Accountants at top international companies – and their auditors – could be forgiven for feeling a sense of whiplash. In recent weeks, US trade policy has undergone some of the most dramatic shifts in modern history. On 2 April, which US President Donald Trump named ‘Liberation Day’, a blanket 10% tariff on all imports coming into the country was announced, along with additional levies of up to 50% on more than 50 of the nation’s leading trade partners. The move took the US effectively to its highest level of tariffs for at least 100 years – even before any further spiralling of retaliatory tariffs between the US and China.

This sea-change in policy came just as many companies were putting the finishing touches to their first-quarter results. And the scale of the tariffs had major potential implications for US companies reliant on imported goods – especially from China – or for exporters exposed to tit-for-tat levies from other nations.

Far-reaching

‘Higher tariffs can touch almost every part of financial statements,’ says Brian Croteau, PwC US chief auditor, with ripple effects on everything from the cost of inputs and liquidity to the valuation of inventories, machinery and factories. For the worst-affected companies, the assumption that a business is a going concern – that it will remain a viable business at least a year into the future – could be called into question.

‘We’re talking about modelling uncertainty in real time’

As a result, the recent flux has posed significant challenges for chief financial officers, finance directors and auditors. ‘There’s very little visibility to the medium and longer term right now,’ Croteau says. ‘The trade picture can change week to week, so we’re not talking about static assumptions, we’re talking about modelling uncertainty in real time.’

So what might this volatile policy backdrop mean for financial reporting, and how are accountants dealing with such elevated levels of uncertainty?

In one sense the pace of policy shifts has been so rapid that most companies have held back from making major changes to financial statements. In the space of little more than a month, US tariffs on imports from China, for example, climbed to as much as 145% before being abruptly lowered to 30% on most goods to allow for 90 days of talks. Discussions are also ongoing with dozens of other major trading partners, from the EU and UK to India and Japan. As a result, where the dust will settle remains unclear.

Against this foggy backdrop, it may have been ‘premature’ to make major changes to financial statements, Croteau says. The most responsible initial reaction from companies was transparency, he adds. ‘Disclosure is the primary response in these types of environments. You may not know exactly what is going to happen next, but if you can, show that you have considered how current uncertainty might affect your assumptions. In this environment, management’s risk factor and liquidity disclosures can also be particularly important to focus on. It is not about having a crystal ball, just demonstrating thoughtful consideration.’

Early warning

That said, globally focused companies should be bracing for a higher tariff future. UBS has argued that a 10% broad tariff for imports into the US is likely to stay, with tariffs of 30%–40% on goods coming in from China. The Swiss bank has also noted that even after the latest roll-back, the effective US tariff rate – the levy on the total value of goods entering the country – is still around six times higher than before Trump returned to the White House, at around 15%. Such a significant move could soon start to impact liquidity at some companies, as rising tariffs lift input costs and potentially force a search for new suppliers.

‘Adapting may include diversifying supply chains, shifting operations or seeking government support’

Companies are needing to closely monitor cash flow forecasts and consider whether short-term refinancing is needed or whether supplier agreements should be revisited. ‘Businesses need to adapt to the evolving landscape marked by trade tensions, tariffs and deregulation in real-time,’ says Scott Flynn, global head of audit at KPMG International. ‘This may include diversifying supply chains, shifting operations or seeking government support to mitigate increased product costs and inflation from tariffs.’

Disclosures in quarterly and annual filings, particularly around liquidity and risks to financial flexibility, are becoming central audit focal points. As it relates to a company’s ability to continue as a going concern, Croteau noted, ‘an auditor’s conclusion that there is substantial doubt about an entity’s ability to continue as a going concern disclosed in their report is more of a red flag to pay attention to when reading a company’s financial statements and other disclosures. But investors would look to a company’s risk factor and liquidity disclosures long before that point.’

Risks multiply

For some companies, elevated tariffs have the potential to fundamentally disrupt their entire business model, potentially lowering the value of the full range of assets on the balance sheet – everything from inventories and deferred taxes to equipment and goodwill. For example, if higher tariffs squeeze margins on a sustained basis, a company’s existing equipment and property assets become less valuable, even if they are still functioning.

‘The assumptions for determining whether your assets are impaired may have changed’

‘You may have long-lived asset impairment issues, such as your land and buildings, and your manufacturing equipment,’ Croteau says. ‘The assumptions that you previously used to determine whether your assets are impaired require careful assessment and may now have changed.’

