Recently I had the privilege of taking a small group of students from the University of Liverpool to the International Accounting Standards Board (IASB) for a lecture. During the talk, one of the students asked about the timeline for a new standard being issued and was met with a wry smile – acknowledgement that the process can certainly take quite some time I have a hope that there may well be a new standard for intangible assets, but certainly very little hope it will happen before these students graduate (but maybe before they retire).

IFRS S1 is an underpinning standard – the sustainability equivalent of IAS 1 and IAS 8

In contrast, the work being done by the International Sustainability Standards Board (ISSB) appears to be turbo-charged. In the absence of one major global set of sustainability standards, the ISSB is pushing ahead at speed. The first two standards to be issued relate to General Requirements (which would be IFRS S1) and Climate Exposure (which would be IFRS S2).

As stated in a previous article, these will be ready at the end of Q2 2023, ready for implementation in 2024. As these are the first two standards of a whole new set of global standards, this article will give an overview of S1, with an overview of S2 being provided in a future article.

Key principles

IFRS S1 will set out the more general reporting requirements, while other IFRS Sustainability Disclosure Standards (such as S2) will set out specific disclosures in certain areas. This means that IFRS S1 is effectively an underpinning standard, being the sustainability equivalent of IAS 1, Presentation of Financial Statements, and IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors.

When preparing the new standards, the ISSB has acknowledged the work done by the Task Force on Climate-Related Financial Disclosures (TCFD), which has carried the torch in this area for a number of years. With this in mind, the standard follows the model of looking at governance, strategy, risk management, and metrics and targets.

While not mandating specific disclosures, S1 emphasises the need for consistency and connections between financial statements and sustainability disclosures. S1 states that the sustainability disclosures should be produced at the same time as financial statements. There is no specific guidance as to where these disclosures should be provided as long as they are in the general purpose financial reporting package.

Companies may feel unsure of what they need to do initially before more standards are issued

S1 will ask preparers to outline information on all of the material sustainability-related risks and opportunities. Previously, S1 talked about things that were significant, but this was met with numerous comments saying it could be difficult to define. This has since been removed but the language continues to refer to materiality.

When talking about materiality, this looks at financial materiality, applying the same definition of ‘material’ as IFRS Standards to ensure that investors understand sustainability risks and opportunities: ‘Information is material if omitting, misstating or obscuring it could reasonably be expected to influence investor decisions.’

To support those using its standards, the ISSB will be providing guidance in the coming months. This will include a number of examples and detailed guidance on items such as judgments and estimates, disclosing the current and estimated financial effects and how to revise comparative information.

What should a company do?

In identifying what to report on, the preparers following the ISSB Standards will apply the specific standard. For climate, this will be S2.

Usually companies have years to look at proposals, but the ISSB Standards are moving more quickly

