The Malaysian government’s Budget 2024 is built upon these intertwining headline figures for next year: economic growth forecast of between 4% and 5%, an all-time high spending allocation of RM393.8bn, and a fiscal deficit target equivalent to 4.3% of the GDP.

When tabling the proposals on 13 October, Prime Minister Datuk Seri Anwar Ibrahim, who is also finance minister, said the government expects GDP to expand in 2024 by 4% to 5%. The projected growth for 2023 is 4%.

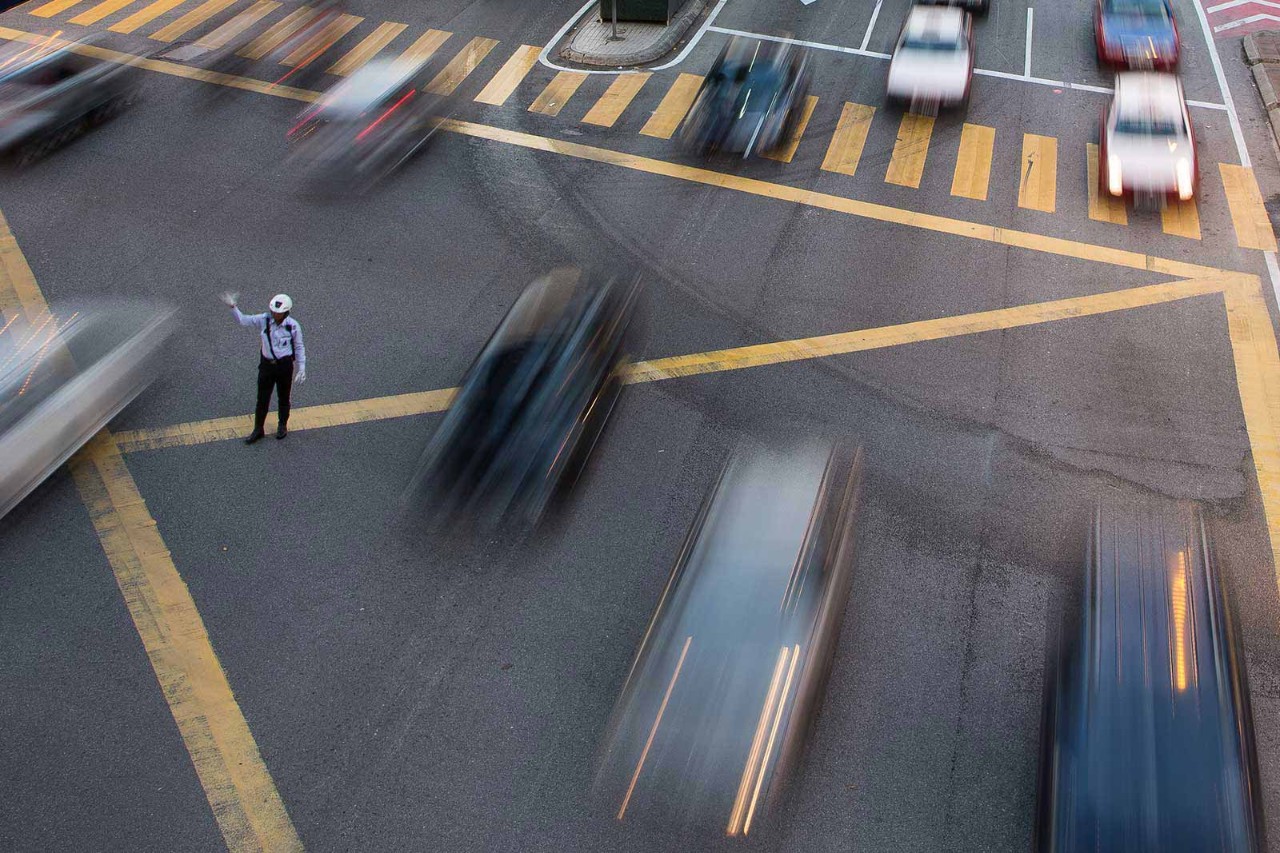

‘The Budget aims to strike a delicate balance between stimulating growth and fostering an inclusive society’

He added that with the implementation of reforms in keeping with the Madani Economy framework, the government is confident that the country’s economy can grow close to 5% next year.