Flynn says that businesses are already reacting to the new baseline. ‘Companies are taking steps to mitigate the potential impacts to profitability, including job losses, valuation issues and heightened credit risks within the financial industry. These business risks translate into audit risks.’

AI response accelerator

To keep pace, auditors are increasingly relying on technology. Both PwC and KPMG say they are deploying tools to track exposure by integrating government tariff data and client-specific trade flows.

‘We’ve built tools that ingest government tariff data in real time that can help with understanding the potential impact of a range of potential scenarios. While built for use with our non-audit clients, such tools can have utility in the audit context in assessing judgments made by management,’ says Croteau.

The trade environment may have calmed since the April peak. But with the path that trade talks will take still uncertain – and various industry-specific tariffs still being discussed – accountants will need to be more agile than ever.

Sectors under strain

Consumer goods and retail

Often price-sensitive with thinner margins, companies in these sectors may struggle to absorb cost increases without dampening demand.

Tech and manufacturing

Often running complex global supply chains, these industries confront the risk of component shortages or delays.

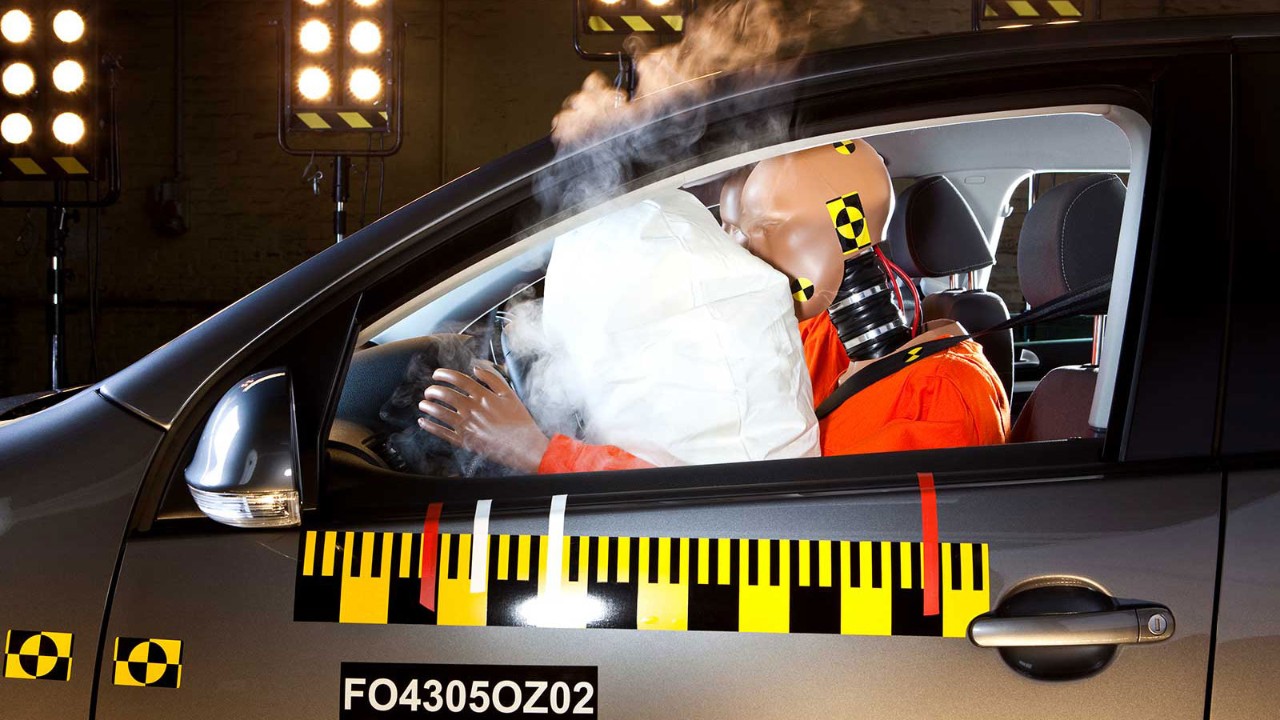

Automotive

Companies in this sector could be impacted by higher input costs. As they also often offer fixed-price contracts to dealers or fleet buyers, it will be harder for them to pass on higher costs in the near term on all their sales.

Healthcare

Businesses in this sector often rely on regulated pricing or insurance reimbursement, potentially limiting their ability to pass on higher input costs to buyers.