Impact investing has long promised to align financial returns with social progress. Yet for all the enthusiasm around environmental, gender and climate lenses, one group has remained largely invisible in the investment process: children.

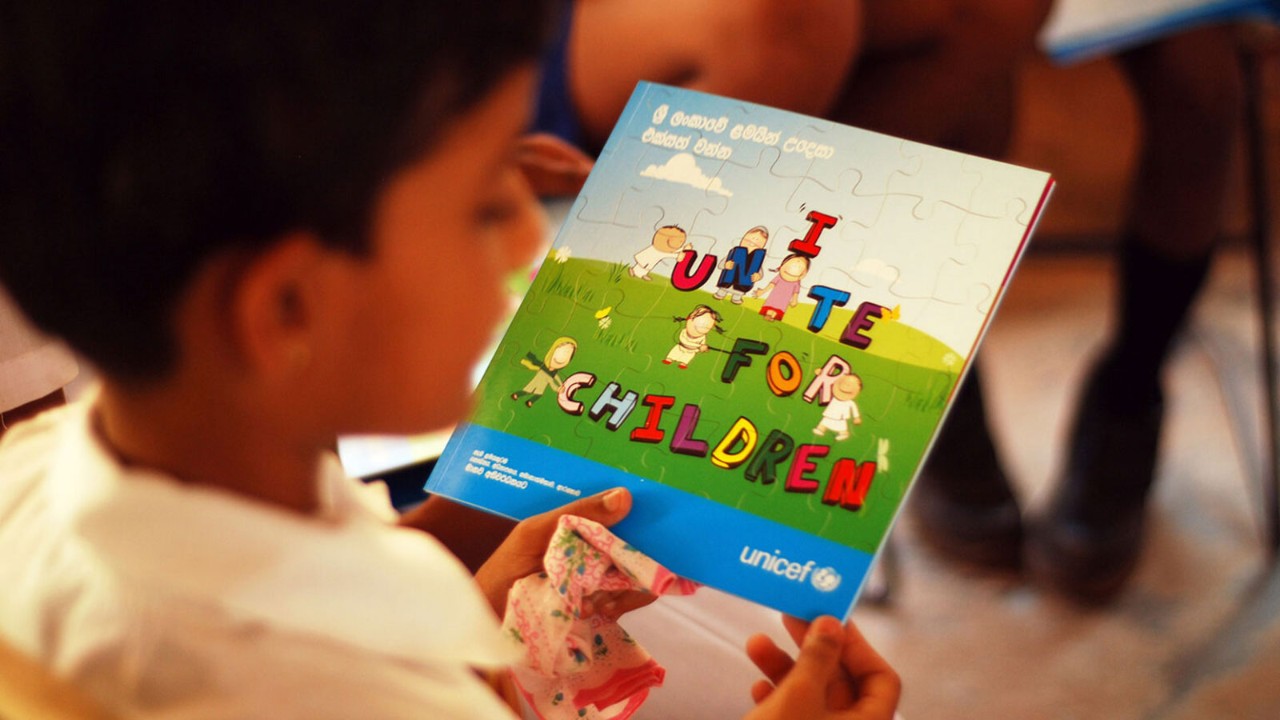

Unicef has set out to change that. Its Child-Lens Investing Framework (CLIF), launched in 2023 to bring children into the investment conversation, was recognised last year as one of Time magazine’s Best Inventions of the Year and received a bronze medal at the Anthem Awards for Humanitarian Services and Services Innovation. Now, over two years since its launch, progress is slow but, to be fair, tricky to measure.

Why a child lens?

Much like gender-lens investing before it, the idea is not to create a niche fund category but to build a way of thinking: how can investors assess, avoid and reduce harm to children, while also identifying opportunities to improve their lives?

‘We wanted to create a practice that upholds children’s wellbeing across investments’

Cristina Shapiro, chief strategy officer and president of the Impact Fund for Children and Unicef Bridge Fund, says that the motivation came from a gap in how mainstream environmental, social and governance frameworks evaluate impact. ‘We realised that while investors were increasingly considering gender, climate and governance, children were missing entirely from the picture,’ she says. ‘We wanted to create a practice that upholds children’s wellbeing across investments writ large.’

Early adopters

Examples of child-lens investing in action the following:

- Triodos Investment Management’s Future Generations Fund integrates Unicef’s framework into portfolio engagement.

