Trump has four years in office with no option of a third term, so he is wasting no time in boldly implementing his agenda. The issue of tariffs is fast moving, with Trump making new declarations almost daily.

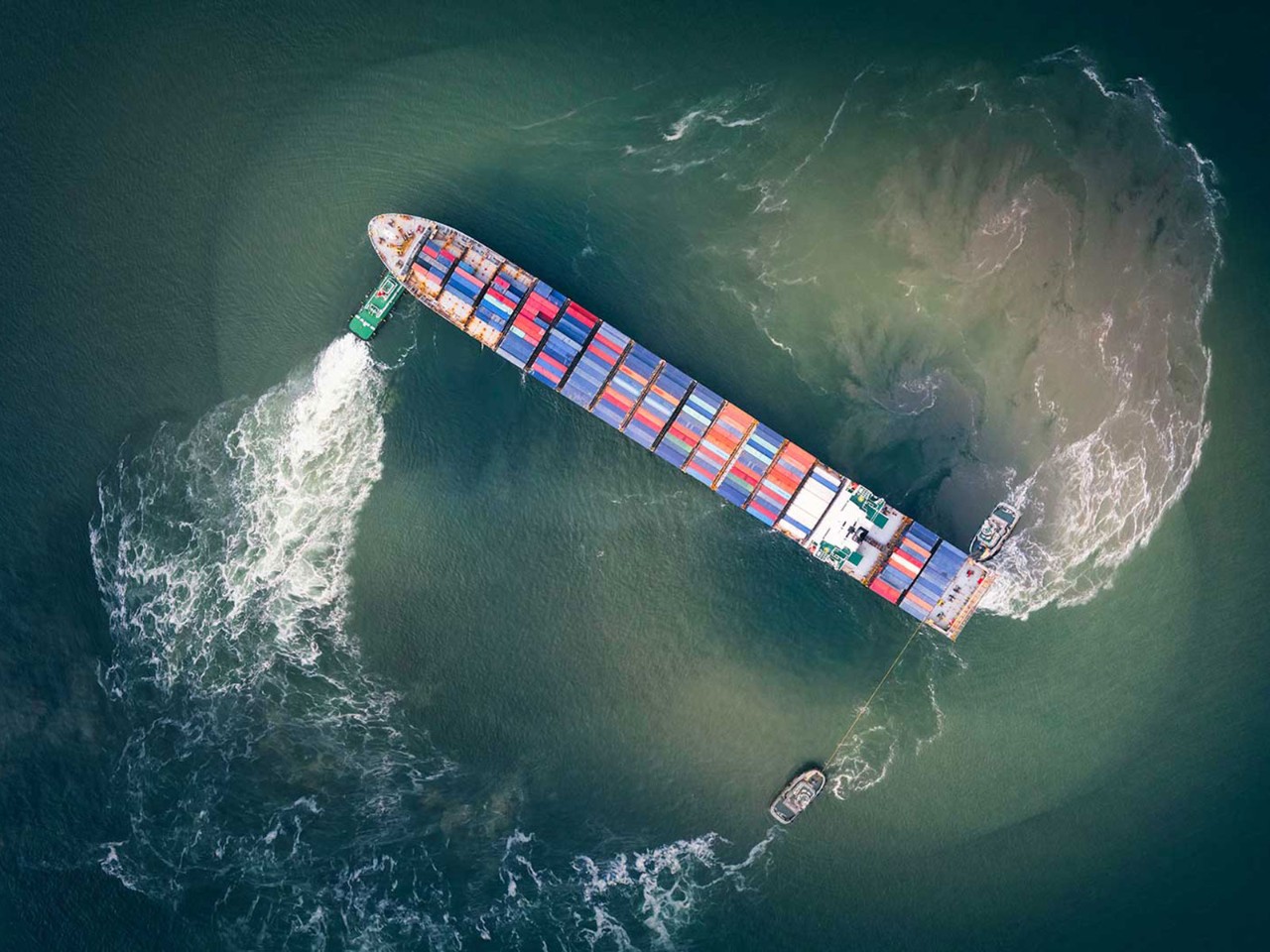

In response to warnings from governments and economists around the world of the dangers of a trade war (or wars) – the International Monetary Fund recently warned that new tariffs could exacerbate trade tensions, lower investment, reduce market efficiency, distort trade flows, disrupt supply chains and affect growth – Trump argues that the higher his tariffs, the more likely companies will come into the US and build a factory to avoid paying them.

Bigger tariffs could mean halved growth, increased inflation and higher interest rates

Trump has also offered tax incentives and subsidies to US companies to ‘reshore’ from overseas, and pledged to reduce corporate taxes and regulation – particularly in environmental, social and governance (ESG) and corporate transparency standards.

