Ghana’s well-deserved reputation as one of Africa’s economic stars has taken a bit of a hit recently. Two years ago, the nation was forced to suspend debt payments. And in October this year it set an inauspicious record, with international bondholders agreeing to a 37% haircut on US$13bn of debt, the largest in African history. Struggles with debt and inflation have depressed the once brisk pace of GDP growth in recent years.

But there are strong reasons to expect Ghana to regain its former standing as a leader on the continent. In the meantime, both the nation’s recent woes and its nascent recovery are generating opportunities for financial professionals.

‘The worst of the debt problems now appear to be in the past’

Survivors are rebuilding

‘The worst of the debt problems now appear to be in the past,’ says Audrey Naa Dei Kotey FCCA, senior attorney at Accra-based AudreyGrey, which specialises in corporate restructuring, insolvency and taxation. ‘Businesses suffered significantly from the domestic debt restructuring, which in many cases halved the value of investments that corporate treasurers had stored in government debt and mutual funds,’ she says. ‘This deterioration in balance sheets obviously made it hard for companies to hire or invest for the future.’ However, the survivors are rebuilding.

While the domestic debt restructuring harmed Ghana’s businesses, the recent deal with international creditors looks likely to result in a more favourable environment. By wiping close to US$5bn off the value of the nation’s debt, the agreement gives the government greater scope to support businesses and the economy and offers reassurance to multinationals considering projects in Ghana. This optimism has already started to show up in the data. Economic growth picked up to an annual 6.9% in the second quarter of 2024, the fastest pace in five years.

Added to this, Ghana has taken steps to bolster the outlook for decades ahead. The spread of the Ghana Card – a biometric national identity system that links a citizen’s birth certificate, voter registration, driving licence, bank details and healthcare – is proving a cornerstone of growth and business creation.

‘It has become much easier to confirm people’s identities, making it harder to dodge debt payments’

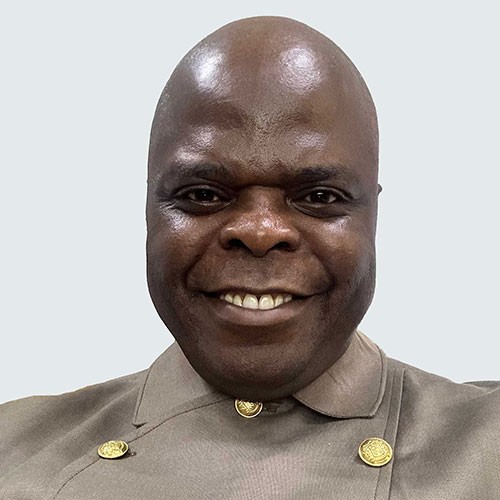

‘It is a crucial step toward building a high-trust society,’ argues Emmanuel Marfo, managing consultant at Asar Ramofh, also based in the capital. ‘It has become much easier to confirm people’s identities, making it harder to dodge debt payments, avoid taxes or commit fraud. That means lenders can have greater assurance when they provide credit to individuals or new businesses.’ Government tax collection should also become easier – boosting the funds available for infrastructure and education projects that are critical to businesses.

More opportunities

Economic developments over recent years, both positive and negative, have been adding to the opportunities for financial professionals. ‘Accountants were in high demand during the tough times, as companies tried to restructure their debt, restore financial stability or manage insolvency,’ says Naa Dei. ‘The rebound holds even more promise for the profession.’

‘National laws require foreign companies to bring in local financial professionals’

Marfo has started to see a pick-up in interest from foreign multinationals. ‘We already have some top global businesses here, in everything from vehicle manufacturing to garment making and agriculture,’ he says. ‘As this gathers pace we can expect an increased appetite not only for advice on entering Ghana’s market but also for ongoing support. National laws require foreign companies to bring in local financial professionals – a top ticket for qualified accountants.’

Even more importantly, the mood has been improving among homegrown firms – the micro, small and medium enterprises that form about 70% of Ghana’s economy, while demand for qualified accountants could also be set to increase at a host of Ghanaian incubators. The same is true of the government’s Ghana Enterprises Agency, which offers financial and technical support to high-growth potential SMEs to accelerate their growth: ‘They are a huge source of hiring of accountants,’ says Naa Dei.

When startups graduate to the next stage of development, as incubators sell their stakes, companies can still access high-quality financial services without adding permanent staff. ‘Smaller accounting and legal firms can provide a package of services – wrapping in tax, payroll and financial reporting – that is within the budget of businesses that have just got off the ground, and don’t have the resources for a permanent finance department,’ says Naa Dei.

Finally, there are long-term drivers of employment growth in financial services. As the Ghana Card makes it harder to evade taxes, more companies and individuals are seeking advice on how to remain compliant.

The upshot, says Marfo, is that qualified and experienced accountants are in high demand across the board. ‘The key for aspiring young professionals,’ he adds, ‘is to make sure they are getting experience as well as credentials.’ One without the other, he explains, could leave them out in the cold.