Shifting global trends in geopolitics and macroeconomics have recently been exacerbated by a global pandemic. These uncertainties have left businesses needing to look at cash conservation and aiming to do ‘more with less’ with existing resources.

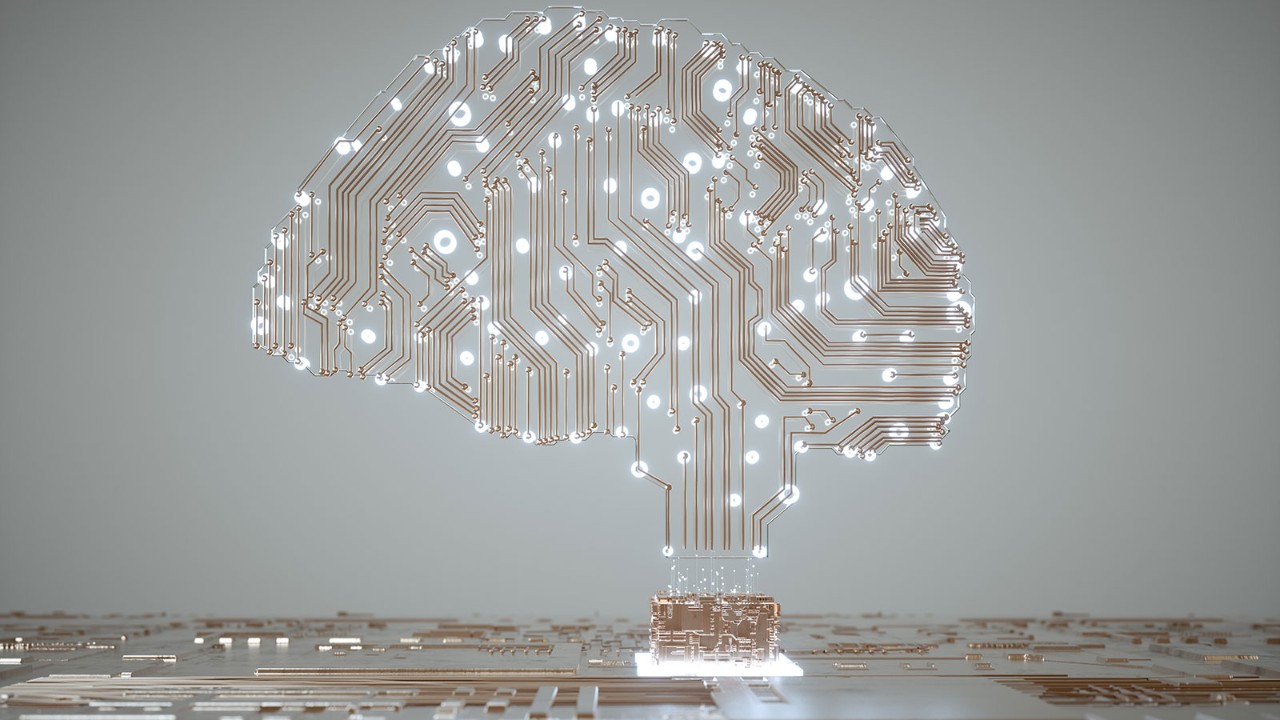

Tax dominates as a critical business issue and this article looks at artificial intelligence (AI) applications that allow businesses to generate value in the context of tax data and processes to harness transformative change: how better use today can create better insights and impact for tomorrow.

Leading businesses are seeking more from tax data and processes, using them for analytical purposes to make strategic decisions

For many companies, tax compliance is seen as a routine matter with tax returns being prepared within the statutory deadlines and then largely forgotten. However, leading businesses are seeking more from tax data and processes, using them for analytical purposes to make strategic decisions.

For example, businesses can use data from submitted returns to inform them of additional risks and opportunities. Data analytics can inform on trends and likely projections around cash tax, taxable income and utilisation of tax attributes, such as losses and credits.

Staying ahead

Similarly, keeping on top of ever-changing tax legislation is a challenge for most businesses, a problem heightened by changing legislation from increased digitisation and post-pandemic recovery legislation. Using AI solutions, legislative texts can be gathered and aggregated using machine and human intelligence to ensure relevant updates are provided to business in real time, thus allowing them to prioritise and take proactive action.

In terms of compliance processes, AI solutions can be applied to high-volume, repetitive tasks that are routine in nature, such as structuring and classifying financial data into tax categories. Businesses should therefore consider building a technology-assisted review of transactional data to speed up return preparation, which allows management to focus on the judgemental areas that determine material tax outcomes.

Improved decision-making

Businesses have always sought objectivity in decision-making, and this will be even more of a focus as the world recovers from the pandemic. Fluid conditions of trading and rapid changes from tax authorities mean that businesses will need to make better decisions within existing resource constraints.

‘Reinforcement learning’ in AI solutions uses trial and error to model the best possible set of decisions within the constraints of an environment. For example, how would businesses react to changing tax policy regarding set pricing strategies, and at what thresholds would those changes happen?

AI solutions can be applied to high-volume, repetitive tasks that are routine in nature, such as structuring and classifying financial data into tax categories

A trial to demonstrate this type of decision-making and typical trade-offs that arise in a resource-constrained environment was carried by a group of data scientists in the US. It modelled the interaction between labour productivity and social equality of two groups of participants.

These were lower-skilled people who were the recipients of income distributed from higher-skilled people, whose reactions to work and paying taxes were then studied by an imaginary agent, seeking to set policy parameters for income tax rates. The answer obtained from the AI solution showed a significant improvement against tax policy answers modelled on conventional economic theory.

Such use of ‘reinforcement learning’ should be transformational in setting tax policy and legislation for the coming years. Companies may then use modelling to set pricing strategies and consider their tax implications.

Clear advantage

Fundamentally, better decision-making is the mitigation of risk factors in a constantly changing world, and this is where AI has a clear advantage: there is no need to set simplifying assumptions or use historical data to understand patterns of human behaviour.

In addition, AI is able to assimilate vast amounts of information and model multiple scenarios while responding to transitions in environments much faster and quicker than any humans can. This application of ‘reinforcement learning’ is at an early stage in tax, and businesses should be aware of this as a megatrend and the possibilities that it can create.

Our world is changing and the only option for a business is to continually evolve and reinvent itself. A focus on innovation and creativity will not only make for a more insightful business, but also enable better decision-making.

AI solutions have a pivotal role to play in that process – from harnessing the power of tax data to answering those big questions of tomorrow, such as taxing rights and changing policy in a dynamic environment, to bring about transformational change.