Decentralised finance (de-fi) has the potential to revolutionise conventional financial services, extending access to new corporate customers and broader demographics. In just a few years it has gained widespread recognition and experienced substantial growth.

‘Crypto businesses crave specific guidance on how to navigate the complex regulatory landscape’

Whether – and how – to regulate de-fi is a nettle some jurisdictions have been slow to grasp. But market turmoil triggered by the collapse of the FTX cryptocurrency exchange, which handled around US$1bn of transactions a day, has seen a marked uptick in the pace of global regulatory initiatives.

Inside the industry

Amid the ‘wild-west’ headlines, many de-fi providers also welcome more clarity. Mriganka Pattnaik, CEO of Merkle Science, a provider of risk mitigation and compliance services to de-fi users and financial institutions, says he is now seeing businesses proactively demanding clear guidelines to combat uncertainty, drive growth and foster innovation.

However, he argues that an enforcement-first approach risks stifling that innovation. ‘We see crypto businesses facing ongoing struggles in navigating the complex international and local regulatory framework,’ he says. ‘It’s evident that there is much work to be done with regulators.

‘It’s important to understand that crypto businesses seek more than a simple compliance mandate; they crave specific directions and guidance from regulators on how to ensure compliance effectively and navigate the complex regulatory landscape.’

Global action

Even a brief summary of steps taken in recent weeks amply illustrates that now regulators really do mean business.

In April the European Union (EU) passed the Markets in Crypto-assets (MiCA) law, creating a common framework for supervision, consumer protection and environmental safeguards. MiCA comes into effect next year, when de-fi platforms will be required to inform consumers about risks. Providers can be held liable if they lose investors’ assets. However, MiCA does not cover fully decentralised services – seen by some as a significant oversight.

France recently approved registration rules for digital asset firms, a direct response to FTX’s collapse

Stablecoins – assets whose value is pegged to that of another currency or commodity, such as the US dollar or gold – will be required to maintain sufficient reserves to meet redemption requests in the event of mass withdrawals. And the European Securities and Markets Authority will be empowered to step in and ban crypto platforms considered not to be protecting investors, or threatening market integrity or financial stability.

What is de-fi?

