While poets, musicians and actors may get the top billing on St Patrick’s Day, accountants need not feel left out. AB highlights 10 impressive, sometimes surprising, contributions to the world of numbers, business and finance where Ireland, and Irish people, have played leading roles.

Columbanus (540-615) and the science of computus

One subject dominated intellectual debate in early medieval Europe like no other: the science of computus, the mathematical calculation of the date of Easter. Computus required both a knowledge of the Julian calendar and the lunar cycle, and differing concepts and definitions developed across the continent.

Considered among the most adept were the monks of Ireland; historian Dáibhí Ó Cróinín says that ‘from the time of Columbanus, Irish scholars led Europe in the field of computistical studies’. With the confidence of a modern-day disrupter, one of them, the famed Columbanus, wrote to Pope Gregory the Great in 600AD to advise that Rome was calculating Easter incorrectly.

Richard Cantillon (1680-1734), father of modern economics

Born in Co Kerry, Richard Cantillon moved to France as a young man, launching a successful banking career that saw him become a leading figure in the Mississippi Company, France’s territories in America. Here, he deftly profited from being on the right side of a number of speculative bubbles.

Cantillon’s enduring fame rests on his work, Essay on the Nature of Trade in General. Considered the first comprehensive treatise on economics, its groundbreaking features included the first use of abstract modelling to explain economic phenomena, the coining of the term ‘entrepreneur’ and a sophisticated analysis of inflation. The concept of relative inflation, where disproportionate price rises occur in different goods, is today known as the Cantillon effect.

Oliver Pollock (1737-1823), accidental inventor of the dollar sign

Hailing from Co Tyrone, Oliver Pollock sailed across the Atlantic aged 23, where flourishing business interests in Philadelphia, the Caribbean and New Orleans made him one of the wealthiest men in North America. He became a major financier of the American Revolutionary War, spending the equivalent of US$1bn in today’s money on military expeditions and falling heavily into debt as a result.

While in a debtors’ prison in Havana, he created the dollar sign through an abbreviation of the Spanish peso, the fiat currency of the time, with penmanship that overwrote the ‘s’ on the ‘p’; this was copied by others and adopted by the Bank of North America, becoming the currency of the infant US in 1786.

EJ Corrigan, female CEO in Victorian Ireland

Ireland’s relationship with whiskey may appear to have a distinctly male bias but, historically, distilling, like brewing, was often undertaken by women. Notable in this story is the figure of Ellen Jane Corrigan, who would drive Bushmills Distillery to new heights in the late 19th century.

Corrigan began co-running the iconic Antrim distillery with business partner James McColgan following the death of her husband in 1865, effectively acting as CEO while McColgan focused on production. Corrigan wanted to expand internationally, building on Bushmills’s reputation for quality; innovations introduced on her watch included the electrification of the distillery and its conversion to a limited liability company.

William Sealy Gosset (1876-1937), statistician and Guinness scientist

Newly graduated from Oxford, Englishman William Sealy Gosset joined the Guinness Brewery in Dublin in 1899. Gosset’s research on the cultivation of barley led him to a method to establish if the null hypothesis (that there was no effect in phenomena being observed) should be rejected or retained.

Afraid its trade secrets might be stolen, Guinness allowed its scientists to publish research on condition they did not mention beer, the company or their surnames. Under the pen name Student, Gosset introduced his research, including his transformative test of statistical significance, known as Student’s t-distribution. His method would have far-reaching consequences on scientific research throughout the 20th century.

TK Whitaker (1916-2017), civil servant who reshaped the Irish economy

The significance of Thomas Kenneth Whitaker centres on his time as head of Ireland’s department of finance, from 1956 to 1969. With the country mired in recession and mass emigration the norm, Whitaker argued for the end of protectionist policies, opening the country to free trade and attracting foreign investment. Published in 1958, his First Programme for Economic Expansion set the stage for policy changes that would ultimately transform the economy.

Whitaker was named ‘Irishman of the 20th century’ in 2001; Whitaker Square in Dublin’s Grand Canal Dock is named in his honour.

