When ACCA was founded in 1904, the sum of shareable human knowledge existed only in our heads and in print form. In 2023, more than 328 million terabytes of data is being created every single day. That may not mean much to you or me, but put it this way: if you tried to download that day’s worth of data at ultrafast Gigabit Ethernet broadband speed, it would take over 90,000 years.

The question is: when our businesses really need data they can rely on – to judge performance, analyse results and inform strategy – they need individuals they can trust to interpret the mass of information coming their way.

Increasingly, accountants are stepping up to fill that role. We are the assurance experts equipped with the digital savvy, and the all-round intuition based on the best training and the widest business education, to hack a way through the tangled thicket of information.

With ever-more processes delegated to automation, the human element is more important than ever

It comes back to those qualities that matter most to accountants: integrity and trust. They are attributes that clearly mean more in a world where insight, personal judgment and a devotion to ethical behaviour are critical in decision-making. At a time when it is possible to delegate ever-more business processes to algorithms and automation – and some corporations are experimenting with ChatGPT-type tools to remove humans altogether from their comms chain – the human element provided by accountants becomes more important than ever.

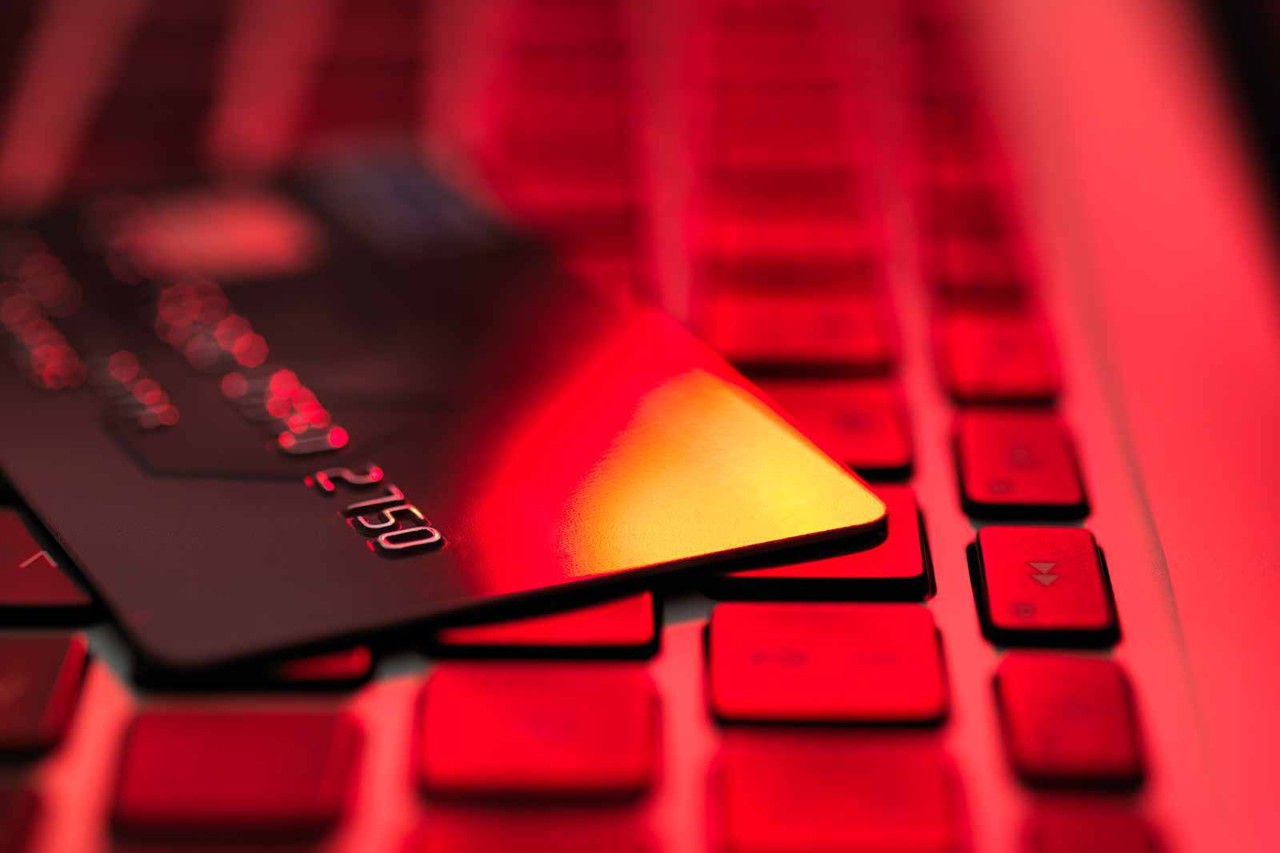

The threats

It is a worrying truth that many technological advances and digital applications are prone to manipulation by bad actors. Deep-fake video has the power to distort public opinion and trash reputations. Adversarial AI includes situations where criminals leverage technology to disseminate malware, execute financial scams or create chatbots to mimic humans.

It is no surprise that PwC’s 2023 Global Digital Trust Insights research found that two-thirds of executives consider cybercrime their most significant threat this year. According to McKinsey, 85% of SMEs in the US intend to increase their cybersecurity spending.

While there are significant gains – machine learning algorithms being taught how to ‘think’ like an auditor, and automated document verification tools being used to find fraud indicators – it’s also important to remember that technology doesn’t always work in our best interests.

Our philosophy as guardians of data must be ‘digital first’ and not ‘digital only’

The greatest financial disaster of our era, the crash of 2008, was triggered partly by automated share-selling algorithms beyond human control dumping huge volumes of stock. In 2021, criminals laundered US$8.6bn of cryptocurrency, forcing governments to bring crypto-assets into their tax domains. At the behest of the G20, the OECD published the Crypto-Asset Reporting Framework with the goal of bringing a new transparency to crypto-asset transactions.

All of this serves as a reminder that our philosophy as guardians of data must be ‘digital first’ and not ‘digital only’.

The world needs us to serve as ethically motivated assurance experts who are ready and prepared to use our professional skill – and our professional scepticism – to ensure that big data and digital technology serve our purpose, and never remove critical human judgment entirely from business decisions.

More information

See AB’s special edition on big tech, in particular the article on audit transformation