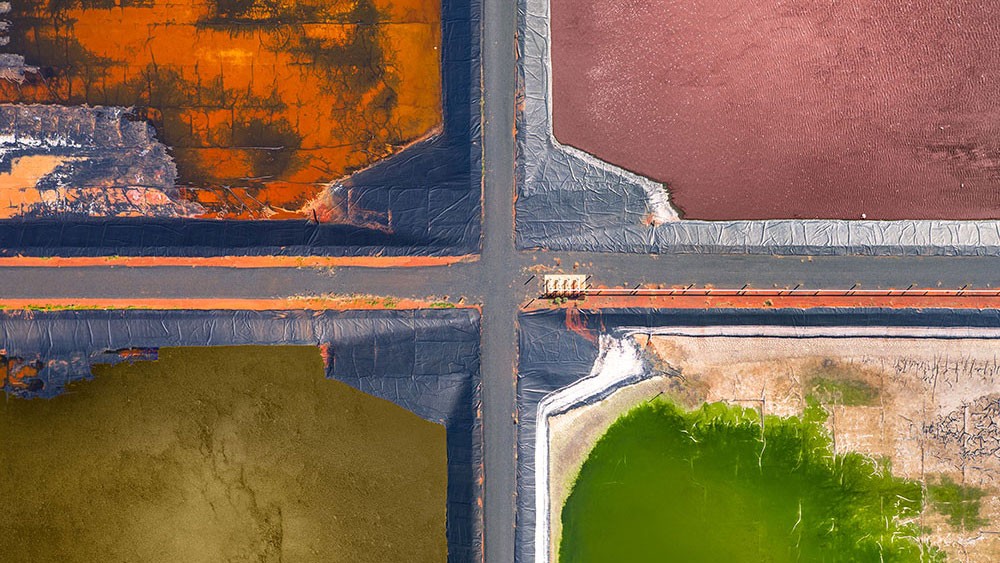

Greenwashing, the practice of companies overrepresenting the extent to which their practices and products are environmentally friendly, sustainable or ethical, is a growing concern in business – and for accountants as guardians of corporate responsibility.

According to a Schroders survey of 650 institutional investors in 26 countries in April 2020, 67% prefer to integrate new environmental requirements into their decision-making processes. However, six in 10 of the investors – which manage more than US$25.9 trillion in assets – believe greenwashing is the biggest challenge to sustainable investment.

The issue has also been highlighted by the International Monetary Fund (IMF), which has called on governments and regulators to do more to protect investors from being misled by greenwashing. The IMF says assets in sustainable investment funds have doubled over the four years to 2020 to about US$3.6 trillion.

‘Firms that greenwash supply chains observe both sales and profitability increase, but only for the short term’

The problem

Research by the Chinese University of Hong Kong Business School has found robust evidence of businesses greenwashing their corporate social responsibility (CSR) image by voluntarily disclosing environmentally responsible suppliers while concealing ‘bad’ ones.

‘Supply chain greenwashing is more prevalent for firms that face higher competition, care more about their brand awareness, are more profit-driven and held more by institutional investors,’ according to the report, Corporate Social Responsibility in Supply Chain: Green or Greenwashing? ‘The greenwashing behaviour mitigates after implementing mandatory CSR disclosure policies. Firms that greenwash supply chains observe both sales and profitability increase, but only for the short term.’

The risks

Emma Herd, climate change and sustainability partner at EY Oceania, worked in sustainable finance in the banking sector at Australia’s Westpac bank for 15 years. She warns that litigation is becoming a significant risk for companies in terms of how they report their green credentials.

In what the Australasian Centre for Corporate Responsibility (ACCR) claims is a world-first legal case, the non-profit organisation is suing oil and gas producer Santos in the Federal Court of Australia over statements in the company’s 2020 annual report that it produces clean energy and is on the way to reaching net-zero emissions by 2040.

‘Companies are looking for external verification of their non-financial claims, particularly with regulators increasing their scrutiny’

ACCR claims Santos has breached corporation and consumer laws by engaging in what ACCR says is misleading or deceptive conduct. Santos will not comment, as the case is before the courts, but has said it stands by its statements.

Herd says the Santos proceedings will be an important test case for the consequences of greenwashing. She also points to increasing oversight from regulators in Australia and around the world about sustainability claims.

‘Jurisdictions as wide-ranging as Singapore, Malaysia, Thailand and Japan are all introducing more robust governance and reporting requirements for companies,’ says Herd, who rates the UK and France as world leaders in reporting standards and requirements.

She adds: ‘We're seeing a very strong focus on the integration of sustainability and financial reporting and performance. In the nuts and bolts of auditing and accounting skills, companies are looking for that greater level of confidence in the internal policies and processes, and also that external verification of non-financial claims that they are making, particularly with the regulators increasing their level of scrutiny.’

Regulators

Earlier this year, the International Organization of Securities Commissions (Iosco), which embraces securities regulators from the US, Europe and Asia, proposed stricter measures to prevent asset managers from greenwashing or overstating the climate-friendly credentials of their products to investors.

According to Iosco, ‘incomplete and inconsistent data’ on environmental, social and governance (ESG) factors could ‘harm market integrity and undermine markets’ ability to support the allocation of capital towards sustainable development and growth projects’.

The Australian Securities and Investments Commission (ASIC) is also reviewing whether financial products or investment strategies are as ‘green’ as they claim. ASIC commissioner Cathie Armour says there is growing global unease about the risks of greenwashing of financial products ‘partly driven by a lack of clarity about labelling or a single generally accepted taxonomy in this area’.

She adds: ‘Misrepresentation of such products poses a threat to a fair and efficient financial system.’

Accountants' role

Herd says accountants have an important role to play in combatting greenwashing. ‘That is absolutely at the heart of what accountants do, in terms of certifying and verifying the claims made by companies to ensure that environmental and sustainability claims are just as robust as their financials. The skills and capabilities that accountants bring to bear are crucial in ensuring that the sustainability claims of companies are authentic and credible.’

Indeed, a whole supply chain assurance sector has sprung up. The Big Four firms, in particular, are scaling up their ESG service offering to unprecedented levels. Holding the paying clients to account is going to be one of their greatest challenges.

Herd says that what makes a green claim credible is open and transparent communication, the absence of misleading or misrepresentative claims, and the avoidance of trendy but factually inaccurate labels for products and services.

Among the questions accountants should be asking are:

- Are we measuring what matters?

- Are we verifying the numbers?

- Have we reported everything material?

- How do we know that information is factually accurate?

Reliable numbers are key to sustainable investments, and accountants and auditors are the gatekeepers of those.

Further information

Read a joint report by ACCA and strategic alliance parter CA ANZ, Ethics for sustainable AI adoption, to find out how prioritising an ethical approach to using AI cuts across all three of the environmental, social and governance (ESG) aspects of running an organisation