The idea of mobility won’t be lost on ACCA-qualified finance professionals – the desire to work internationally might even have been a key factor in choosing accounting and finance as a career and ACCA as a qualification. Indeed, many ACCA members leave home to study, work and live abroad, but many also move back, bringing with them new thinking, skills and perspectives. Here, members talk about their experiences, and why they returned home.

Call of Africa

Lilliane Rumanyika FCCA first left Uganda to study ACCA full-time in the UK. She then returned and worked in audit at PwC in Kampala for 10 years before making a significant move to Canada, where she spent nearly 14 years in global banking. 2023 saw her return to Africa as global CFO for Inkomoko, a non-profit based in Kenya’s capital Nairobi that seeks to empower entrepreneurs among refugees and displaced peoples in Africa.

‘Perhaps with age, a sense of homesickness and being at a certain point in my career, I kept thinking it would be good to go back home and contribute, especially when you see Africa in the news with all its challenges and everyone leaving,’ she says. ‘I also missed the food, the people, the sense of community, and it’s appealing to skip the Canadian winter.’

‘I’m thankful for the opportunity to share my knowledge here in Africa’

But the biggest pull has been the opportunity to make an impact, she says. ‘Before I retire, I want to give back. I’m very thankful for the opportunities I’ve had to move around the world, to qualify with ACCA, become a CPA Canada, then bring my experience and qualifications back, and share my knowledge with my team here in Africa.’

Back to Zimbabwe

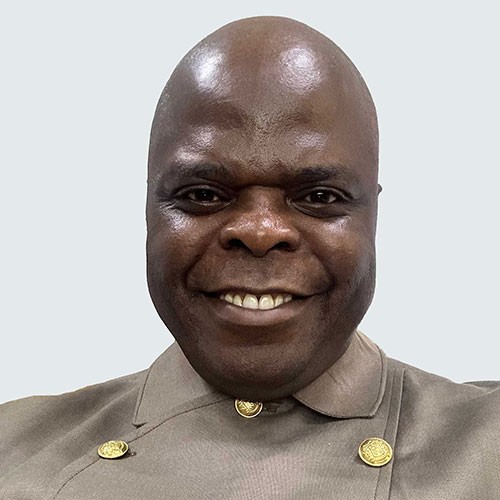

After several years studying and working in the UK, Rodney Ndamba FCCA returned to his native Zimbabwe to set up the Institute for Sustainability Africa (Insaf) – an independent multi-disciplinary sustainability thinktank which is going from strength to strength, in tandem with his profile as an expert on the world stage.

‘Spending time in a developed economy showed me how I could use my experience to pick out opportunities in Zimbabwe and to develop something that is going to be impactful,’ he says. ‘When I came back in 2008, I did research into environmental reporting and produced a report that found only 3% of the 71 listed companies in Zimbabwe could account for their environmental impact. This was a big moment for me; I could see that this was a space in which I could use my skills.’

Pull of Nigeria

Oyinda Akanbi FCCA also found a major opportunity that spoke to her career objectives upon returning to her home country, Nigeria. After several years studying and working in junior roles in the UK, she developed a fascination for the strategic potential of finance. With this in mind, she joined telecoms company Etisalat Nigeria in 2013 as a finance business partner, which at the time was ‘quite a niche role’.

‘There were a lot of accountants, but not many finance people who could talk strategy,’ she remembers. ‘They didn’t get out from behind their computers and get to know a business. But business partnering means first understanding a business before figuring out how finance can help drive it forward.’

‘I saw what was possible in a developed country and wanted that for my own country’

Now CFO of SYNLAB Nigeria, a medical diagnostics company, and still very hands on with strategy, Akanbi sees how her work has an influence beyond the numbers. ‘I moved back to Nigeria to really make an impact, to be part of the ongoing development that I’d seen from abroad. I saw what was possible in a developed country and I really wanted that for my own country.

‘I’ve got these qualifications and I’ve got this experience. I wanted to bring them back to my home to hopefully drive development and growth in my own little way,’ she says.

Akanbi believes that healthcare is the perfect home for her finance nous. ‘I’m doing the analysis and providing the strategic insights that are driving business growth and enabling it to touch more lives,’ she says.

Chika Dotimi-Beke FCCA also returned to Africa with new perspectives and ideas to implement. She undertook a two-year secondment to the UK from PwC Nigeria and considered staying on afterwards, or even seeking a move elsewhere, but ultimately chose to continue her path to partner back home.

Some years later, she was persuaded to leave her position as a senior manager at PwC to become head of investment at private equity firm Quantum Capital Partners, before taking on her current role as associate vice president, business performance and product control, at Africa Finance Corporation (AFC) and CFO of its subsidiary AFC Capital Partners. A multilateral development finance institution, AFC was established by an agreement between African sovereign states to play a part in closing the continent’s infrastructure gap.

‘Contributing to transformative projects across the continent is very fulfilling’

Joining AFC is more than just a ‘work experience’, she says. ‘Being part of a team contributing to transformative projects across the continent is very fulfilling. I am thrilled to be involved in such an impactful cause.’

Her experience in the UK added value to her career, she believes, as well as being ‘a useful notch’ on her CV. It also provided her with a list of things she wanted to implement when she returned to Nigeria. She found this wasn’t the easiest thing to do, though. ‘There was a reverse culture shock,’ she says. ‘You get used to working a certain way in the UK, then you come back and, even though it’s familiar territory, you have to start over again.’

However, this didn’t prevent her from bringing in some new ways of working in the roles that followed her return to Africa. ‘I saw a push for flexible and hybrid working at PwC UK, even before Covid, and it was increasingly popular there for employees to be able to use a work day to volunteer, or do something they were passionate about,’ she recalls.

She is now an advocate for remote and flexible working, having seen how it can help managers deal with staff turnover, and how teams can thrive by tapping resources outside their usual networks. ‘Every member of staff is a unique resource and should be treated as such,’ she says.