I started my career with KPMG Pakistan and since then have worked with brokerage houses, investment firms and commercial banks. My last stint was with Bank Alfalah where I came to understand the nuances of project finance and structuring of capital market instruments. I now work for InfraZamin, a for-profit credit enhancement guarantee company funded with equity capital that supports infrastructure projects in Pakistan.

I decided to venture into the corporate world early in my career. Corporate finance and investment banking have given me exposure to various industries, while project finance has allowed me to gain valuable insights into the financing and risk of greenfield projects.

It is imperative that projects that reduce national emissions and adapt to climate change be encouraged

A major challenge facing Pakistan is financial inclusion. We have a population in excess of 200 million, but only 16% of the total population, and only 7% of women, have access to bank accounts.

Conservative lending among banks is an issue too, with 71% of bank loan portfolios focused on corporate lending. However, SMEs, which make up 30% of the GDP, only account for 7% of the portfolio.

The government of Pakistan and the central bank have introduced several market measures to support financing in various sectors. Similar interventions will be required in others to get banks to move away from traditional lending.

I would impose a ‘pay inequality tax’ on companies

What I enjoy about my current job is it allows me to gauge the developmental impact of each project we undertake. It gives me a lot of satisfaction that InfraZamin's guarantees will generate social and environmental benefits for a variety of stakeholders.

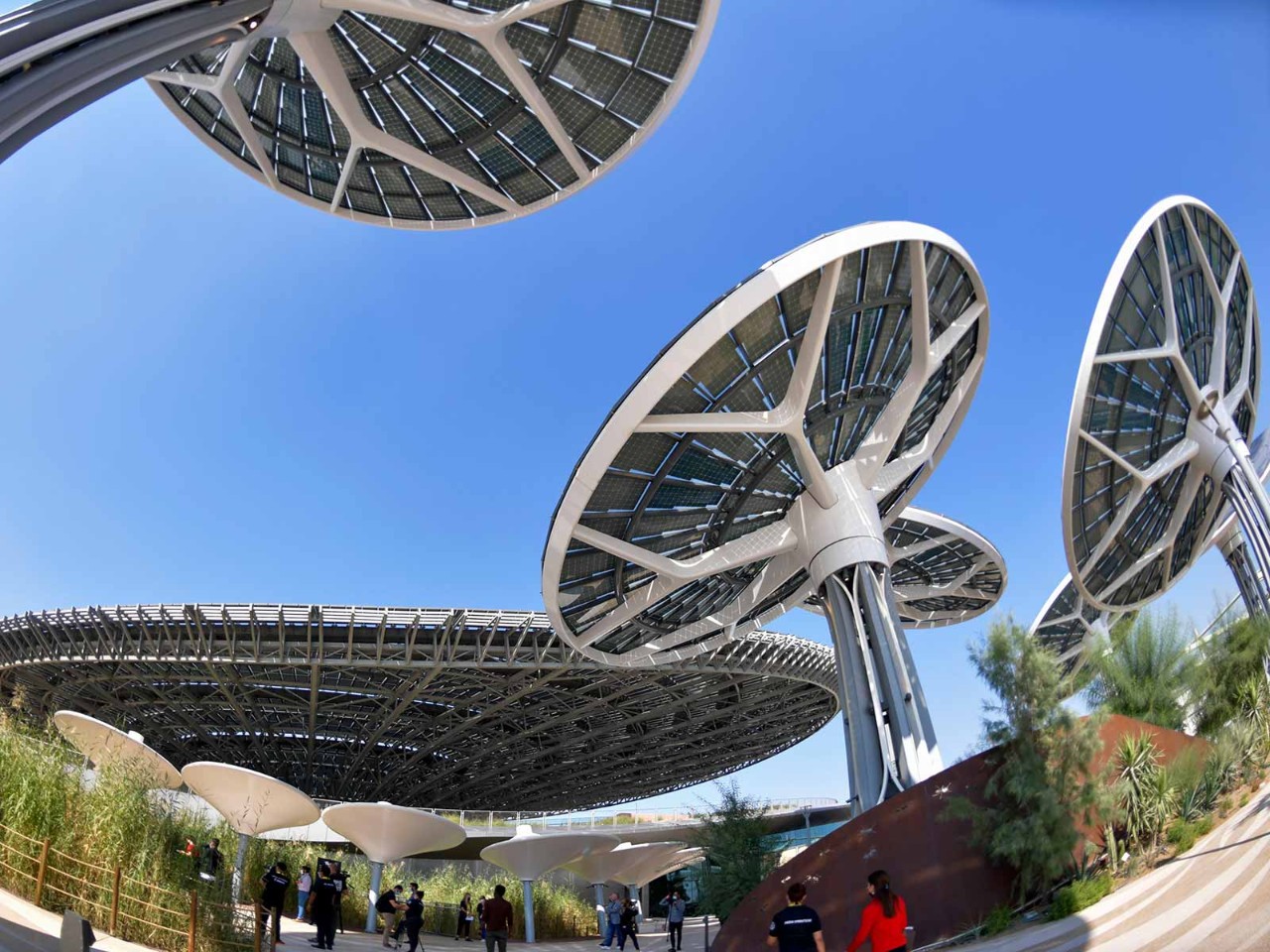

With Pakistan being a country highly susceptible to climate change, it is imperative that projects that reduce national emissions and adapt to climate change be encouraged. InfraZamin is very conscious of promoting environmentally sustainable projects, and emphasis is placed upon the development, safety and environmental aspects of a project.

If I could I would introduce a law addressing the inequality of pay in the corporate sector. The pay difference between senior executives and other employees has increased alarmingly, and this law would impose a 'pay inequality tax' on companies where the highest paid employee earns 75-100 times more than the average employee.

I believe my standout professional achievements are the successful consummation of long and short-term capital market transactions. I am very proud to have led two sukuks (used in Islamic finance) for Pakistan’s largest private power producer, which had traditionally used bank financing. The sukuks served as a catalyst for greater participation from low-risk institutional investors. I also led the issuance of Pakistan’s first social impact bond for a leading microfinance bank in the country.

If I weren’t in finance, I would be a cricket journalist and analyst. I would love to be associated with an international team. Two of my favourite cricket commentators are George Dobell and Osman Samiuddin.