Company size limits

The European Union (Adjustments of Size Criteria for Certain Companies And Groups) Regulations 2024 have increased the size limits for companies to qualify under the various size criteria in the Companies Act. The company must still meet two of the three criteria, and none of the other terms and conditions in Section 280A to 280G have changed. The change is effective for financial years beginning on or after 1 January 2023.

The change reflects a roughly 25% increase on the previous limits and approximately adjusts the limits for inflation since they were first set.

There are narrow-scope amendments to IFRS 9 and IFRS 7, effective from 1 January 2026

Early childhood scheme

The Department of Children, Equality, Disability, Integration and Youth has recently issued its Guidance Note for Core Funding Reporting Requirements Transitional Arrangements Year 1 and 2 to entities providing childcare and early education services. This outlines the transitional arrangements to a new funding model, Together for Better. These transitional arrangements will be in place for the next two reporting periods (years ended 31 August 2023 and 31 August 2024).

However, there is a potential issue with auditors assisting clients in submitting the income and expenditure template where there is a potential conflict with the Ethical Standard for Auditors (Ireland). Where the auditor is not in a position to do the work, the in-house qualified accountant may perform the mapping exercise and the client can provide a declaration.

IFRS 9 and IFRS 7

There are narrow-scope amendments to IFRS 9 and IFRS 7, effective for annual reporting periods beginning on or after 1 January 2026. The amendments clarify:

- how the cashflows on loans with environmental, social and governance-linked features should be assessed

- the date on which a financial asset or financial liability is derecognised when settled through electronic payment systems.

The Corporate Enforcement Authority has published its first annual report

Corporate Enforcement Authority

The Corporate Enforcement Authority (formerly the Office of the Director of Corporate Enforcement) has published its first annual report, which includes 17 case studies that provide an insight into how the authority operates. These cover most of the common company law infringements, from the simple example of not filing an annual return and director’s loans to a detailed account of the actions taken by CEA in respect of John Delaney, former CEO of the Football Association of Ireland.

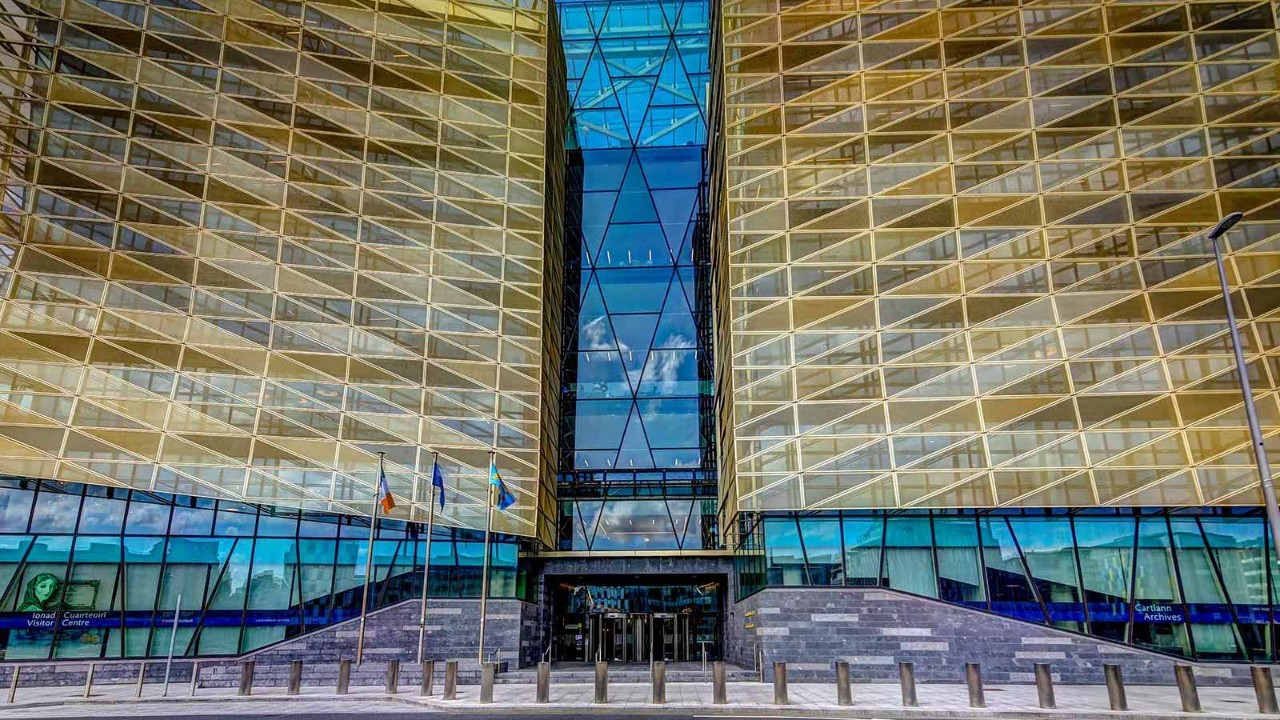

Central Bank of Ireland

The Central Bank of Ireland (CBI) has published its June 2024 Quarterly Bulletin, which includes its assessment of economic growth potential, inflation and labour markets. The CBI has also published its Insurance Newsletter, which explores the CBI thematic review of natural catastrophe perils modelling, the operation of the Individual Accountability Framework, and a review of sustainability insurance and the assessment of double materiality in climate risk reporting under the Corporate Sustainability Reporting Directive.

Anti-money laundering authority

Regulations and directives have now been published, and a new EU authority for anti-money laundering and countering the financing of terrorism (AML/CFT) has been established to enhance supervision and cooperation across the union. The authority aims to implement harmonised AML/CFT rules, reducing divergences in national legislation and supervisory practices. It will directly supervise high-risk entities and coordinate with national supervisors for other entities. A central AML/CFT database will be created for better data sharing and analysis, promoting efficient cooperation among supervisory authorities.

The new AML authority will coordinate financial intelligence units for effective crossborder cooperation

The authority will also develop a framework for peer reviews to identify good practices and shortcomings, publishing reports and guidelines to foster convergence of supervisory practices. It can investigate breaches or incorrect applications of the law by supervisors such as the Irish Central Bank where it supervises Irish entities in indirect scope and issues recommendations or warnings. In addition, the authority will support and coordinate financial intelligence units for effective crossborder cooperation and joint analyses of suspicious activities.

Parent’s leave

The Parent’s Leave and Benefit Act 2019 (Extension of Periods of Leave) Order 2024 has increased parental leave from seven to nine weeks. (Originally this was two weeks.) The new limits are effective from 1 August 2024.