Businesses have faced a veritable obstacle course of challenges over recent years – from a global pandemic to a surge in energy prices following Russia’s invasion of Ukraine. But one hurdle that they had not expected to confront was a banking crisis.

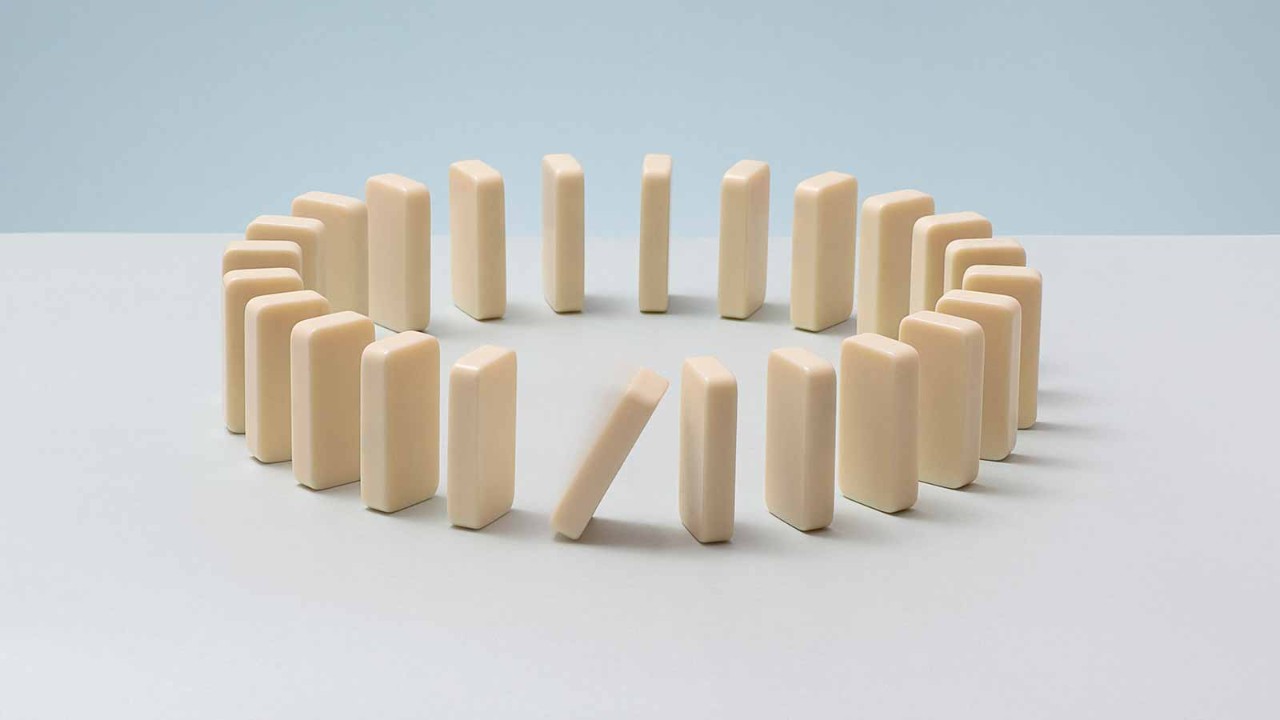

The stricter rules imposed on financial institutions following the 2008 financial crisis were intended to make the threat of a banking crisis a thing of the past. Unfortunately, the potential for a repeat of the domino of bank collapses seen during the Global Financial Crisis has started to seem all too real. Complacency over the stability of the financial system was punctured early in March by the failure of Silicon Valley Bank, the biggest bank to implode since 2008.

This was followed by the erosion of confidence in Credit Suisse, a 160-year-old Swiss lender that was one of the 30 global banks considered ‘too big to fail’ by the Financial Stability Board, a global financial watchdog. Swiss authorities speedily arranged a gunshot wedding with larger national bank UBS to avoid a chaotic disintegration.

