When supranational entities want to deploy capital in the pursuit of top-level goals, they have mechanisms to help them. For example, to drive innovation and develop smaller businesses the EU uses the European Investment Fund (EIF), which is the specialised financing arm of the European Investment Bank (EIB).

‘You need to be strategic about what’s needed, which means deeply understanding financial instruments’

As with other supranational financiers, such as the World Bank, the IMF, the European Bank for Reconstruction and Development and the Asian Development Bank, the EIF has a developmental role. It enhances access to finance for small and medium-sized enterprises (SMEs) and entrepreneurs by developing financial products for intermediaries such as banks, venture capital and private equity funds, guarantee and leasing companies, and micro-credit providers.

Tomasz Kozlowski FCCA, the EIF’s head of mandate and product development, works with the European Commission to structure products and mandates in line with various themes. Examples include getting banks to lend to innovative businesses across Europe, and deploying money to support the EU’s commitment to the UN’s Sustainable Development Goals.

‘You need to be strategic about what’s needed in any of the EU’s 27 markets, which means deeply understanding financial instruments,’ Kozlowski says.

Career scope

For finance professionals seeking to forge a career in such institutions, it may help to view them more like investment management firms than regular businesses.

There will, for example, be an investment department, product and mandate development teams, governance teams, tax compliance officers, risk management and investment teams, as well as a board of directors, external auditors and HR, operations and IT functions, or a regular finance function.

Nevertheless, accountancy backgrounds are highly valued in the sector, especially when bolstered by relevant experience and qualifications. Kozlowski, who came to product and mandate development from Big Four audit and advisory services, says he wouldn’t be where he is now without his accountancy background.

‘Structuring tranches of asymmetric investments requires creating a tiered order of priorities’

He says: ’Structuring tranches of asymmetric investments requires ultimately creating a waterfall, a tiered order of priorities, all of which interact with our own and our clients’ balance sheets and income statements. It’s therefore so important to design something that works and, importantly, maintains our triple-A rating. I present to ratings agencies on how our mandates are developing in line with our strategic plans and [in relation] to EIF’s position.

‘All of this without an accounting qualification would be tough. It really makes my life easier, and I would not be as successful today if I didn’t have that background. It’s given me a common language and a platform on which to further develop.’

Getting in and getting on

The right attitude and a shared sense of purpose go a long way in this sector. For the EIF and other senior institutions operating in international development, it’s about contributing to something bigger than just a company, Kozlowski says.

‘You need a genuine interest in developing economies, in helping entrepreneurs and startups, setting the ecosystem so that the economy thrives. Believing that the effort you put in every day is ultimately going to benefit the greater good, and you want to see thousands of companies benefiting, getting better conditions and realising their business plans, hiring people, developing technologies to combat climate warming or to explore space — very nice things to be passionate about.’

Of course, as well as the right fit for attitude and purpose, you will need a striking CV. There is, however, no cookie-cutter professional profile for success here – it all depends on the path you want to take. But in general, a good background in audit and advisory or financial services will stand you in good stead.

‘Your core will always be your deep technical skills, but you also need to be a very active listener’

There are several qualifications that can help with breaking into the field, and which may even be viewed as essential, as they demonstrate an understanding of financial instruments and markets, as well as commitment to the sector. The Chartered Financial Analyst (CFA) designation is almost an industry standard – Kozlowski, for example, is a CFA. There are also the Chartered Alternative Investment Analyst (CAIA) and Certified Investment Fund Director (CIFD) designations.

Advanced communication skills are also a prerequisite, given you can be working not only with other departments, but also other bodies, with differing policies and priorities. ‘Your core will always be your deep technical skills, but you also need to be a very active listener, because ideas and information that might at first seem unrelated can fly at you from all directions,’ Kozlowski says.

