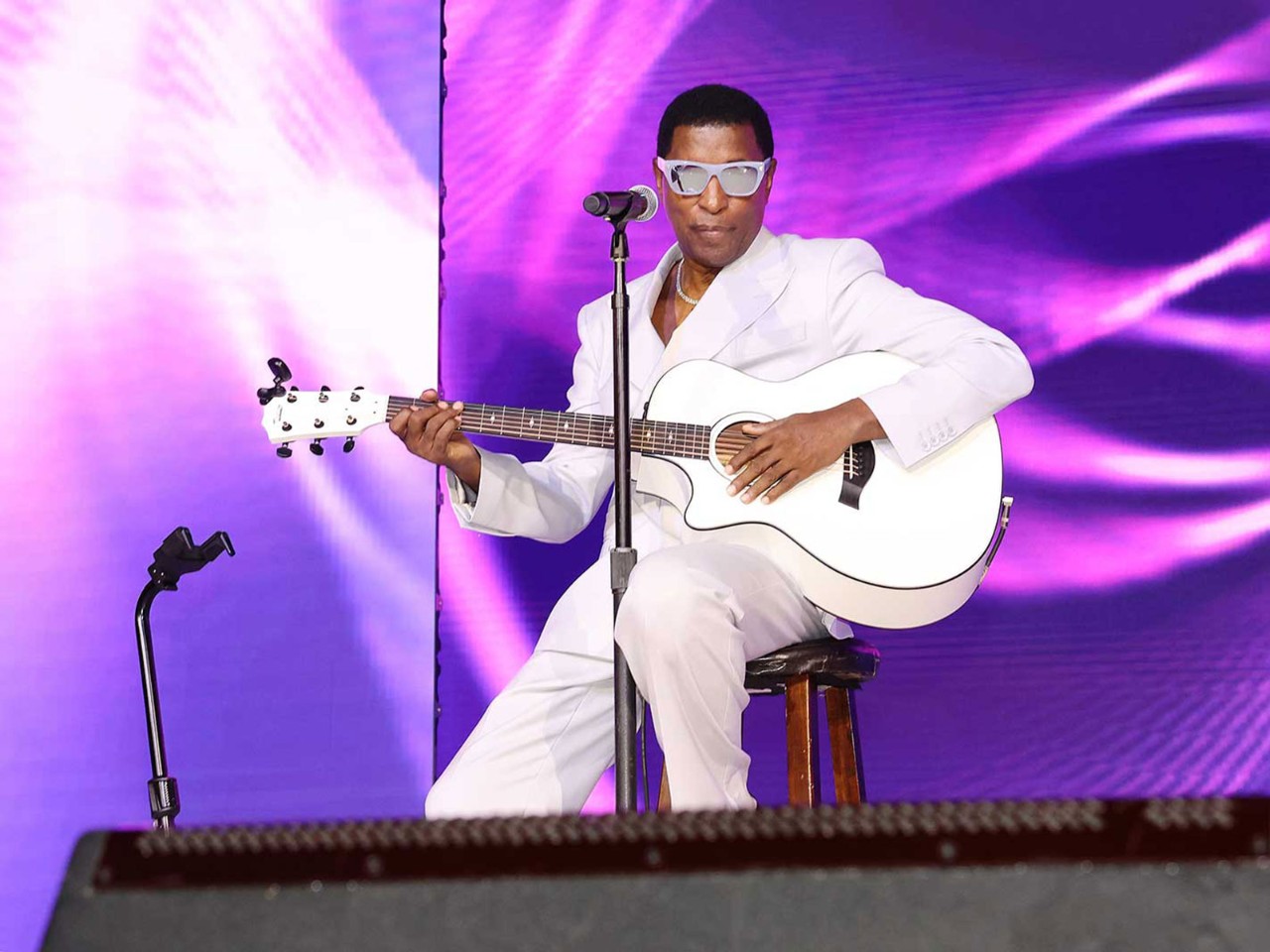

After a successful 11-year career in external and internal audit, I stepped out of my comfort zone when I switched to a different sector. In 2022, I entered the world of digital financial services as portfolio manager for digital lending at Stanbic Bank in Uganda.

What I enjoy about my job is analysing varied sources of data and identifying relationships between data. I then use that analysis to make recommendations that drive strategic direction. I also like reimagining the way the bank should do business with its clients and enhancing efficiency through digitisation of credit processes.

Banks need to become more customer-centric and draw on lessons from new entrants

Increased digitisation and customer awareness has seen the ‘modularisation’ of the banking industry globally. In the past, customers tended to use one bank for all their financial needs; but today, customers are often using different providers for different products. This has resulted in increased competition from both traditional and non-traditional providers.

To thrive in this situation, banks need to become more customer-centric and draw on lessons from non-traditional players in the market. Opportunities for banks in Uganda include exploring partnerships with fintech businesses to help drive growth. Increasingly, data-driven decision-making, coupled with the digitisation of customer interfaces and back-end services, should also become a strategic focus for banks.

The banking sector in Uganda does face challenges. While the market is awash with credit providers, there are far more credit-seeking customers than there are creditworthy borrowers. This has resulted in competition among the banks for the few creditworthy borrowers.

My inspiration to join the accounting profession came from my mum. Like me, she was a professional accountant with a degree in statistics. Prior to joining Stanbic, I started off my audit career at PwC, and spent eight years providing services to a broad range of clients in South Africa, Uganda and Rwanda. Before taking on my current role in digital lending, I worked as an internal audit manager at the Standard Bank Group in Uganda and at Standard Bank Zimbabwe, where I executed audits in Côte d’Ivoire, Tanzania, Kenya and Zimbabwe. If I wasn’t in finance, I would like to have taught maths or statistics, or possibly taught in a nursery school.

I’m an FCCA, a CIA and an ICPAU member, and also have an MBA

My biggest achievement was coming second in Uganda and 47th worldwide in my ACCA exam sitting in 2013. I am also proud to have completed a secondment as head of internal audit at Stanbic Bank Zimbabwe within two years of joining the Standard Bank Group. As well as being an FCCA, I am a Certified Internal Auditor (CIA), a member of the Institute of Certified Public Accountants of Uganda (ICPAU) and I possess an MBA. I currently serve as a board member for the Institute of Internal Auditors of Uganda and was recently awarded the Young CIA Achiever Award for my exemplary contribution to the internal audit profession.

My favourite quote is from Denzel Washington. It’s from a speech he made at the University of Pennsylvania: ‘If I’m going to fall, I want to fall forward. I figure at least this way I’ll see what I’m going to hit. Falling forward means that I am still progressing. It means that I am learning. And it means that I can pick myself up and keep on going.’

When I am not at work, I enjoy travelling the world with my wife and playing with my children. I also enjoy watching Formula One racing and reading, especially the EastAfrican newspaper.