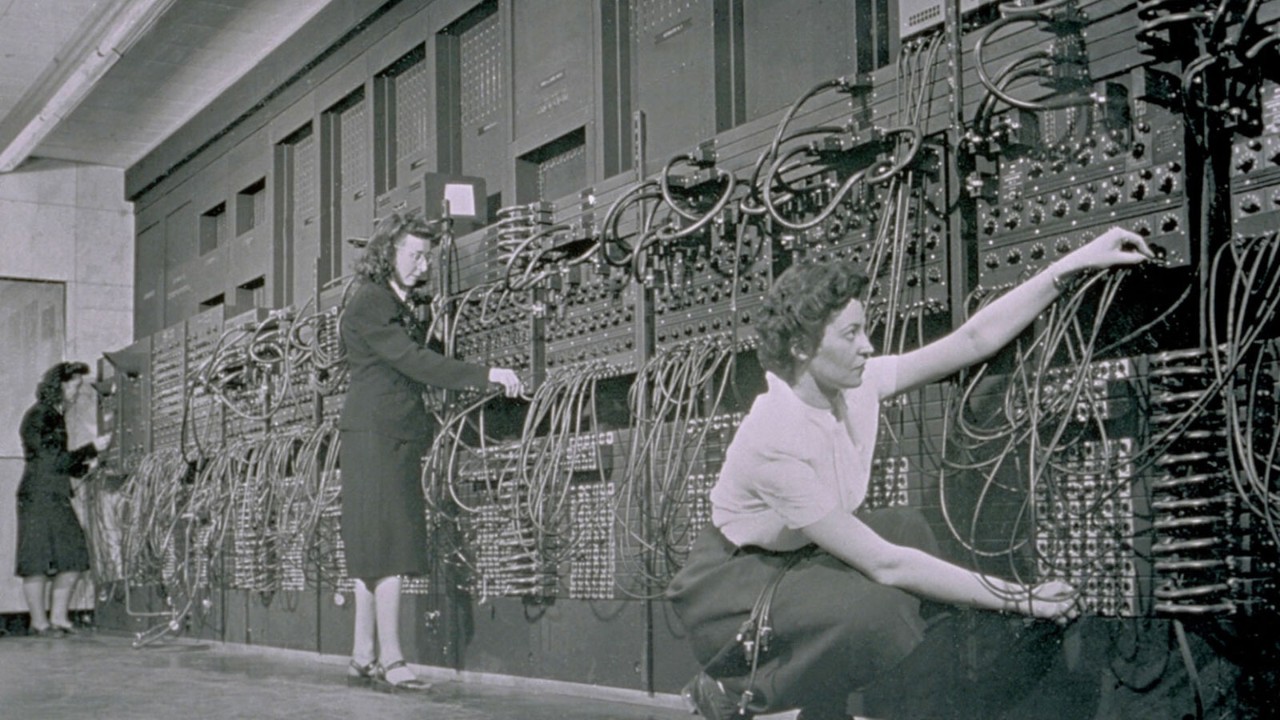

Kay McNulty (1921-2006), computer programming pioneer

Born in Creeslough, Co Donegal, Kay McNulty emigrated with her family to Philadelphia, where she earned a degree in mathematics in the early 1940s. A recruitment drive by the US civil service focusing on women with numeric aptitude led to McNulty being hired as a human ‘computer’ – serving the war effort by manually calculating ballistics trajectories.

McNulty was soon promoted to programming the newly developed Electronic Numerical Integrator And Computer; after speeding up the process, she was credited as the inventor of the computer program subroutine. She was inducted into the Women in Technology International Hall of Fame in 1997, having received little credit for her achievements at the time.

Charles Handy (1932-2024), business thinker who coined the ‘portfolio career’

Born in Co Kildare, author and business thinker Charles Handy spent most of his life in Britain, playing a key role in founding the London Business School, the first graduate business school in the UK, in the 1960s. In a series of bestselling books, he foresaw the arrival of the gig economy, remote working and the fragmentation of the traditional career. His concept of the ‘portfolio’ life has undoubtedly influenced many ACCA members on their career paths.

A sign that Ireland retained a place in his heart was his concept of the ‘shamrock organisation’: a three-fold business model involving professional core workers, freelance workers and part-time/temporary routine workers.

