I trained as an engineer, not as an accountant. One of the first concepts you learn is tolerance. No, not being nice to someone who voted the wrong way in a referendum, but the idea that all dimensions should be specified with an acceptable range. The internal diameter of a 6204 ball-bearing, for example, isn’t 20mm; it’s actually 19.996mm plus or minus four microns.

This idea, that numbers are seldom exact, is common across many professions. Statisticians talk about confidence limits, often saying that they are 95% certain that the metric they are estimating falls in a certain band. Doctors talk about the chances of a cancer coming back. Archaeologists estimate the age of bones from carbon-dating, and they always round the numbers; you will never hear someone saying ‘This fossil is 237.34 million years old’.

All about the context

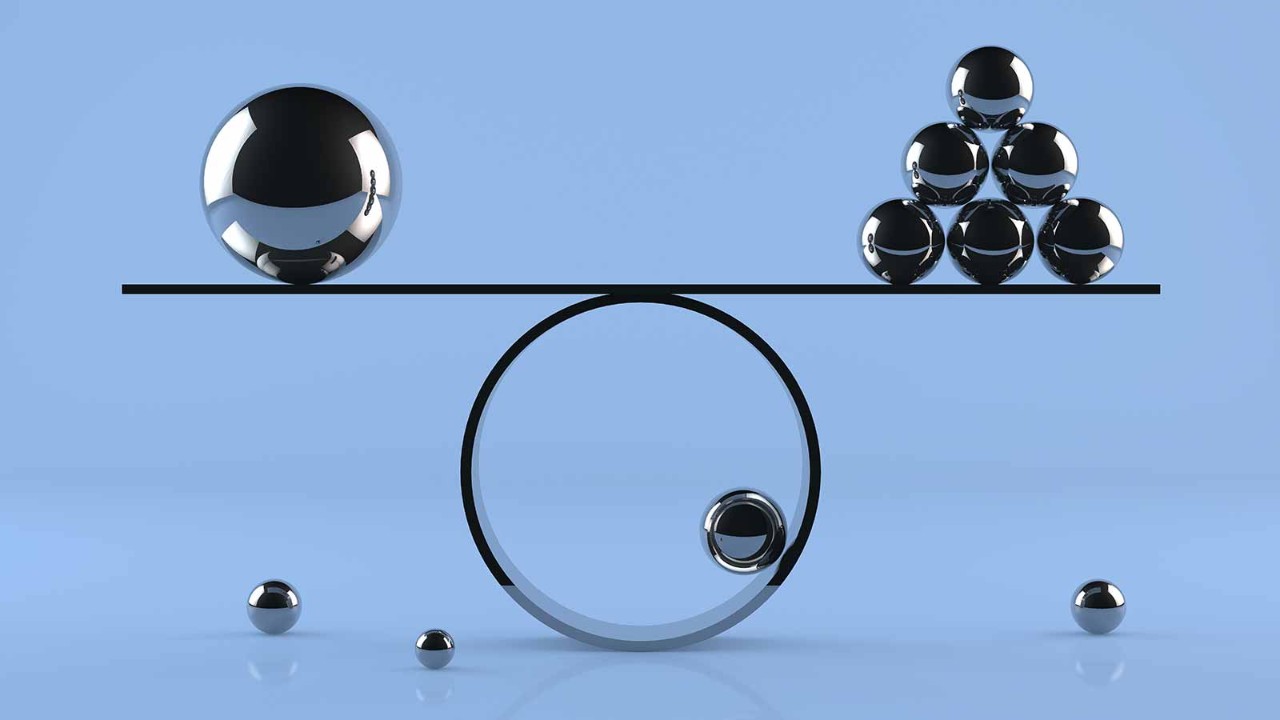

There are actually two concepts at work here: appropriate precision and spurious accuracy, but they come down to the same thing. Almost all professions recognise that numbers are usually a simplification of a complex reality. Numbers seldom have any meaning without understanding the context of how they are derived.

Accountants are different. I recently read German conglomerate Siemens’ 2020 annual report. On page 120 it says that the closing gross pension liability was €35,777m. As an engineer, I am tempted to laugh because, to me, this a ludicrous statement. A more informative one would be that the gross liability was ‘about €35bn but with a wide margin for error due to the large number of subjective judgments involved’. (An actuary once told me that he could easily flex a company’s pension liability by 5% in either direction while staying fully within all the rules.)

The only reason that balance sheets balance is because accountants use estimates and spurious accuracy to ensure that they do

This problem goes back to 13th-century Florence, where double-entry bookkeeping is thought to have been invented. The underlying concept is that the balance sheet must always balance, which is not a problem if you have a very simple business making, say, olive oil. As soon as you start doing more complicated things, such as promising to pay a pension 40 years in the future, the balance sheet starts being polluted with estimates.

Fudges and plugs

If you stand back and look at some of the heated accounting debates in recent years, there is an unspoken common thread: how can we provide a meaningful income statement while maintaining the fiction that the balance sheet balances? Where do we hide all the fudges and plugs?

To a non-accountant, the only reason that balance sheets balance is because accountants use estimates and spurious accuracy to ensure that they do. The original purity of the idea vanished centuries ago. In a modern, complex company, almost every line in the balance sheet is an estimate of some sort. Quoting a pension liability to five significant figures is fundamentally a nonsense.

The reason all this matters is that it makes it hard for accountants to engage constructively with the rest of the world. The things that really matter, such as cashflow and acquisition accounting, get ignored while experts debate the right way to conduct a goodwill impairment test.

It is sad and a little depressing to see all this energy wasted on things that don’t matter. It is no accident that almost all useful measures of performance are now non-GAAP metrics. The accounting profession is still fighting the battles of 700 years ago while the rest of the world has moved on.

I am not suggesting that we abandon double-entry bookkeeping, but I am suggesting that accountants should start being honest about its shortcomings. Spurious accuracy is bad for the profession’s credibility.