For Prasenna Balachandran, chief internal auditor at LAUGFS Holdings, being independent is key to his success. Removing biases has, he believes, helped him earn trust and respect from his colleagues at the Sri Lankan conglomerate, which operates across 20 industries including energy, retail and real estate.

‘If you are biased towards anyone, you’ll lose your credibility as an auditor,’ he says. ‘The more we help colleagues understand that our findings are going to benefit them and not us, the more they will accept us.'

Without the mechanisms of corporate governance, risk management and internal control, says Prasenna, companies cannot expand effectively. ‘Sales and production don’t make companies grow,’ he says. ‘It’s like driving a vehicle; you need to have your breaks, sensors and things like Google Maps to guide you.'

'My job is to identify the defects and repair them so the company runs properly'

CV

2021

Chief internal auditor and chief risk officer, LAUGFS Holdings, Sri Lanka

2018

Chief risk and control officer, Hemas Holdings, Sri Lanka

2011

General manager, risk and control, Hemas Holdings, Sri Lanka

2008

Specialist, enterprise risk management, Dialog Axiata, Sri Lanka

2006

Assistant manager, risk and control, Brandix Lanka, Sri Lanka

2003

Trainee accountant, PwC, Sri Lanka

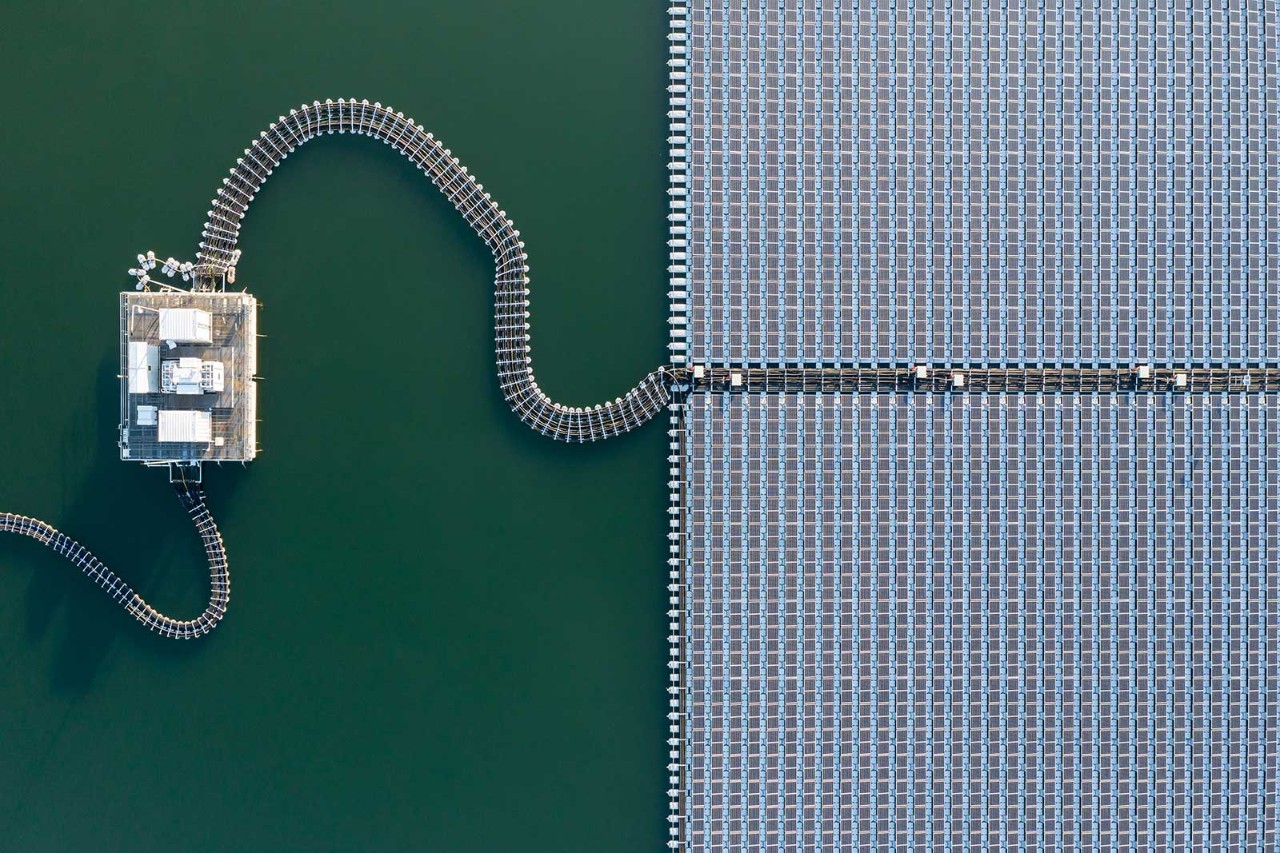

Technological shift

Prasenna welcomes the move towards AI-based internal audit, and stresses that internal auditors must be at the forefront of change in order to provide assurance to the board. ‘The industry is on the right track,’ he says, recalling the monumental shift from the start of his career.

‘We documented everything on paper and carried box files from place to place,' he says. ‘I used to go through accounting systems first to find deviations before I started my work; now, we have software for that.'

As systems evolve, auditors must keep learning. ‘If we don't learn, we will not be able to audit,’ he says.

Inside the repair shop

In addition to his role as chief internal auditor, Prasenna is chief risk officer and likens his role to working in a repair shop. ‘My job is to identify the defects and repair them so the company runs properly.’

While he enjoys the challenges the role presents, Prasenna admits that he sees himself as an ‘accidental risk manager’. He could also claim to be an accidental auditor; his love of biology could have taken him to a career far from finance, as a palaeontologist. ‘But I needed money for that so I started an accounting career,’ he says.

After three years in an audit firm, Prasenna received two job offers: one as a finance executive, the other as a risk executive. At the time, he didn’t know much about being a risk executive but it ‘looked more interesting and fresh,’ he says, so he ‘took it up and learned it’. When he started questioning department heads on the risks they were facing and how they managed them, he began to understand how organisations are run, and he knew he'd found his niche.