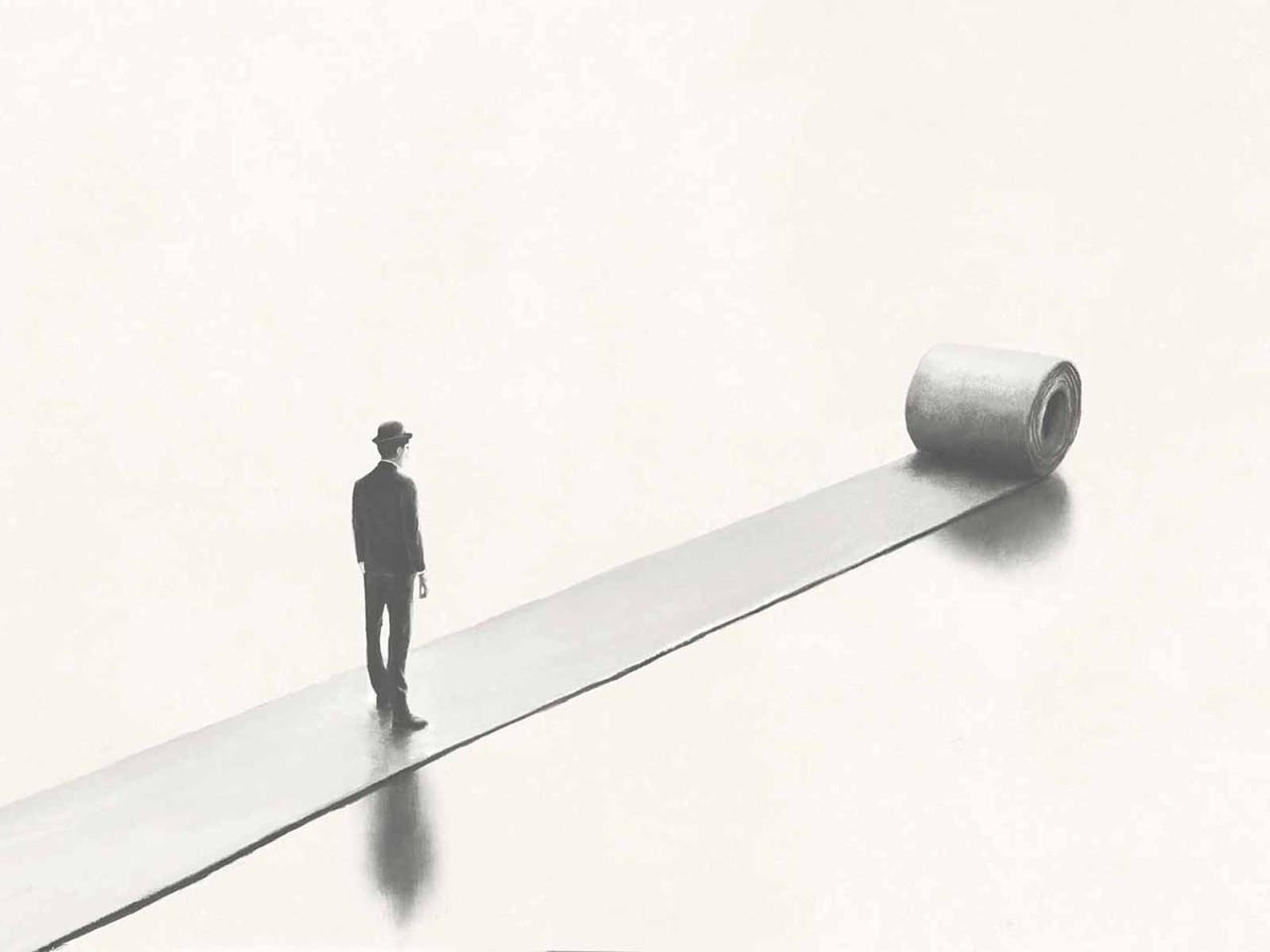

Within this you also need to be a diplomatic soft negotiator, a leader and project manager. ‘Policymakers will come to us with their vision and funding, but also a lot of questions about how to do it – ultimately a lot of unstructured problems. You need to create a structure, a pathway and development cycle, then translate policy and public finance into a language private finance understands, then operate the product in a timeframe, manage budgets, assess P&Ls, keep people motivated,’ Kozlowski says.

More information

Visit the ACCA Careers website for news and advice on your next career move