As discussed previously, the International Sustainability Standards Board (ISSB) is in the process of drafting the first two IFRS Sustainability Disclosure Standards, namely IFRS S1 and IFRS S2. While IFRS S1 looks at general sustainability reporting and is largely a standard that underpins the general sustainability reporting in an entity (see my previous article, ‘Time to prepare for S1 and S2’), IFRS S2 looks specifically at climate.

The proposed standard follows a similar pattern to IFRS S1, requiring entities to provide information regarding four areas in relation to climate.

By including a discussion of the entity’s proposed strategy, it is hoped that this leads to positive action

Governance

Similar to IFRS 1, entities should outline the governance processes used to monitor and manage climate-related risks and opportunities. This is likely to be similar to the items disclosed within IFRS 1, identifying the bodies responsible and the scope of their duties.

Strategy

This section is a key area where the ISSB believes the new standards can add value. Rather than boilerplate disclosure, by including a discussion of the entity’s proposed strategy in relation to climate, it is hoped that this leads to positive action that not only reduces climate-related damage but also creates shareholder value.

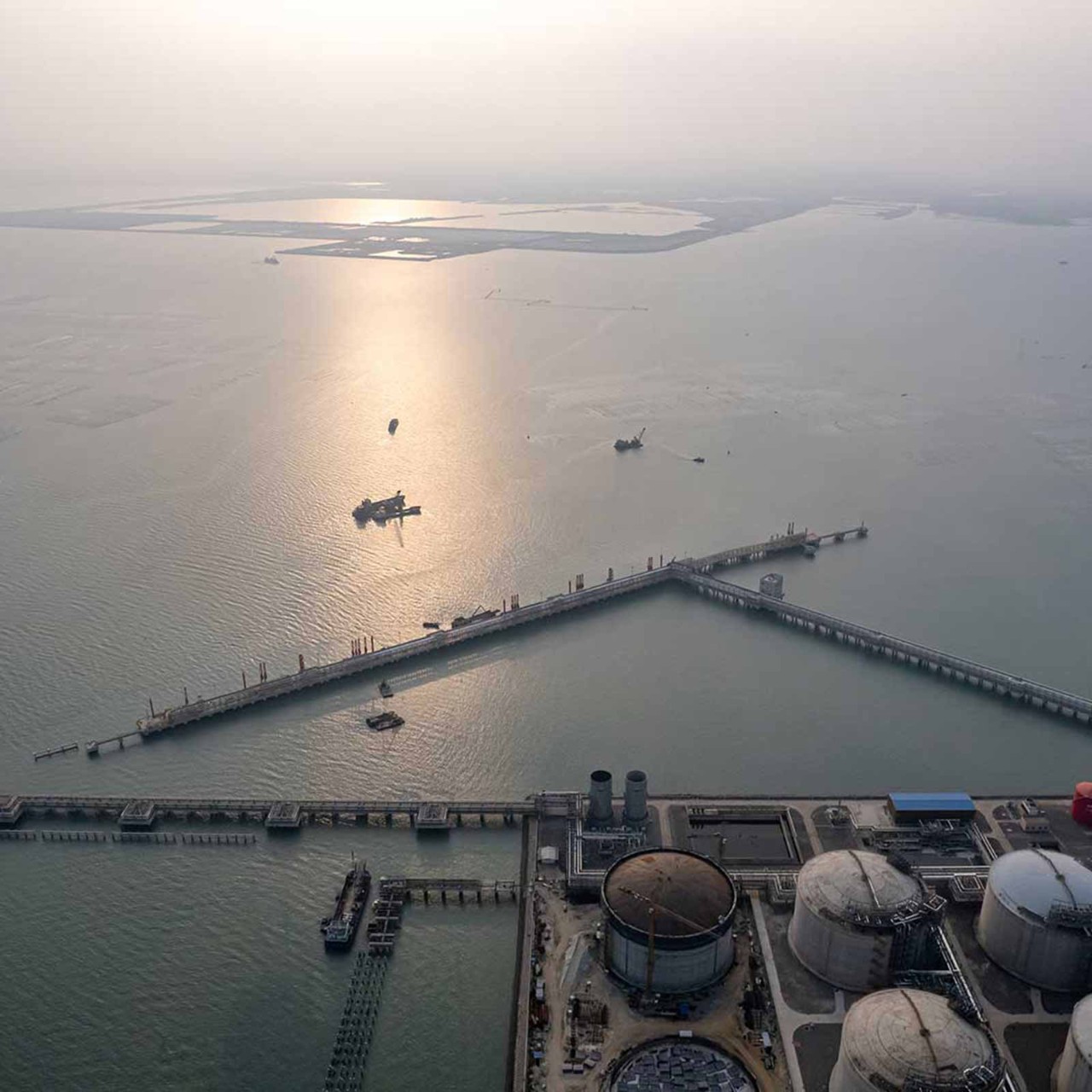

Entities will have to differentiate between physical risks (such as rising sea levels) and transition risks

The aim is that companies take the time to assess how they plan to navigate the transition to a lower carbon economy. It should look at the effects that climate risks and opportunities will have on the business’ business model and cash flows, including an assessment of how resilient the current business model is to a range of climate scenarios.

In identifying climate-related risks, entities will have to differentiate between physical risks (such as rising sea levels) and transition risks (such as regulatory or reputational issues). In taking this approach, the ISSB is getting companies not just to state ambitions or targets, but actually give the users some information on how they are planning to achieve them.

Risk management

Entities will be asked to disclose how climate-related risks and opportunities are identified, assessed, managed and mitigated by those responsible.

There will be an exemption from disclosing Scope 3 emissions for a year following the effective dates of IFRS S2

There is a likelihood that some of these risks will be discussed in IFRS S1 as part of the overall risk management relating to sustainability. In this case, integrated risk management of sustainability factors can be produced to avoid unnecessary duplication between IFRS S1 and IFRS S2.

Metrics and targets

Some of the key discussions around IFRS S2 have related to the metrics and targets that will be required in this. In accordance with the Greenhouse Gas Protocol Corporate Standard, IFRS S2 will require the disclosure of scope 1, scope 2 and scope 3 emissions where the information is available.

Scope 1 emissions relate to direct emissions that occur from sources that are owned or controlled by the company. Scope 2 emissions are energy indirect emissions that account for the generation of purchased electricity that is consumed by the company. Scope 3 emissions are other indirect emissions – those that are a consequence of activities that occur outside the ownership or control of the company (upstream and downstream).

The inclusion of scope 3 emissions has been the area with the most pushback from respondents, noting that these are the most difficult to measure. As scope 3 emissions will be the most difficult to disclose, there will be a temporary exemption from disclosing these for a year following the effective dates of IFRS S2.

The ISSB is keen to emphasise that IFRS S2 focuses on opportunities and risks

The ISSB mentioned in a recent meeting that entities could use the software company Salesforce as an example of reporting, as it has published a limited assurance report from EY on scopes 1-3.

The other item included in IFRS S2 for metrics and targets states that industry-specific metrics should be included. To aid this, the ISSB produced Appendix B to IFRS S2 with the aim of making this mandatory. Following concerns that not all the examples provided will be fully relevant to all jurisdictions, this is no longer going to be mandatory at this point.

Overall, the ISSB is keen to emphasise that IFRS S2 focuses on climate-related opportunities and risks, and not just the risks. This is consistent with the board’s belief that sustainability disclosures have much greater value than a compliance exercise.

The hope is that the more expansive data produced by companies applying these new standards should inform the decision-making process and result in better decisions being made and a more informed strategy.

Watch and learn

Watch Adam Deller’s series of videos explaining the basics of IFRS