These days, the challenges of sustainability and the transition to net zero loom over business transactions. Often, a merger, acquisition or divestment is driven by the need to acquire sustainability-linked technology or expertise. But even if it is not, sustainability is not something that can be ignored during a transaction – a time of intense workload and disruption for finance professionals.

So how can organisations and their finance teams manage their sustainability responsibilities effectively during the upheaval of a deal? A new report from ACCA and Chartered Accountants Australia and New Zealand (CA ANZ), Sustainability in transactions, explores this question by looking at the interaction of mergers and acquisitions and sustainability. It is intended to support CFOs and their teams in identifying appropriate sustainability considerations during the investment and divestment cycles.

There are significant opportunities as companies seek to acquire sustainability expertise

Sustainability matters

The report asks directly if sustainability matters in the transaction cycle. The short answer is yes, but the extent to which it matters depends on the location, size and sector of the organisation involved.

The type of deal also matters, predominantly because sustainability-related issues typically have a medium to long-term horizon, which can be at odds with the priorities of a deal. The future view in a strategic deal is likely to be around 25 years, as one contributor to the report points out, whereas in a private equity-backed deal it might be five years or less.

The report concludes that sustainability forms a fundamental part of the strategic intent of a transaction and valuation of an entity.

‘The sustainability aspect of transactions is an organisational opportunity and risk that can no longer be ignored,’ says ACCA chief executive Helen Brand in the introduction to the report. While the report focuses on the impact of economic, social and environmental components of sustainability, it stresses that strategic and governance activities are also integral.

