The path to citizenship in Ireland is complex and lengthy for most people coming from outside the EU or UK, taking a minimum of five years for those in possession of a government-issued employment permit to enter the first phase: long-term residency status. For a privileged few, there was, until recently, a short cut.

Introduced in 2012, the Immigrant Investor Programme (IIP) followed the model of ‘golden visas’ elsewhere in the world, offering residency and citizenship opportunities to high-net-worth individuals in return for investment in the country. To be eligible, an individual was required to have net assets of at least €2m and commit to a business investment of at least €1m or a philanthropic endowment of €500,000.

‘Golden passport programmes open the door to corruption, money-laundering and tax avoidance’

On 14 February this year, Justice Minister Simon Harris announced the IIP’s immediate closure. The decision followed mounting criticisms of such schemes by a range of international bodies, among them the EU Commission, Transparency International and the OECD, all brought to a head by the war in Ukraine and concern at how sanctioned individuals from Russia and Belarus could manipulate such schemes.

In 2022, Didier Reynders, EU commissioner for justice and consumers, uncompromisingly described ‘golden passport’ programmes as illegal under EU law and said they ‘open the door to corruption, money-laundering and tax avoidance’.

Competitive market

Ireland has not been singled out for any particular criticism with regard to the IIP by such bodies. Similar schemes are in operation across the EU, in many cases with what might be described as far more lucrative offers to investors.

While criticisms of the programmes are clear cut, their value to economies is more complex

According to a 2018 report by Transparency International, four EU member states – Austria, Bulgaria, Cyprus and Malta – ‘sold’ passports to investors, while Ireland was one of 11 member states (then including the UK) offering residency permits. Ireland’s threshold for eligibility was also well above many of its peers. Greece, for example, offered residency in return for just €250,000 invested in property (a figure raised to €500,000 this year).

While criticisms of the programmes are clear cut, their value to economies is more complex to assess. Following a 2021 study on investor residency programmes internationally, London School of Economics academic Dr Kristin Surak argued that their average economic value to EU member states was marginal, calculating ‘golden visas typically bring in no more than 0.3% of GDP in revenues’.

The IIP raised approximately €1.2bn in total over its 10-year run

The caveat, however, was that ‘the yields are not spread equally’. The study found that ‘most of the money goes into Greece, Portugal and Spain’, each taking some €750m of a €3bn EU market.

Ireland’s share of this money pot certain fell into a more modest bracket. By the end of 2022, the IIP was estimated to have raised approximately €1.2bn in total over its 10-year run.

‘Their appeal for many investors lies in gaining mobility and options in an uncertain world’

Analysis by Transparency International suggests by far the largest market for golden visa schemes globally is Chinese citizens, accou for 70% on average of participants. In Ireland, the campaigning group estimates Chinese citizens accounted for 90% of applicants.

Surak’s research led her to question the negative characterisation of participants, in particular the idea that ‘these schemes are just used by shady businessmen trying to dodge tax bills’. She argued that their appeal for many investors lies in ‘gaining mobility and options in an uncertain world, where there are huge inequalities between citizenships’.

Calls for reversal

Coincidentally, just a day after the closure of the IIP, the Portuguese government followed suit. While widely seen to have helped re-energise the country’s moribund property market following the financial crisis, Portugal’s golden visa subsequently fell foul of public opinion and was seen to have contributed to soaring rental prices in the capital Lisbon.