In trade, he will also prioritise renegotiating the US-Mexico-Canada agreement to favour domestic production and likely pursue new bilateral deals with Asian countries to counter China’s economic might in the region.

Impact on UK

The US is the UK’s biggest national trading partner, accounting for 22% – over £186bn – of UK exports. However, almost 70% of these exports are in services and not therefore subject to tariffs. Nor does the UK run a large trade surplus in goods with the US, in contrast to China, Mexico, Canada, Germany and Japan.

Nonetheless, the National Institute of Economic and Social Research forecasts that bigger tariffs on the UK could mean halved growth, increased inflation and higher interest rates.

In aerospace, automotive, pharmaceutical, chemicals and machinery sectors, UK exports to US-based firms are substantial and face strong US competition. At the same time, UK tech and financial services firms could fill advisory or service gaps if US regulations are tightened and global volatility increases – especially if the US market becomes less competitive for multinational businesses.

‘A US-EU trade war could mean more inward investment in the UK to avoid tariffs’

The UK government, hoping to enter trade talks with the Trump administration in the weeks ahead, will be seeking opportunities for digital trade in goods and services, crossborder data flows and financial services. This conversation may also cover UK restrictions on chicken and beef imports, cars, liquid natural gas, machinery and pharmaceuticals, as well as the UK government’s planned levy on certain imports of carbon-intensive goods.

Some UK-based, US-owned companies could be attracted to relocate operations to the US to benefit from a lower tax environment. This has the potential to cause job losses, or to prompt UK companies to explore alternative export markets. Conversations with the EU have already started, catalysed by Trump’s trade threats.

UK trade and Europe

Rachel Harris MAAT, director, StriveX and Accountant_she, expects the UK government to focus on mitigating any downsides of the Trump administration by reinforcing trade ties with Europe and Asia, potentially accelerating trade agreements and providing support for sectors most affected by US policies (particularly those priority sectors identified in the US Industrial Strategy such as advanced manufacturing and clean energy).

However, any attempt to reduce trade barriers with the EU with the stated intention of lowering costs for British businesses means accepting the EU’s regulatory system as the non-negotiable condition of entry for increased market access.

Some optimism

Damian Connolly FCCA, managing director of Sakura Business Solutions, suggests that ‘a US-EU trade war could mean more inward investment in the UK to avoid tariffs, and any capital flight from the US is likely to come to the UK.

‘Alternatively if Trump’s latest presidency avoids the worst excesses and materialises success,’ Connolly continues, ‘a growing US economy has a positive impact on the global economy.’

Connolly urges some realism; in practice, few of the worst-case scenarios will materialise precisely because they will also impact US business profitability and sentiment. But he forecasts that ‘companies with US subsidiaries will probably be best placed, given that investment in the US, employment of local staff and payment of US taxes is likely to sit well within this new business environment.’

Currency impact

In terms of monetary policy, if the US Federal Reserve keeps US interest rates high while other central banks cut theirs back, we could expect a stronger dollar. A relatively weaker sterling would mean rising costs to UK businesses, another economic headwind for an already slow growth rate.

‘When sterling is weak, the value of international earnings increases, which can be a boon’

However, Gabriella Macari, senior investment manager at Arbuthnot Latham, points out that ‘a weak sterling currency can be positive for investors in the UK market, notably the large FTSE100-indexed companies.

‘When sterling is weak, the value of international earnings increases in sterling terms, which can be a boon for UK-listed companies,’ she says.

Support for business?

Trump isn’t the only challenge for UK business. The UK economy is misfiring on many metrics. Jobs are being cut in the private sector at the fastest rate since the 2009 financial crisis. SME confidence is at the lowest since ACCA began surveying this in 2014. The CBI forecasts that private sector activity will fall in Q1. One in five UK-listed companies issued a profit warning in 2024. Annual public sector borrowing is higher than forecast.

There’s a difference between the maximum Trump argues for and what he will settle for

Raoul Ruparel, director of Boston Consulting Group’s Centre for Growth, writes that ‘what business leaders really want to see is the relentless focus and action to promote growth that they were promised. This means addressing some of the UK’s underlying problems…such as high energy costs, poor returns on investment, flawed delivery of large capital and infrastructure projects and the lack of a coherent industrial strategy.’

To navigate the next four years, Emanuel Adam, executive director of the transatlantic trade association BritishAmerican Business, advises UK companies to ‘assess [Trump’s] policy proposals seriously but also wait to see where and how proposals turn into action’.

We have long known that there’s a difference between the maximum Trump argues for and the final agreement of what he will settle for.