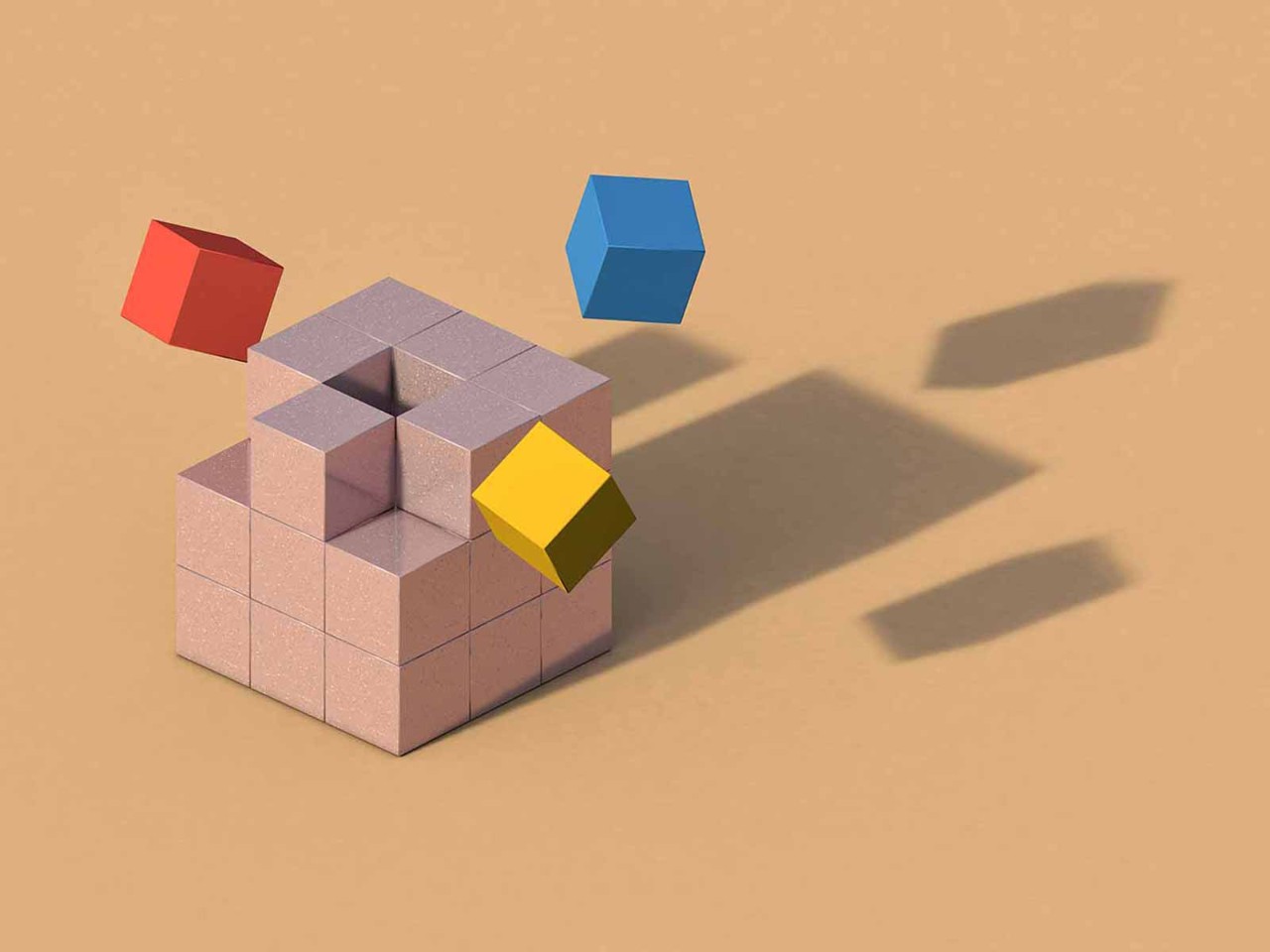

For other items, companies may feel a little unsure of what they need to do initially before more standards are issued. In this case, S1 requires companies to consider the Sustainability Accounting Standards Board (SASB) Standards to see if the information contained within it covers the area that they are looking to report on. The SASB Standards contain 77 industry-based disclosure standards. In addition to this, companies could consider the Climate Disclosure Standards Board (CDSB) Framework application guidance.

Next steps

The ISSB suggest three ways in which companies can prepare for the implementation of the ISSB Standards:

- They could evaluate internal systems and processes for collecting, aggregating and validating sustainability-related information across the company. This could identify what information is already captured by these processes but also any gaps in these processes and how these could be filled.

- They should consider the sustainability-related risks and opportunities that affect the business’s performance and long-term prospects. This is the information that investors will be interested in. This will be required by S1, and all material items will need to be disclosed.

- They should review the ISSB’s proposed standards and supporting materials, including the SASB Standards. They could look at other relevant information, such as the CDSB Framework and TCFD recommendations, as these will give a really good idea of what companies will be required to disclose.

Usually, in preparation for new standards, companies have many years to look at the proposals, but the ISSB Standards are moving far more quickly. While many nations are currently standing by and are yet to adopt the standards, the move towards more sustainability disclosures is happening.

Companies should be thinking about these things now, as it will certainly happen faster than many accounting standards projects.

Watch and learn

See Adam Deller’s ‘back to basics’ series of short videos on IFRS Standards