Monex (1997) and the invention of dynamic currency conversion

Dynamic currency conversion (DCC), the point-of-sale service that allows people make credit card payments overseas in their home currency, was the brainchild of Irish businessman Frank Murphy, who had the idea while working in a summer job for a car rental company. In 1997, Murphy founded financial services firm Monex in Killarney, Co Kerry, appropriately finding his first customer in Hertz.

While DCC has its critics – some point to its higher costs – the transparency and assurance it brings has seen this Irish innovation gain an enduring place in the global payments industry.

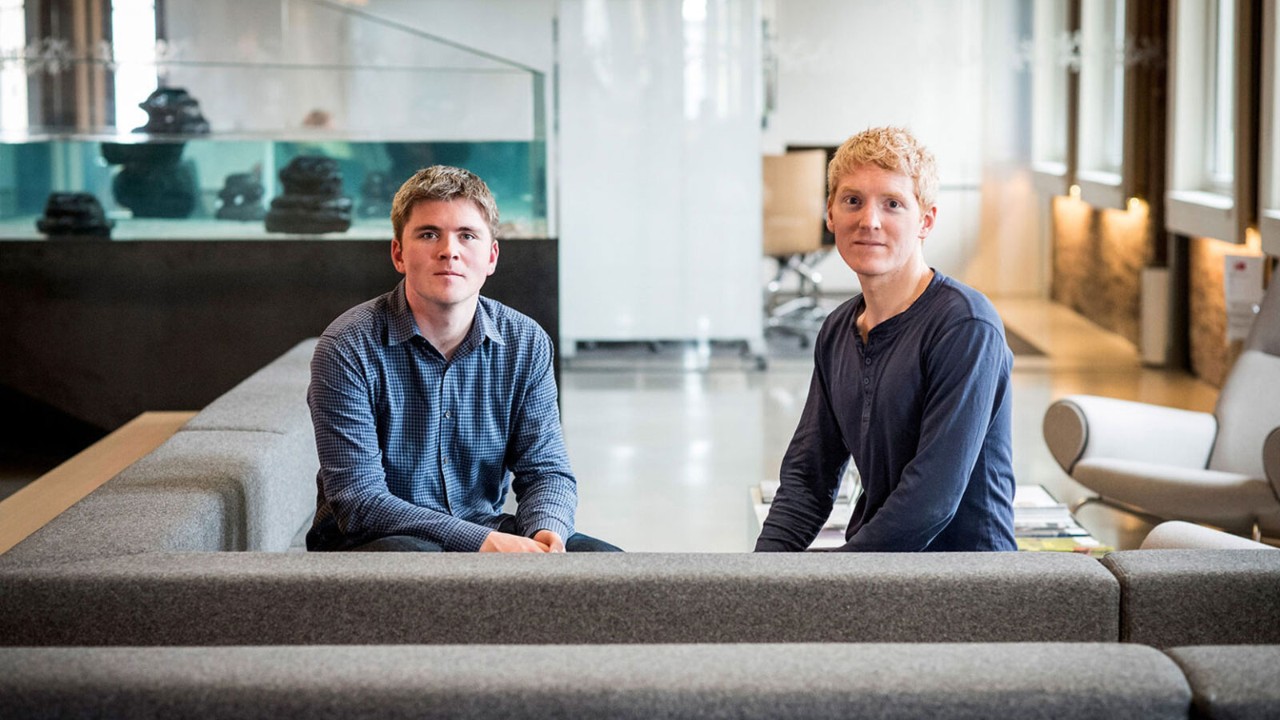

Stripe (2010), Ireland’s financial services unicorn

Stripe, which allows businesses to safely accept debit or credit card payments online, was founded in 2010 by Co Tipperary brothers Patrick and John Collison, aged just 22 and 19. The two already had form in the tech world, having sold their first start-up for US$5m a few years earlier.

Currently employing around 8,500 people globally, the firm was dubbed a unicorn – a privately owned company worth US$1bn – in 2014. As of 2024, Stripe was valued at US$70bn.

In 2021, John Collison purchased Abbeyleix House in Co Laois, built on the grounds of a monastic settlement dating back to 600AD – a fitting link between Ireland’s early achievements in computus and modern-day financial innovation.