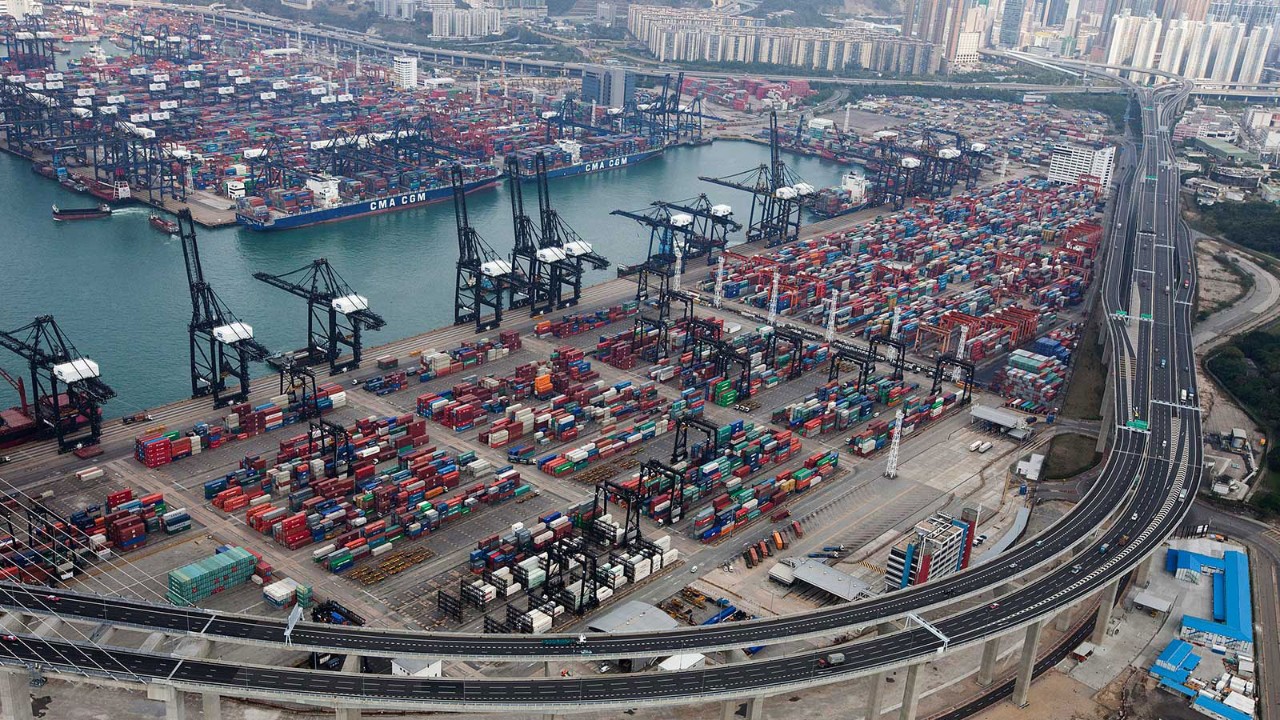

Given the breakneck pace of business evolution, companies operating across Hong Kong SAR and mainland China face complex tax challenges that can greatly impact their bottom line. With tax authorities in both jurisdictions intensifying their scrutiny of cross-border transactions, businesses must navigate an intricate web of compliance requirements while staying competitive.

The practical implementation of robust tax strategies to prevent double taxation, particularly around transfer pricing and mutual agreement procedures, took centre stage at the ACCA Hong Kong Virtual Tax Conference 2025. During a panel discussion on mitigating risks in cross-border tax disputes, speakers said that though a mutual agreement procedure can be effective in resolving cross-border transfer pricing disputes, it comes with important caveats.

Cross-border complexity

‘Although Hong Kong has tax treaties in place, this doesn’t automatically eliminate concerns about double taxation,’ said Polly Wan FCCA, co-chairman of ACCA Hong Kong’s tax subcommittee and tax and business advisory partner at Deloitte China. ‘The complexity increases massively with multijurisdictional transactions.’

While mutual agreement procedures offer a pathway for resolution, Petrina Chang, transfer pricing partner at Deloitte China, warned of its limitations. ‘For example, even with a complete Hong Kong tax refund, companies still face an 8.5% rate differential with mainland China, plus unrecoverable costs like penalties and interest charges, secondary adjustments, etc,’ she said.

‘An advanced pricing arrangement allows you to engage with tax authorities upfront’

For businesses where transfer pricing greatly impacts operations, Chang advocated a proactive approach through an advanced pricing arrangement. ‘This approach allows you to engage with tax authorities from different jurisdictions upfront to agree on related-party transaction pricing, providing protection for up to five years, with possible rollbacks,’ she said.

