Sustainability

Accountants and auditors have been asked to contribute to an International Sustainability Standards Board (ISSB) review of its sector-specific sustainable accounting standards, to make them more applicable worldwide. The ISSB has taken on responsibility for the former Sustainability Accounting Standards Board (SASB) standards, which companies using ISSB’s IFRS S1 and S2 standards on general sustainability and climates must consider when drafting sustainability reports. Some 20% of SASB standards incorporate references to specific jurisdictional laws and regulations. ‘Revising these references will help improve international applicability and remove regional bias,’ says the ISSB, which wants comments by 9 August.

The ISSB is also seeking guidance in developing a two-year work plan for its activities, once it has finished rolling out its S1 and S2 standards, which come into force from 1 January 2024. It is asking accountants to provide feedback by 1 September 2023 on four potential research projects it has identified. These are: biodiversity, ecosystems and ecosystem services; human capital; human rights; and integration in reporting.

Tom Seidenstein, chair of the International Auditing and Assurance Standards Board (IAASB), says the body intends to complete a sustainability assurance standard by December 2024. ISSA 5000, General Requirements for Sustainability Assurance Engagements, will build on ISAE 3000 (revised), Assurance Engagements Other than Audits or Reviews of Historical Financial Information, and more specific standards. The IAASB says that public consultation on the proposed standard will now be brought forward to early August 2023 and last for five months.

Companies involved in the CDP sustainability reporting system have been asked to disclose their plastic-related impacts in the organisation’s 2023 global environmental disclosure platform. Data will be collected on the production and use of plastic polymers, durable plastics and plastic packaging, and be made available from September 2023.

The GRI (Global Reporting Initiative) is developing a new sector standard for mining, which will improve the sustainability reporting of artisanal and small-scale mining, as well as mines in areas of armed conflict, political instability or higher instances of human rights abuses.

Going concern

The IAASB has proposed revisions to its current standard on going concern, ISA 570. It aims to aid responses to identified risks of material misstatement by promoting consistent practice and behaviour, to strengthen auditors’ evaluation of management assessments of going concern, and to boost the transparency of auditor responsibilities and work.

Public sector

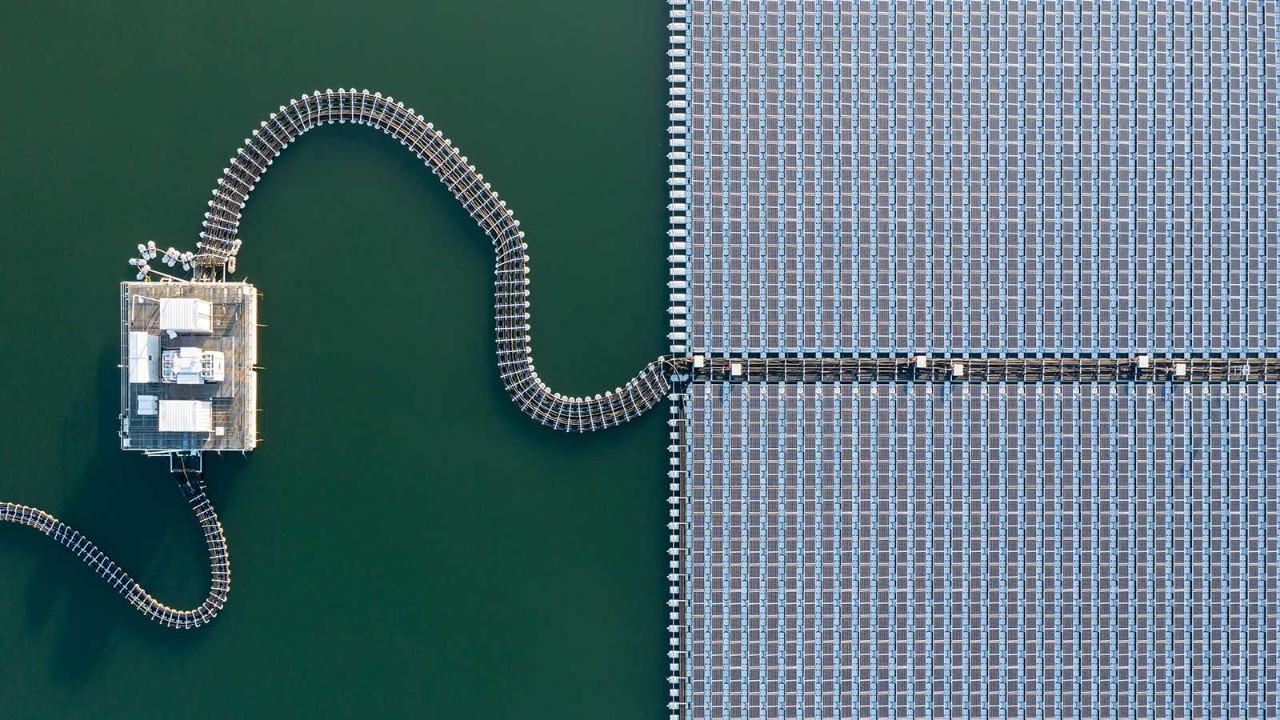

The International Public Sector Accounting Standards Board (IPSASB) has released additional guidance on reporting about public programmes promoting sustainability in RPG 1, Reporting on the Long-Term Sustainability of an Entity’s Finances, and RPG 3, Reporting Service Performance Information. RPG 3 presents illustrative examples on assessing the effectiveness of programmes financed by green bonds, a carbon tax, climate change mitigation infrastructure investments, and tax expenditure for sustainability investments.

Ethics

The International Ethics Standards Board for Accountants (IESBA) has released a database of jurisdictions’ public interest entity (PIE) definitions to boost their use by accountants under its revised international code of ethics for professional accountants. It now includes an expanded list of organisations whose audits should be subject to additional independence requirements and says firms should publicly disclose the independence requirements they have followed in their PIE audits.

Spacs

The International Organization of Securities Commissions (Iosco) has issued a report to help members regulate special purpose acquisition companies (Spacs). According to Iosco, ‘while Spacs pose similar risks to investors as traditional IPOs, the complexity and uncertainty inherent in the Spac structures raise a number of different risks’. The report advises on Spac listing requirements, due diligence, dilution disclosures, and more.