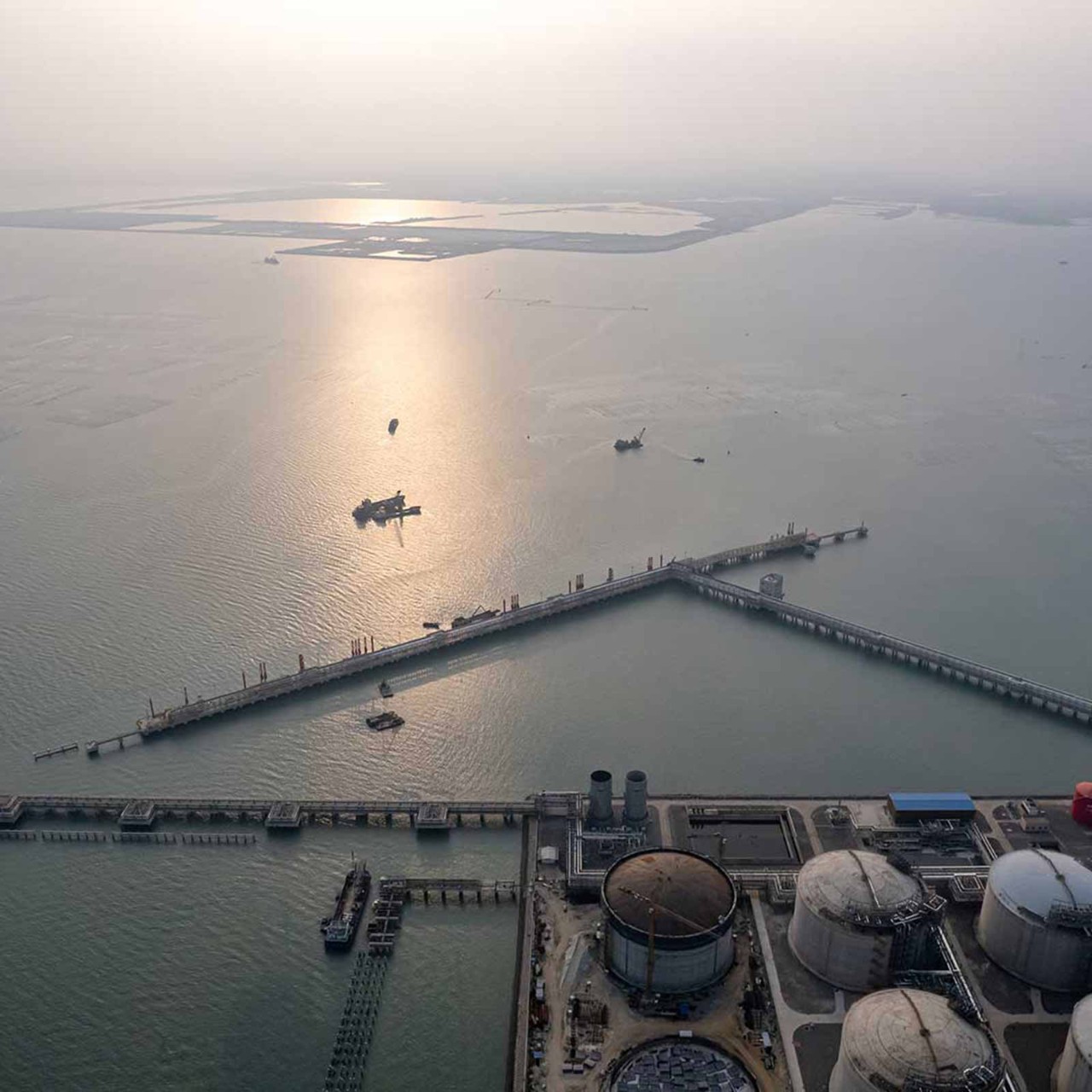

Decentralised finance (de-fi) is an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies. It challenges traditional centralised financial systems by enabling transactions over peer-to-peer digital exchanges. It also therefore eliminates the fees that banks and other financial companies charge for using their services.

In April the EU also passed additional new rules for tracing digital asset transfers. Traditional finance’s ‘travel rule’ will in future also apply to transfers of virtual assets.

France recently approved registration rules for digital asset firms, a direct response to FTX’s collapse. These align with MiCA while addressing gaps in its scope.

The UK committed to a new regulatory regime last year but says that proposals currently out for consultation have been specifically informed by recent market events. They include tightening up crypto promotions, enhancing data-reporting requirements and preventing market manipulations.

HMRC, the tax and revenue authority in the UK, has opened consultation on de-fi taxation aimed at simplifying rules and reducing investor tax burdens. In April London’s Stock Exchange Group announced a partnership with Global Futures and Options (GFO-X), offering the UK’s first regulated bitcoin trading.

G7 advanced economy members have indicated that they will follow standards set by the UK’s Financial Stability Board (FSB), which is due to publish a framework in July for regulating de-fi. The group’s finance ministers and central bank governors discussed crypto asset supervision at a meeting convened just before the Japan summit in May.

Many believe regulation contradicts de-fi’s fundamental purpose

India, president of the G20 group, is advocating for globally coordinated crypto rules. In February, the group said that forthcoming global crypto standards would be based on a new report jointly produced by the International Monetary Fund and the FSB.

The US is widely considered to have been slow to get to grips with de-fi. The US Treasury published a risk assessment in April, calling for regulatory supervision to be considered. Given that there is still no decision on whether cryptocurrencies fall within the remit of the Commodity Futures Trading Commission or the Securities and Exchange Commission, this has been seen as a significant intervention.

False security?

As governments prepare to assimilate de-fi’s capabilities and momentum within their own financial systems, it is important to be aware of opposing views. Many providers and participants believe that regulation contradicts de-fi’s fundamental purpose: peer-to-peer transactions free of intermediaries.

But there is another school of thought that argues that regulation will lend an air of stability and legitimacy to an industry that has neither. In May the UK’s parliamentary Treasury Committee expressed concerns that this ‘halo effect’ might cause consumers to lose large sums of money. It argued that cryptocurrency trading should be regulated with the gambling industry, rather than financial services.

United effort

In Pattnaik’s view, mitigating de-fi risks is ‘everyone’s business’. ‘For the de-fi ecosystem to thrive, participants – from regulators, to investors, to platform developers – must share the risks. Participants should analyse the insurance underlying anti-money laundering and financing of terrorism, and cybersecurity risks, before entering into a project, and proactively enact risk-mitigation strategies.

There is likely to be increased demand for expertise as businesses face more robust internal controls

‘De-fi businesses must implement robust security measures such as encryption, secure authentication protocols and regular security audits to protect their platform and customer data from unauthorised access or breaches,’ says Pattnaik. ‘They must conduct risk assessments, vulnerability testing and third-party audits to identify and address potential security vulnerabilities or compliance gaps proactively.’

Accountants will have a key role to play as de-fi transitions towards a more conventionally regulated future. There is likely to be increased demand for their expertise and support as businesses face implementing more robust internal controls, establishing compliance procedures and verifying audits. Providers and participants alike will also benefit from professional advice on evolving tax obligations.

Ideally, a balance will be struck between the advantages of decentralisation and essential safeguards that ensure user protection.

More information

See the AB article about regulating crypto markets and ACCA’s report, Risk culture: building resilience and seizing opportunities