When you are in conversation at parties, your insights into accounting standards will rarely keep your listeners in thrall. Yet every once in a while a news story emerges that gives us financial reporting nerds a decent chance to be the centre of attention.

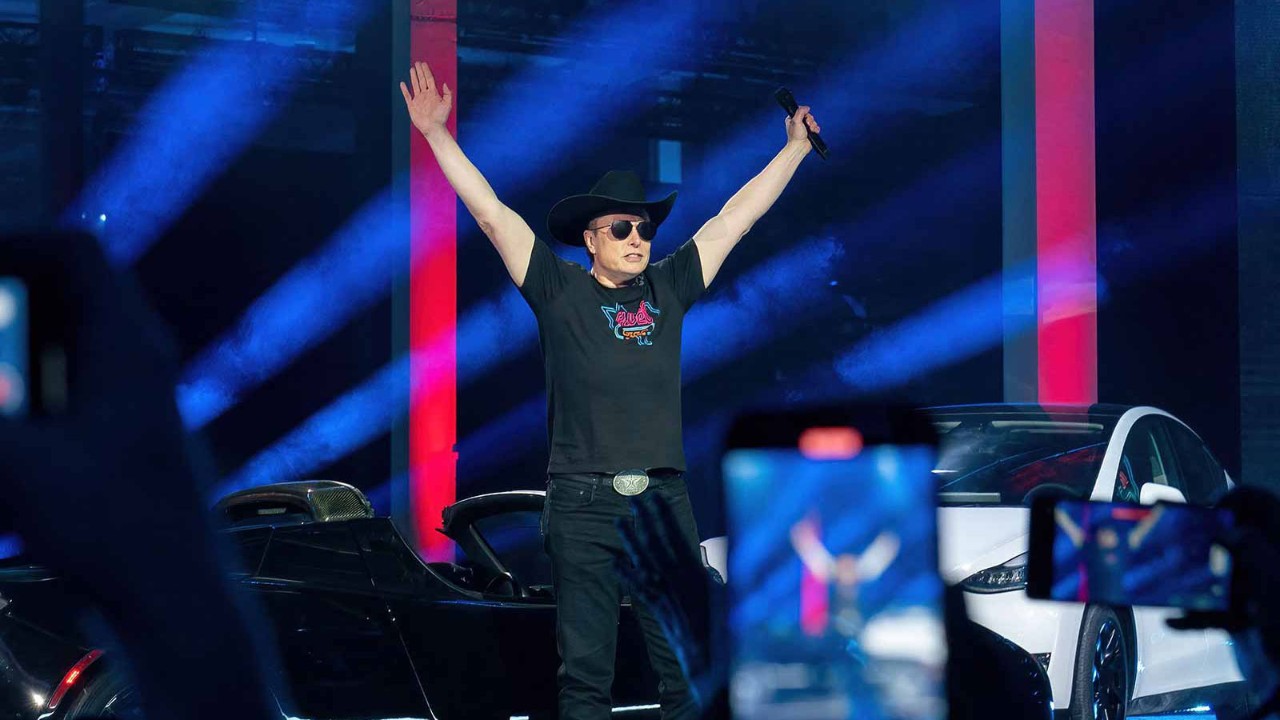

Depending on the circles you move in, many of your party-going friends may have seen that Elon Musk’s US$56bn pay package from Tesla in 2018 was annulled as not being in the best interests of shareholders. The judge ruled that such compensation would be an ‘unfathomable sum’.

For the US$56bn value to be crystallised, Musk would need to exercise the options

The standout figure in all the news reports was the US$56bn value of the package to Musk. This is where your conversational nuggets can come into play. Your non-accounting friends (and surely we all have some somewhere) may be confused as to how Tesla paid him US$56bn, and how on earth he is supposed to pay the company back.

In helping clear up your friends’ understanding of the issues, the principles of IFRS 2, Share-based Payment, are key. Share-based payment (commonly referred to in the US as stock-based compensation) awards are very common in large US companies, allowing them to offer lucrative remuneration packages without paying out anything in cash.

Value recorded

A key element of recording these transactions is that equity-settled transactions (where the employee receives shares or share options) are recorded at the fair value at the grant date. This fair value is then multiplied by the number of options expected to be exercised and spread over the vesting period (the period in which certain criteria must be hit), to give an expense for the year.

While the number of options to be exercised may change year on year, based on targets being hit or employees leaving the company, the fair value calculated at the grant date is never remeasured, regardless of any future changes in the options being given to the employee.

This measurement of the fair value at the grant date is perhaps the most controversial element of applying IFRS 2. This accounting rule is driven by the principle that you are valuing the service provided by the employee and not the value of what they will ultimately receive. The expense to the business is the value of the service provided, and that is what the standard hopes to capture.

While the value of a service provided by a third party can be reasonably estimated, the value provided by an employee is much harder to quantify. In the absence of such a measure, the fair value of the options awarded at the grant date is used to signify the value placed on the employee’s service.

The value placed on Musk’s continued service was projected at US$775m but could be worth US$2.3bn

Tesla’s figures

When Tesla announced the pay award, it was placing a value on retaining and incentivising Musk’s skills. This award would give him the right to buy a number of shares at around US$23 each, as long as a number of vesting tranches were hit.

In 2018, Tesla recorded an expense of US$175m in relation to the compensation package, and the annual report at that date estimated that the value of the compensation that was probably achievable would be US$598m, with a further US$1.51bn not deemed probable. This was based on the targets for growing the share price and hitting other performance measures.

This suggests that the expected value placed on Musk’s continued service was projected at US$775m but could be worth US$2.3bn if Tesla achieved all of the vesting tranches. As the years progressed, and Tesla’s performance hit the required targets, the full US$2.3bn amount became the figure recorded in the profit or loss between 2018 and 2022.

This is clearly significant, but some way short of the US$56bn value reported. The reason for the disparity is that while the fair value calculation made at the grant date incorporated the chance of those targets being hit, they appear to have not factored in how significantly the share price might grow.

The US$56bn ‘unfathomable’ value would never be recorded in Tesla’s accounts

Too unfathomable

On 21 March 2018, when the pay award was granted, Tesla’s share price was quoted at US$21 a share. At the date the judge annulled the pay deal, Tesla’s shares were trading at around US$190, a figure that could not even have been contemplated when the agreement was made.

So while the value of the options received by the Tesla CEO would be around US$56bn, this ‘unfathomable’ value would never be recorded in Tesla’s accounts. Instead, the much smaller value of US$2.3bn has been recorded.

Which leads us to the final question: how can Musk possibly repay such an amount? The answer is that he doesn’t need to, as none of these options has yet been exercised. As the options have been earned, they were recorded as an expense and in equity. For the US$56bn value to actually be received, Musk would need to exercise the options, acquiring the shares and then selling them (something he could not do for five years under the terms of the scheme) at their market value. So not only was the US$56bn never recognised in Tesla’s financial statements, it was never taken by Musk either (despite being factored into calculations of his wealth).

So when that little group gathered around you at the party demand to know how much Musk is worth to Tesla, you could answer: according to the 2018 agreement, US$2.3bn – Tesla never paid him US$56bn, and he is unlikely to ever receive such an amount. You could even tell them that the US$56bn never really existed – it was more a theoretical figure. Something that may have happened to you before will then happen again: those party people will make their excuses and start up a conversation with someone else.