'Pick up something – it might be financial analysis, AI or risk management – and be technically superior in that area'

Specialisation is key

While many of his friends in finance opted for general MBA programmes, Prasenna instead focused on the ACCA qualification and postgraduate studies in risk management; he is now undertaking a doctorate in business administration in technological risk; his research focuses on the impact of enterprise risk management on technological organisations.

‘I wanted to specialise in something and be the best in the country in that field,’ he says. His advice to aspiring finance professionals is to avoid generalisation. 'Pick up something – it might be financial analysis, AI or risk management – and be technically superior in that area,’ he says. He also emphasises that excellent communication and presentation skills, and the ability to question fearlessly, are essential for both risk managers and internal auditors.

‘Today’s students are tomorrow’s finance managers'

Acquiring qualifications is, of course, necessary for success, but encouraging Sri Lankans to invest in higher education is difficult, particularly in times of financial stresses, Prasenna says. This means that professional bodies like ACCA play a crucial role in providing opportunities for professionals and students to sharpen their skills.

For Prasenna, ACCA is ‘part and parcel’ of every professional achievement of his life, and that the qualification and his experiences have contributed to his successful career journey. As well as providing him with support when job hunting, ACCA's resources – from research papers to webinars – have been invaluable. ‘ACCA also provides a lot of networking opportunities, not only in Sri Lanka but also across the world,’ he adds.

Supporting the accounting community in a more holistic way, by focusing on the importance of wellbeing, is also key for professional growth. Prasenna was recently invited by ACCA Sri Lanka to take part as a moderator at an event on mental health and resilience. The panel discussion looked at how professionals can implement simple practices like meditation, walking and being with friends in order to balance their professional and personal lives.

Prasenna sees his skillset and knowledge as something to share so that the talent pipeline can learn and thrive. In his spare time, he is also an educator. ‘Today’s students are tomorrow’s finance managers,' he says.

'You can identify a student coming perhaps from a rural area, show them a career path and see them succeed,’ he says. 'That’s something I truly enjoy.’

LAUGFS Holdings

1995

Year LAUGFS Holdings was established in Sri Lanka

20+

Number of industries LAUGFS operates in, including energy, retail, leisure and logistics, in Sri Lanka, Bangladesh, UAE, US and the Netherlands

4,000+

Number of employees

Rs37bn

Annual turnover