The framework is based on the ‘Malaysia Madani’ concept promoted by Anwar’s administration. Madani is a Malay acronym that refers to the concept’s core values of sustainability, prosperity, innovation, respect, trust, and care and compassion.

Balancing act

An expansionary Budget will help drive the growth of the economy, and this explains the size of the 2024 operating expenditure (RM303.8bn) and development expenditure (RM90bn). At the same time, the government aims to shrink its fiscal deficit from 5.6% and 5% of GDP in 2022 and 2023 respectively, to 4.3% next year. The medium-term goal is to lower the deficit to at least 3% of GDP.

As EY puts it, the Budget reflects a ‘steadfast pursuit of fiscal consolidation’.

‘With a strategic focus on prudent financial management and structural reforms, the Budget aims to strike a delicate balance between stimulating growth and fostering an inclusive and equitable society,’ says Farah Rosley, Malaysia tax leader at EY.

Widening the revenue base

In his speech, Anwar said reforms include enlarging the revenue base, implementing targeted subsidies, and eradicating systemic corruption and malpractices. In addition, public service needs to be efficient, outstanding and agile.

‘Expanding the service tax to cover logistics services will have a cascading effect on costs’

To diversify its revenue sources, the government will introduce a 10% capital gains tax on net gain arising from disposal of unlisted shares by Malaysian companies. This will take effect in March 2024 but won’t apply to initial public offerings on Bursa Malaysia and internal restructuring. The government will also consider exempting such share disposals involving venture capital companies.

Another new development is the high value goods tax at 5% to 10% on certain luxury items, such as jewellery and watches, based on their threshold value. To encourage tourism, tourists will be able to claim a tax refund before they leave Malaysia.

Service tax stopgap

For most people, what was unexpected was the announcement that the service tax rate will be increased from 6% to 8%, although this will not apply to food and drink, and telecommunications. It’s equally significant that the scope of taxable services will be extended to logistics, brokerage, underwriting services and karaoke.

PwC Malaysia tax leader Jagdev Singh says the service tax hike appears to be a stopgap measure until the government is ready to bring back the goods and services tax. He cautions that the tax will lead to an increase in the cost of doing business, adding that ‘expanding the service tax to cover logistics services will have a cascading effect on costs, and businesses will seek to pass these on to consumers in the form of prices increases’.

E-invoicing and GMT

Anwar addressed some questions about plans to implement mandatory e-invoicing and global minimum tax (GMT). From August 2024, e-invoicing will be a must for taxpayers with annual income or sales exceeding RM100m.

For other taxpayers, the rollout will be enforced in phases starting in July 2025. The use of the tax identification number will be expanded to support the effectiveness of e-invoicing in enhancing Malaysia’s tax administration.

‘Subsidiaries of foreign-based MNCs will need to start assessing the GMT implications on tax incentives’

GMT is a feature of international taxation standards for curbing tax-base erosion and the transfer of profits to countries with low rates. Malaysia had planned to introduce GMT next year; this will now happen in 2025 and will only apply to companies with a global income of at least €750m.

Soh Lian Seng, head of tax at KPMG Malaysia, says that it is encouraging and comforting that the government has responded to the concerns of local businesses by providing more certainty regarding the implementation of e-invoicing and GMT.

Businesses must make it a priority to assess the potential impact of e-invoicing and the GMT-related tax standards, and devise the right strategies for adapting to the changes.

Says Tan Hooi Beng, Deloitte Malaysia’s international tax leader, ‘Malaysian subsidiaries of foreign-based MNCs will need to start assessing the GMT implications on the tax incentives that they are enjoying in Malaysia. Likewise, GMT needs to be considered in new applications for tax holidays in Malaysia.’

New approach

Another key item is the introduction of outcome-based and tiered tax incentives. This means investors enjoy the incentives according to what they bring to the table, including their commitments to Malaysia.

Farah says this move is commendable and is a significant step towards a more resilient and sustainable Malaysian economy. ‘By linking tax incentives to specific outcome-based conditions, the government incentivises businesses to focus on long-term value creation,’ she says.

‘This innovative approach not only attracts targeted investments but also ensures that economic growth is aligned with the country’s broader goals of social inclusivity and environmental stewardship.’