It is widely understood that the ICC Men's T20 World Cup was relocated from India to the United Arab Emirates and Oman because of the Covid-19 pandemic. However, a wrangle over tax was equally responsible for the move.

The 16-team tournament, taking place between 17 October and 14 November, was originally scheduled to take place in Australia last year, but it was delayed due to the pandemic and given to India. However, the authorities there were unable to confirm that they could safely host the tournament amid a rise in Covid-19 cases, despite the International Cricket Council (ICC), the world governing body, offering extended deadlines.

The Board of Control for Cricket in India can avoid a tax burden while retaining the same levels of revenue

‘While we are incredibly disappointed not to be hosting the event in India,’ says ICC acting CEO Geoff Allardice, ‘the decision gives us the certainty we need to stage the event in a country that is a proven international host of multi-team events in a bio-secure environment.’

India retains fees

Despite the tournament moving out of the country, the Board of Control for Cricket in India (BCCI) will retain hosting rights, estimated to be worth US$300,000 per match. With 45 scheduled matches, these rights could be worth US$13.5m.

The competition will now be held across four venues: Dubai International Stadium, Sheikh Zayed Stadium in Abu Dhabi, Sharjah Stadium and the Oman Cricket Academy Ground.

Dhiraj Malhotra, appointed by the BCCI as the tournament director, confirmed in a BBC podcast that the Indian board had always intended to retain the hosting rights, even in the event of a move.

There is precedent for such a situation. When Pakistan lost its co-hosting rights to the 2011 World Cup, after the 2009 terror attack on the Sri Lanka team in Lahore, the country’s cricket authorities fought and won the right to retain around US$13m in hosting fees.

