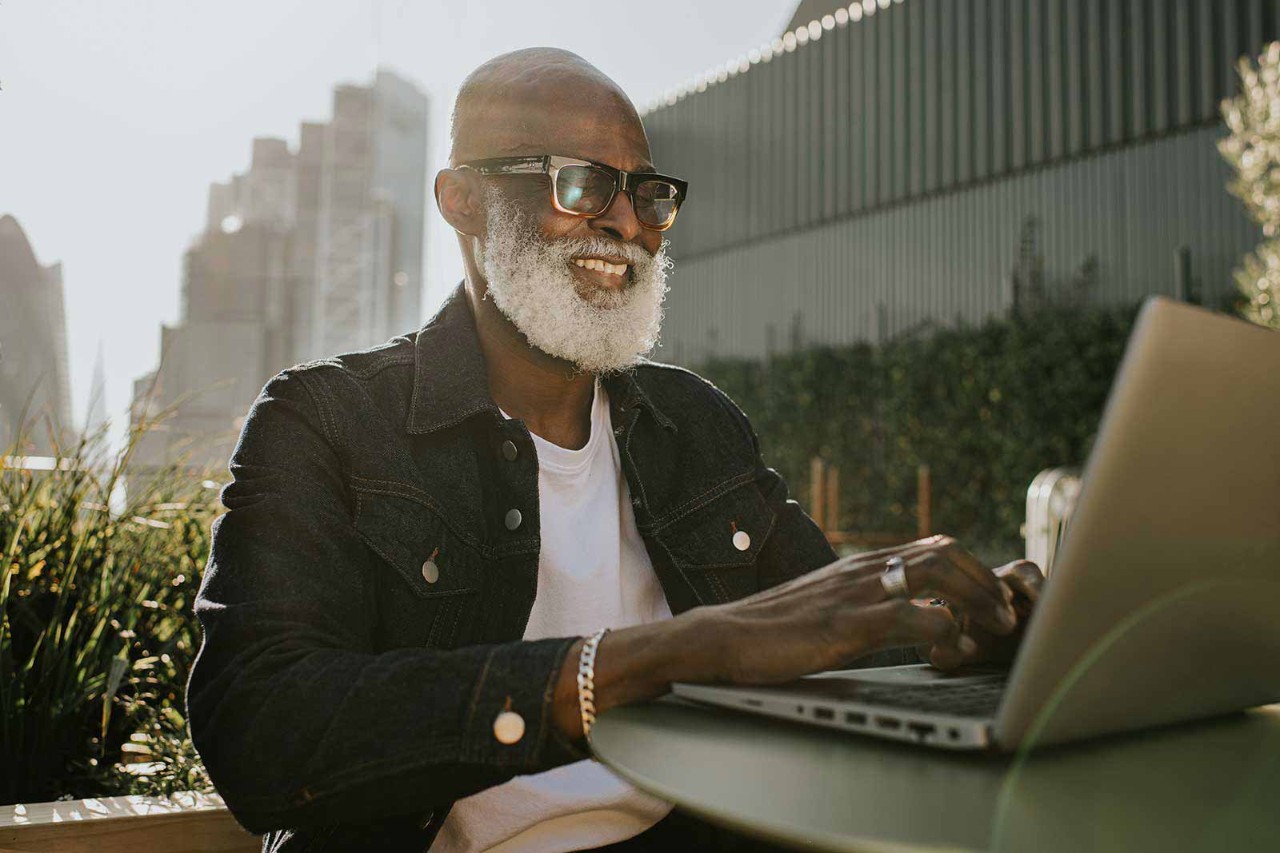

‘Everybody’s worried,’ says Angela Ireland FCCA, cabinet member for finance at Wandsworth Council in London. ‘Additional funding is required for more adult social care and extra responsibilities. And the government hasn’t compensated us for inflation, which is so corrosive.’

With price inflation now running at around 10%, Angela says her council’s situation is ‘the worst I’ve ever known’.

This underfunding at local government level has a knock-on effect on the charitable sector. ‘Our biggest worry is the rates the local authorities give us,’ says Chibuzo Opkala FCCA, director of finance for Vibrance, a charity for disabled people. ‘They place disabled people with us, but they determine the rates they pay, and we can spend only what they give us. There has always been pressure, but when the local authority’s budget is slashed, they look where they can cut costs. It is really bad.’

Impact on pay

Chibuzo points out that the recent 3% increase in government funding is inadequate given that inflation is more than three times that, and the minimum wage has gone up too. ‘You can imagine the strain on finances with increasing costs and salaries.’

Policing is in a very different part of the public sector, but the pressure on pay felt by Evans Chisala FCCA, operational accountant at a major constabulary in the north of England, is just the same.

Evans says: ‘Pay is a big chunk of our expenditure, over 80%. Some of our budget is ringfenced but other parts are not, so we have to find savings. We look for efficiencies, but the work doesn’t go away. Policing is unique and is often reactive – operations can be unpredictable.’

‘The only productivity change we can make is in admin, but that is already back to the bare bones’

Finding savings

When having to do more with less, public finance staff are urged to find new ways to save on costs. But this has been going on since austerity measures were first introduced in late 2008, so what is there left to trim?

‘There is a mandatory ratio of staff to service users at Vibrance, so we can’t touch that,’ Chibuzo explains. ‘The only productivity change we can make is in administration, but that is staffed by barely 50 of our 500 employees, so we are already cut back to the bare bones. We have to look at other things that are necessary but not essential, such as training for the finance team, which we have had to delay, as there isn’t the money.’

Chibuzo would also like to get staff at the charity ACCA-qualified but cannot. Unavoidable choices like this inevitably reduce efficiency and productivity – the very opposite of the outcome being sought. He also had to keep postponing a project to replace the paper-based HR system with one fit for the digital age as part of cost-saving measures, although the implementation is now complete. ‘It was necessary but not essential, so the focus on finances meant the £60,000 needed for the project took five years to gather.’

In terms of cost savings in policing, Evans says he is looking at priority-based budgeting. However, it is a challenge to demonstrate the economic benefits of policing. ‘Whereas reduced crime attracts investment, the effect of good policing can be hard to measure. But we strive do this by showing our positive KPIs.’

‘We’re under no illusions: it’s going to be very tough’

Nor can the organisation necessarily select for itself the areas it would like to focus on. ‘The police and crime commissioner is held accountable by the people,’ Evans explains. ‘It is the public that determine our top priorities.’

In Wandsworth, the local authority is ‘prioritising the priorities’, Angela says. ‘We are looking at all our contracts, trying to be more efficient and using technology to provide services.’

One of the areas of spend focus is housing. The borough currently has 3,000 families in temporary accommodation, at a cost she describes as ‘crippling’. The council plans to provide 1,000 new homes.

‘We are funding this through borrowing,’ she says. ‘We have done the costing and think it’s affordable. We believe it will eventually pay for itself – and we don’t feel we have any choice.’

Talent drain

In an ideal world, Chibuzo would spend any extra budget on salaries in order to compete for talent with the private sector. Employees leave to work in the better-paid care home sector, for example.

‘Even supermarkets pay more and for less stressful work. Our managers should be managing our staff, but instead they have to do client-facing shift work because of staff shortages.’

The economy isn’t about to suddenly improve. Brexit may have reduced GDP by as much as 5.5% by the end of 2022. More difficult decisions await finance teams across the public sector as they continue having to do more with less.

‘Everything you want to achieve costs money,’ Angela says, ‘but when the money is gone, it’s gone. We’re under no illusions: it’s going to be very tough.’