I think I was destined to become an accountant at a young age; my first job was aged 13, working in my grandfather’s shop. I would serve customers and process their orders on the till, and at the end of the evening I would count up the physical cash along with the report from the debit/credit card machine and ensure that it matched the Z report printed out by the till.

My ACCA journey was a pretty tough one. I dropped out of university after the third year (in Scotland, most degrees take four years), and it took me a long time to pass the exams. I failed the P6 Advanced Performance Management exam four times in a row; this meant it took me over two years to pass just one exam. You can imagine how happy I was when I received that letter through the post saying I had passed.

I would like to see increased adoption of a triple-bottom-line reporting approach, incorporating social, environmental and financial

I launched Inaequo (‘level-up’ in Latin) a few months ago. We provide full compliance accounting, finance support and virtual finance director services. Our clients generally have a minimum of £500,000 sales or are high-growth investment-backed startups.

Solely speaking from a business perspective, the pandemic has been a plus point. We deliver all our services virtually and, due to the rise in homeworking, the perception towards this means there are fewer barriers to purchase for our clients. We are an extremely tech-focused firm, constantly keeping up to date with new apps and software, and can offer multiple solutions to our clients. I believe that, in the next two to three years, we’re going to see big advances in AI for bookkeeping and compliance, which will free up a lot of the accountant’s time.

Sustainability is an extremely important issue as our planet continues to evolve, and I believe that climate-tech is going to be a huge industry going forward. I would also like to see increased adoption of a triple-bottom-line reporting approach, which is an accounting framework that incorporates three dimensions of performance – social, environmental and financial.

I have a good understanding of marketing, tech, law and communications, and I thrive on variety, solving complex projects and managing organisations. Venture capitalists David Sacks, Chamath Palihapitiya, Jason Calacanis and David Friedberg have had a huge influence on my understanding of how businesses are built at scale, analysing relevant metrics and what investors are looking for.

If I wasn’t an accountant, I’d have loved to have started as a venture capital (VC) scout – meeting founders, analysing their pitch decks and business plans, and then recommending the best ones. I would then have liked to become a VC partner myself – which is still one of my goals.

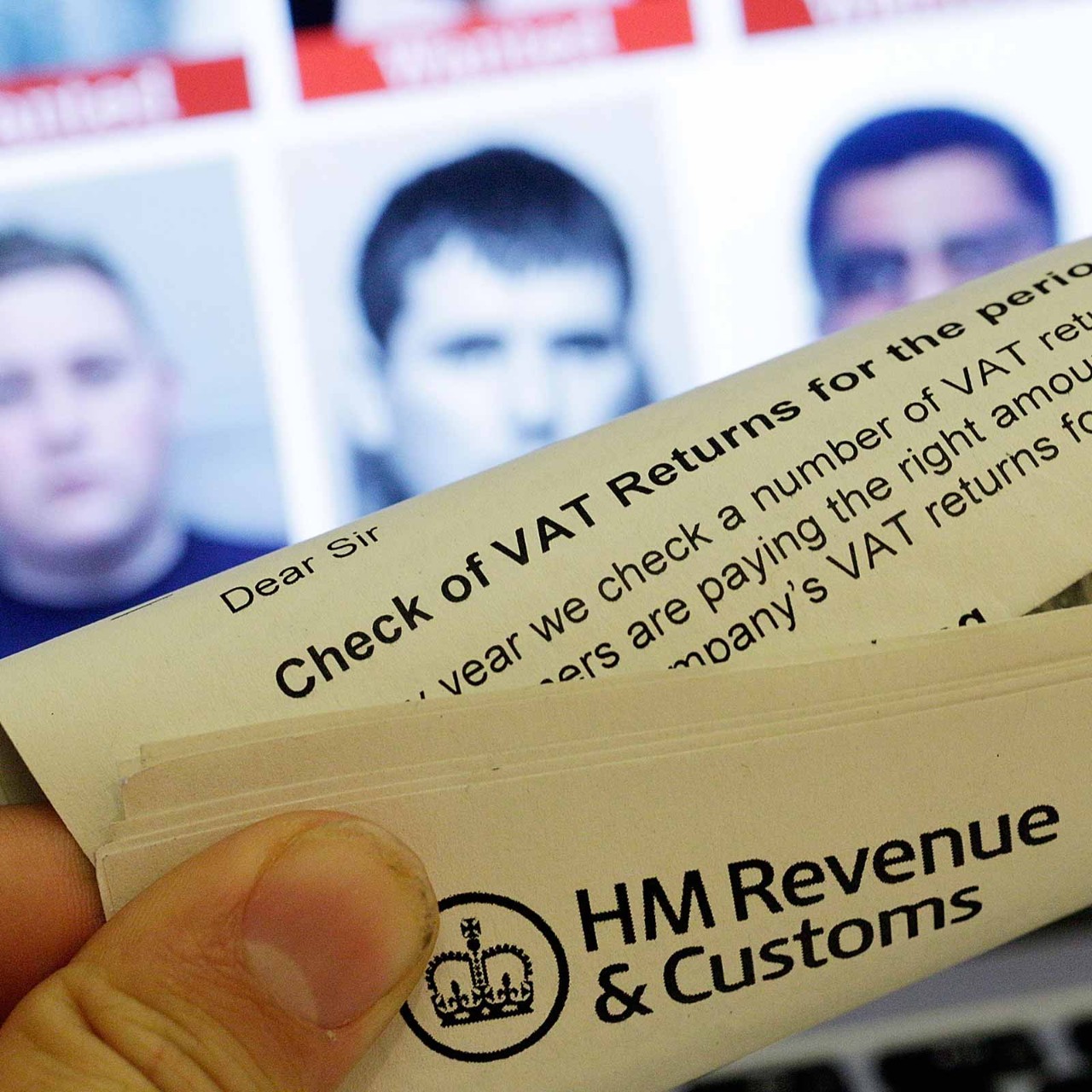

If I had lawmaking powers, I would put some serious consideration into rethinking IR35. The current incarnation of the ‘check employment status for tax’ (CEST) tool isn’t great, and there is so much confusion and ambiguity around the current IR35 framework.

Outside of work, I’m into fitness and weightlifting, and work out four days a week. I also take a 30-minute walk every day, and I listen to as many business podcasts as I can. Apart from that, I’m a huge geek and love gaming, and I’m a massive fan of boxing.