There is both good and bad news for companies worried about the health of the banking system

So how worried should chief financial officers on both sides of the Atlantic be by the possibility of a full-blown banking crisis? The precedent of the 2008 crisis is intimidating. The episode led to a loss of more than $2 trillion in global economic growth, a drop of close to 4%, between the pre-recession peak and the low point in the first quarter of 2009.

Company executives witnessed the value of their stocks plunge by nearly $8 trillion, with a peak to trough fall in the S&P 500 of over 55%. The result was a deep dip in earnings worldwide.

There is both good and bad news for companies worried by the health of the banking system. The good news is that a repeat of this crisis is considered unlikely by economists and financial experts. The bad news is that more vulnerable banks are almost certain to cut back on lending, which will have a chilling effect on the economy and make it harder for companies to fund investments.

Good news

First the good news. Banks in both the US and Europe are in far better shape than they were prior to the 2008 crisis. At the start of 2023, US banks had an aggregate Tier 1 risk-based capital ratio – a measure of the reserves on hand to absorb losses – of 13.7%, compared to 10.1% at the end of 2007.

The Federal Reserve also acted decisively to shore up what looks like the major vulnerability of US banks. Many financial institutions invested heavily in longer-duration US Treasuries following an influx of customer deposits throughout the pandemic. As the Fed raised rates, these bonds lost value, leaving US banks sitting on a paper loss of around $620bn, according to the Federal Deposit Insurance Corporation.

This becomes a potential problem if depositors withdraw their funds, forcing banks to sell these bonds before maturity – which caused the collapse of Silicon Valley Bank. The Federal Reserve’s new Bank Term Funding Programme allows struggling banks to borrow money against their bond portfolios at face value, rather than the lower current market value.

Idiosyncratic problems and adverse sentiment towards European banks may well prompt them to tighten their lending standards

Europe’s banks look in even better shape. Since they didn’t generally experience such a swift influx of deposits, they invested less in long-dated bonds and, therefore, have more modest unrealised losses. In addition, their capital positions are generally even stronger, with an average Tier 1 ratio of 14.8%, from around 11.5% as recently as 2014, based on data from the European Banking Authority.

Strict banking regulations were also applied more comprehensively in the Eurozone compared to the US, observes Andrew Kenningham, chief European economist for Capital Economics. ‘European banks with a balance sheet of at least €30bn are subject to a stress test, compared to $250bn in the US,’ he observes.

Bad news

Now for the bad news. Chief financial officers are likely to face tighter lending conditions as vulnerable banks seek to bolster their balance sheets and liquidity positions. The example of Credit Suisse illustrated that even well-capitalised banks can face a flight of capital. As Kenningham says: ‘Idiosyncratic problems and adverse sentiment towards European banks may well prompt them to tighten their lending standards, adding to already-high recession risks.’

There are already signs that banks have been curbing lending to businesses. EY is forecasting a 3% contraction in lending to Eurozone businesses this year, the weakest in a decade. In the US, banks have been stricter on business loans for some time. The most recent Senior Loan Officer Opinion Survey from the Federal Reserve indicated that a net 43.7% of banks are tightening standards for small firms and 44.8% for large firms. Worse is likely to come.

This will be an additional headwind for the economy and businesses. While many larger companies raise much of their funding in the capital markets, smaller companies are typically more reliant on financing – especially from the US regional banks that are currently struggling most.

Banks with less than $250bn in assets account for roughly half of US industrial and commercial lending. These banks are also critical providers of loans to the rest of the economy, including 80% of commercial real estate lending and around 45% of credit to consumers. It is also worth noting that small US businesses – those with fewer than 500 staff – account for just over half of overall employment.

Financial market volatility

An additional potential pitfall is that worries over the banking system will cause volatility in financial markets – both credit and equity – further exacerbating funding constraints for companies. The initial burst of anxiety over banks seems to have subsided, at the time of writing in early April. But it would perhaps be over-optimistic to assume that no further unpleasant surprises lie in wait to test regulators, investors and businesses.