- Mission-Driven Finance’s Care Access Real Estate Fund expands childcare infrastructure while supporting women’s workforce participation.

- Unicef USA’s Bridge Fund accelerates funding for health, education and emergency aid, with more than US$670m deployed.

Children are affected by investment decisions across sectors: a factory’s supply chain may involve child labour; housing developments might ignore access to childcare or safe play spaces; advertising firms can shape gender norms through the way they portray children. Conversely, taking children into account can strengthen both social and financial outcomes: for example, affordable housing near schools or childcare facilities may lead to lower tenant turnover and more stable communities – an economic as well as social gain.

Complementary lens

In many ways, child-lens investing builds on the success of gender-lens investing, not as a rival but as a complement. Empowering women often leads to better outcomes for children, while investments that overlook child wellbeing may undermine gender gains.

‘Investing in children’s wellbeing is a form of risk management’

CLIF deliberately goes further than simple risk avoidance. ‘We didn’t want to stop at “do no harm”,’ Shapiro explains. ‘What if there’s an opportunity to advance positive child outcomes, not just avoid the negative ones? We think there’s a market-opportunity there – in maternal and child health, in education, in renewable energy that directly affects children’s wellbeing.’

Quoted in a CLIF annual update, Jennifer Pryce, president and CEO at Calvert Impact, underscores the framework’s holistic nature: ‘Children don’t live in silos. Children can have educational opportunities but, if they don’t have a house, they’re not going to grow up to be productive citizens.’

Cautious optimism

Two years after the initiative’s launch and enthusiasm still exceeds evidence. Shapiro acknowledges that hard data linking child-lens practices to higher returns or measurable social outcomes is limited. ‘We can’t yet go to a KKR or a BlackRock and say “implement this and you’ll return 10% more to investors”,’ she admits. ‘That data simply isn’t there. What we can say is that it’s the right thing to do, it helps mitigate risk, and over the long term it will strengthen the systems on which our future workforce and consumers depend.’

That long-term view, she says, is precisely why this matters. ‘Children today are tomorrow’s entrepreneurs, employees and leaders. Investing in their wellbeing is a form of risk management. But most investment strategies are not long-term strategies, so part of our challenge is helping investors see beyond the next quarter.’

‘We knew it wasn’t going to be a walk in the park’

The framework is not about creating a Unicef-branded fund, Shapiro adds. Instead, it aims to influence existing managers. ‘We’re not raising capital ourselves. The goal is to work with fund managers who already have capital and show them how to integrate child considerations into their strategies. That’s far more scalable than building a few standalone funds.’

Challenges in practice

Scaling, however, won’t be simple. The lack of regulation requiring child-related disclosures means adoption is entirely voluntary. In the European Union, sustainable-finance rules have advanced faster on environmental factors than on social ones; in the US, there is no comparable obligation at all. As Shapiro notes: ‘We knew it wasn’t going to be a walk in the park. There’s no regulation that says you need to do this.’

The child-lens investing approach

Unicef’s Child-Lens Investing Framework centres on the following areas:

- Child-focused: where improving children’s lives is the primary mission of the fund

- Child-inclusive: where children are indirect beneficiaries of a wider impact goal, such as gender equity or financial inclusion

- Child-screened: typically public-equity investors who actively assess companies’ child-related policies and risks.

Investor fatigue is another barrier. ‘There are already so many standards and lenses – gender, climate, biodiversity – that many investors are feeling overwhelmed,’ she says. ‘We’re encouraging them to see this not as another layer of bureaucracy but as a way to improve risk management and deepen impact.’

There are also complex real-world dilemmas. Consider child labour: Unicef opposes it but recognises that in some contexts it stems from poverty and family need. ‘An approach that is purely punitive could actually lead to more harm,’ says Shapiro. ‘So we advocate for engagement – helping companies identify and mitigate risks, rather than simply divesting. Exiting doesn’t necessarily help the children; staying and improving practices might.’

A work in progress

For investors, accountants and finance professionals, child-lens investing offers both an ethical imperative and a strategic opportunity: a chance to align capital with the long-term health of societies and economies. The challenge is to make that alignment measurable, scalable and financially sustainable.

‘Nobody’s going to argue against doing better for children,’ says Shapiro. ‘The question is how we make it real – how we make it practical for investors. That’s where the hard work begins.’