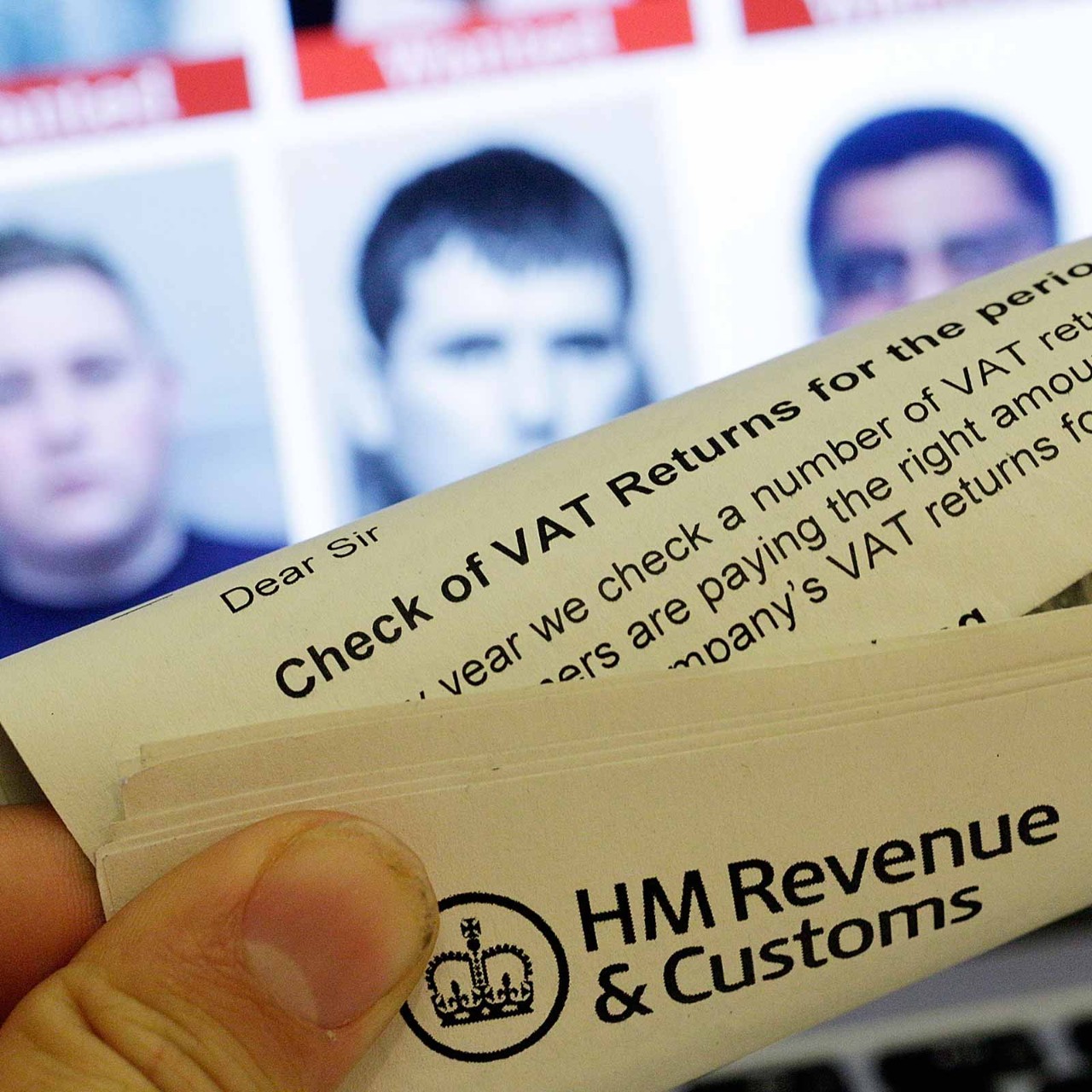

Tax exemptions are key

When the ICC allots its tournaments to member countries, the two parties – the ICC and tournament hosting country – sign an agreement that binds the host to securing full tax exemption. The financial model gives a certain amount to the host country, while each match-staging association receives a fixed sum for organising a match and retains the gate money.

But despite 18 months of negotiations, the BCCI revealed in June that it had failed to win the tax exemptions it sought from the Indian government. This failure prompted the ICC to pull the tournament out of India, according to sources close to the talks.

ICC Men’s T20 World Cup in figures

- 45 matches

- 16 teams

- US$3.5m total prize money

- US$1m prize money for winners

- US$500,000 prize money for runners up

- US$300,000 individual awards (top run scorer, man of the tournament etc)

- US$250,000 prize money for losing semi-finalists

- US$100,000 participation fee for every competing nation

- 2007 - first tournament

- 6 previous tournaments

- 2 tournament wins by West Indies

The numbers in cricket are driving decisions with huge significance

An unnamed BCCI member confirmed to the Indian press that the board’s failure to get tax exemptions from the Indian government was the main reason that the tournament had been moved, and that BCCI president Sourav Ganguly 'had informed the members that if the Indian board failed to get the tax exemption, it would not be hosting the tournament in India’, said the source.

In 2020, the ICC threatened to move the tournament if the BCCI failed to get the exemptions, worth an estimated US$125m, according to an official who attended the meeting.

A matter of media rights

With India feeling the impact of the pandemic – in Q2 of 2020, the country's GDP contracted by a record 24.4% – it was always unlikely that the government was going to agree to the BCCI’s request.

Instead, the move means the BCCI avoids a tax burden, while retaining the same levels of revenue.

One key element of the problem involves the ICC's media rights holder, Star Sports, which has the global broadcast rights for all ICC events until 2023. Based in India, the broadcaster pays the ICC to broadcast the tournament.

Because the Indian government refused to grant a tax exemption, however, the broadcaster would have reduced the fee it had promised the ICC. This would have cascaded down the cricket pyramid, with member countries receiving millions of pounds less from their share of tournament distributions.

Compensation demand

The denial of tax exemption has been the cause of a tussle between the ICC and the BCCI since the 2016 T20 World Cup in India, when there was a US$23m shortfall for the ICC. The ICC asked the BCCI to pay the amount as compensation for tax deductions incurred for the 2016 T20 World Cup. Star TV had deducted all taxes before paying US$226m to the ICC.

The BCCI is adamant that it did not guarantee the ICC a tax exemption from the Indian government for that tournament.

This amount has been withheld from the BCCI's share of ICC's central revenue, pending a decision from the ICC's Dispute Resolutions Committee.

We might not be looking at the eye-watering amounts seen in football tournaments, but the numbers in cricket are nonetheless driving decisions with huge significance.