China’s tax reform

In mainland China, tax authorities are making great strides in modernising their mutual agreement procedures framework, with new measures aimed at clarifying tax residency requirements and streamlining dispute resolution processes.

‘While China has maintained mutual agreement procedure protocols since 2013, recent reforms are improving their effectiveness,’ said Rebecca Wong FCCA, South China tax markets leader at PwC. ‘The April 1 clarification of tax residency certificate requirements will streamline both mutual agreement procedure applications and cross-border dispute handling.’

To provide certainty on complex tax issues for taxpayers, tax authorities in the mainland at different provincial and municipal levels have recently undertaken trial runs of advance ruling services. ‘Taxpayers need observe the local rules regarding advance ruling applications and communicate with the competent tax bureaux in advance to assess if a ruling can be applied for,’ Wong said.

The groundwork for stronger tax coordination within the Greater Bay Area has been laid

Last September, the Belt and Road Initiative Tax Administration Cooperation Forum in Hong Kong marked a significant milestone in regional tax cooperation. The signing of a memorandum of understanding between tax authorities from Guangdong province, Shenzhen municipality, Hong Kong and Macao laid the groundwork for stronger tax coordination within the Greater Bay Area (GBA).

‘Enhanced communication and cooperation between these jurisdictions will help address cross-border tax issues for taxpayers operating in the GBA and resolve tax disputes more effectively,’ said Wong.

Global tax net

Across the world, jurisdictions are tightening their oversight of transfer pricing arrangements, targeting transactions involving low-tax jurisdictions such as Hong Kong. The changes have major implications for multinational enterprises.

‘Transfer pricing audits are the most common challenge we encounter,’ said Jenny Hau, assistant vice president of Pacific Century Group. ‘Some jurisdictions have more sophisticated compliance requirements and maintain comprehensive databases that track transfer pricing data across different industries. When they identify discrepancies, they often challenge and reject our transfer pricing positions.’

Traditional transfer pricing audits are giving way to more sophisticated review programmes worldwide. For instance, the UK tax authority has a profit diversion compliance facility that examines entire corporate groups rather than individual transactions. Similarly, Australia has implemented public country-by-country reporting, and European Union nations are expected to follow suit.

‘Advance tax rulings may trigger increased scrutiny across multiple jurisdictions’

Wan highlighted the dilemma companies face with such programmes. ‘If they opt in, they might face penalties during the review process. But if they choose not to participate and are later investigated and found to have underpaid their taxes, they could face even steeper penalties.’

To mitigate risks, companies are increasingly seeking advance rulings, though this strategy comes with its own complexities. Hau pointed out that while advance rulings can provide certainty, they differ from jurisdiction to jurisdiction. ‘Hong Kong takes a transaction-based approach, while the EU imposes time limits on ruling validity,’ she said.

The rise in information exchange between tax authorities also creates new compliance challenges. ‘When issuing an advance ruling, some jurisdictions will explicitly state that they’ll share this information with tax authorities in other countries, potentially triggering increased scrutiny across multiple jurisdictions,’ said Hau.

A systematic approach

Against such a complex backdrop, tax professionals need to take a more systematic approach to transfer pricing documentation and year-end adjustments, according to Wilson Cheng FCCA, vice chairman of ACCA Hong Kong and partner and tax leader at EY Hong Kong and Macau.

When handling cross-border adjustments, Cheng highlights six key areas for consideration: local rule interpretation, withholding tax implications, double taxation prevention, certificate of resident status requirements, customs implications and indirect tax (eg VAT/GST) implications.

‘What seems certain on paper may not translate perfectly to practice’

‘While companies may secure advance rulings for some of these areas, comprehensive coverage isn’t guaranteed,’ Cheng explained. ‘Even when seeking certainty in these matters, professionals should understand that what seems certain on paper may not translate perfectly to practice.’

Contemporaneous documentation is paramount for transfer pricing defence, according to Cheng. ‘While transfer pricing involves theories, characterisation and benchmarking, the most important element is contemporaneous evidence,’ he said. As well as emails and contracts, the scope of acceptable evidence has now expanded to include instant messaging and travel records.

In tackling these challenges, Cheng recommended implementing centralised data management systems. ‘When tax compliance is a legitimate business need, we need efficient ways to gather information from various departments like human resources and finance,’ he said. ‘That data often exists in different internal systems across organisations and requires IT consultant support for proper integration.’

More information

Watch the on-demand ACCA Hong Kong Virtual Tax Conference 2025

Read our articles from ACCA Hong Kong’s tax conference, ‘Rethinking supply chain strategies’ and ‘Major upgrade for tax‘