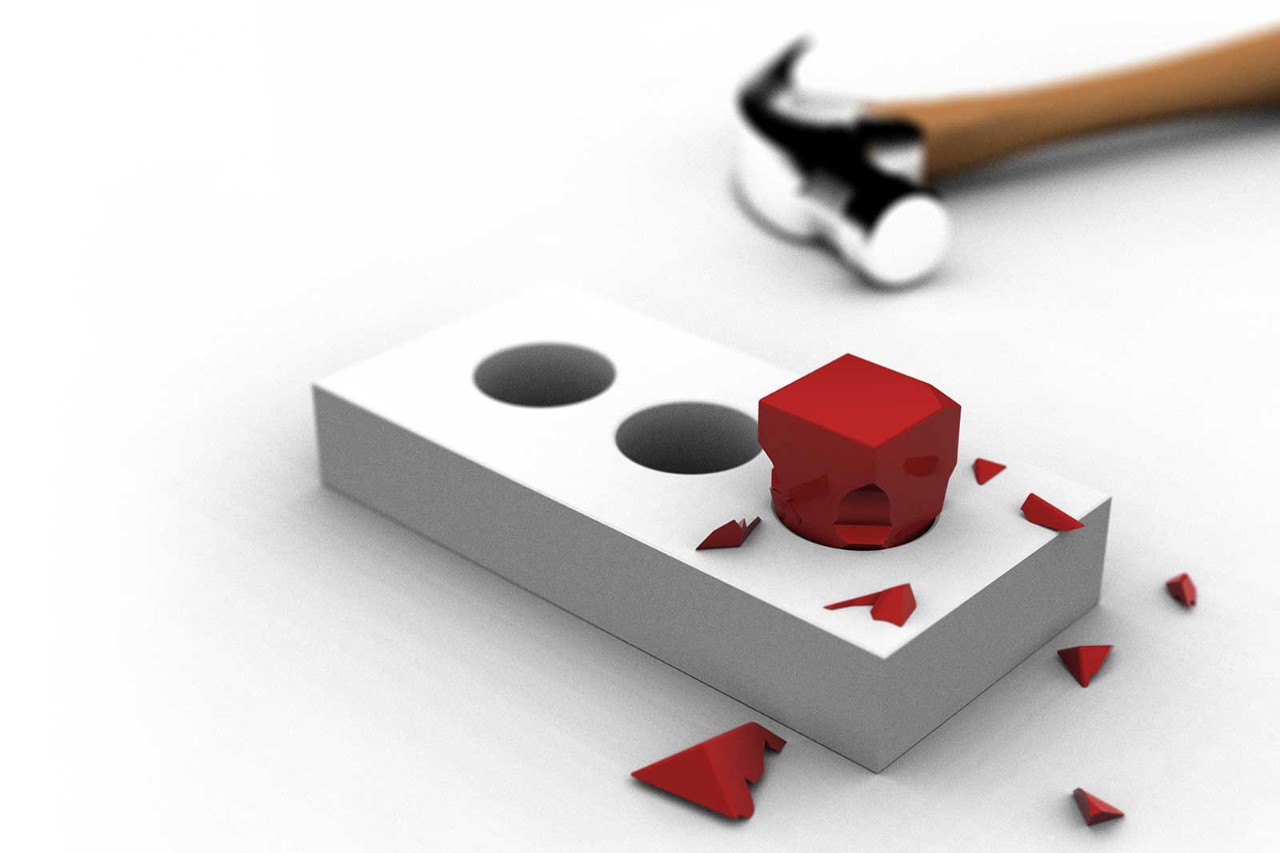

The report argues that the critical business risks that arise from sustainability ‘can pose a threat to the outcome of any transaction’. Equally, there are significant opportunities on offer as businesses seek to acquire sustainability expertise and integrate this into aspects of their business model. The report adds that assessment of these risks and opportunities ‘must be comprehensively considered as part of the due diligence process, both as a specific workflow and as an integral part of other forms of due diligence’.

Sustainability can be one of the most critical factors in determining whether a deal proceeds or not

Where it matters

The report uses the insights of more than 50 finance professionals worldwide to explore the extent to which sustainability has become a factor in the transaction cycle. It found an uneven distribution in terms of the importance of sustainability in the transactional process across sectors and geographies.

In some economies and industries, sustainability is ‘still barely a subtle noise; in others it is a loud drumbeat, so loud that it can be seen as one of the most critical factors in determining whether a deal proceeds or not’.

The report identifies the following as the main reasons why sustainability matters in a transaction:

- Investors may have committed to their own sustainability goals, which can be achieved only through the investments they make.

- Supply chains can be a weak point for due diligence, and regulators (notably the EU) are increasingly requiring organisations to assess not just their own activities but those in their supply chains.

- Customers, clients and employees matter because brand value can be affected by the perception of inappropriate activities.

The report looks in detail at the due diligence process of a transaction, from the perspective of both acquirer and acquiree. Sustainability can either be incorporated into the due diligence process as a standalone exercise, or it can be integrated into the assessment of risks in other forms of due diligence. Either way, it should not be ignored.

The areas that should be considered in the due diligence process are identified below, and call on a wide range of skills from finance professionals.

Key observations

Finance professionals who are assessing sustainability-related risks in the due diligence process should note the following key considerations:

Recommendations

The report acknowledges that assessing the impact of sustainability on a transaction and the valuation of an organisation is not straightforward. ‘It requires detailed understanding both of the sector and jurisdictions involved but also of the various aspects of sustainability itself,’ it says.

With this in mind, it makes the following recommendations for acquirer and acquiree when considering sustainability in a transactional context:

- Recognise that the social, economic and environmental dimensions of the sustainability agenda need to be considered equally.

- Assess the impact of sustainability on the cost of capital, and the implications for any variations on the modelling of future cashflows.

- Assess relationships and key risks relating to suppliers.

- Conduct a skills assessment to make sure that the team has an appropriate range and depth of skills, knowledge and qualifications to appropriately address sustainability-related risks and opportunities.

- Assess the current and known potential regulatory landscape from a sustainability perspective across the social, economic and environmental dimensions.

- Assess how the value of the brand may be impacted by sustainability considerations.

More information

See also ACCA’s guide to sustainability reporting