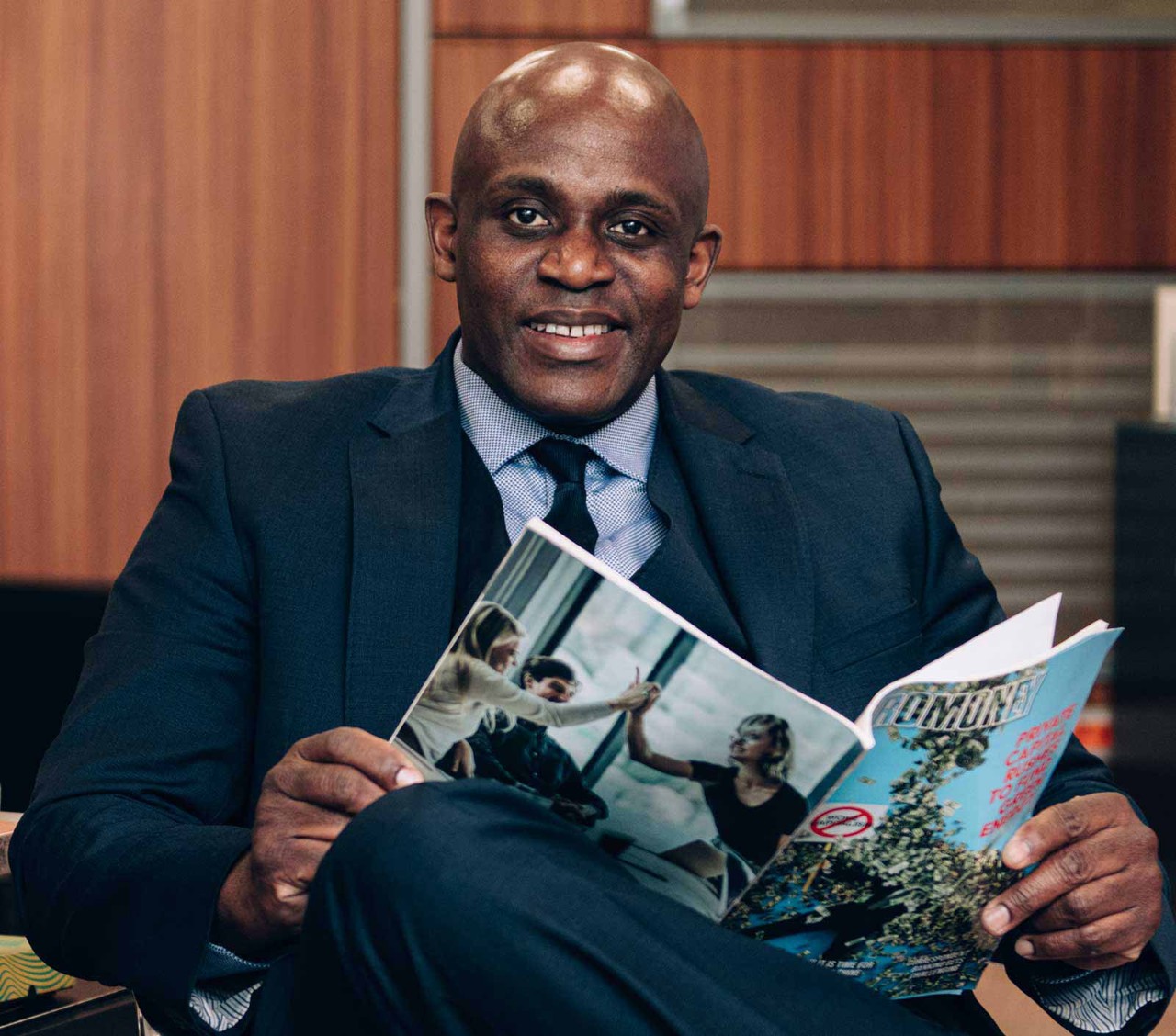

The education and hospitality sectors are among those now calling for the decision to be reversed

In Ireland, no such downsides were linked to the IIP and it was, in fact, its closure that provoked a negative response. Lobby groups for the education and hospitality sectors are among those now calling for the decision to be reversed.

According to an RTE News report, the Irish Universities Association said the IIP had enabled ‘significant funding’ for the country’s third-level institutions in the past decade, while the Irish Hotels Federation described it as a ‘vital source of suitable funds’, bringing €40m into the hospitality sector over the last two years alone.

It was also revealed in April that plans for a novel ‘satellite gallery’ of the Irish Museum of Modern Art, to be based in Ballina, Co Mayo, had been shelved as the philanthropy provisions of the IIP were no longer available.

‘Europe’s golden age of golden visas appears to be ending’

While the programme has closed to new applicants, the Department of Justice said that projects already approved under it would continue. In addition, the approximately 1,500 cases pending a decision will remain under consideration. Nor was the door entirely shut on new investors. Investment funds approved under the IIP were allowed a further three months to accept new investor applications, while a sister programme to the IIP, the Start-Up Entrepreneur Programme (STEP), remains in place. STEP, the government says, allows ‘innovative entrepreneurs to apply for permission to establish their business and reside in Ireland on a full-time basis’.

Signal of direction

The closure of the IIP will certainly be welcomed by the EU as a signal of direction for member states generally. News outlet Bloomberg commented soon after the Irish and Portuguese decisions that ‘Europe’s golden age of golden visas appears to be ending’. It is not a global picture however, and among Caribbean nations, promotion of citizenship by investment remains as strong as ever. Recent years have also seen a new market emerge in the Middle East with the United Arab Emirates, Jordan and Qatar all introducing their own investor residency schemes.

Ireland will have secured kudos for its actions, but the investor citizenship and visa market will continue to grow internationally, while the questions they pose for policymakers will remain as live as ever.