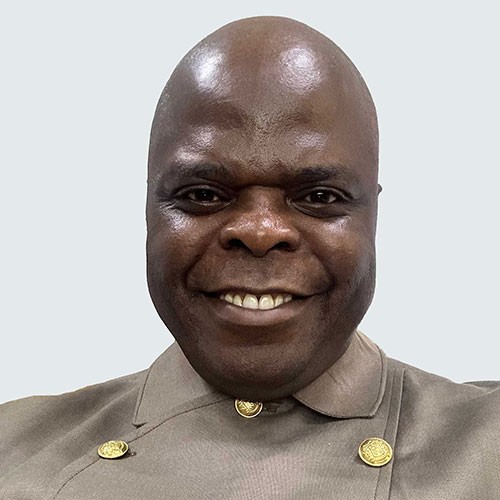

Lilliane Rumanyika FCCA has business in her blood. While growing up in the Ugandan capital of Kampala, her parents’ shop – which sold imported apparel and footwear from the UK – was a second home, she recalls.

‘As children we spent a lot of time there, doing customer service, stocktaking, taxes – this is where the idea for a career in business took shape,’ she says.

That childhood experience paved the way for an exciting and varied career that has taken Rumanyika across the globe and prepared her for her most challenging role yet: as global CFO of Kenya-based non-profit organisation Inkomoko. Operating across Eastern and Central Africa, Inkomoko supports thousands of micro, small and medium enterprises including those of refugees, with capacity building, access to finance, market linkages and advocacy, and is the continent’s largest lender to refugees.

‘I wanted to make an impact, to use my skills to help those less privileged’

Rumanyika’s current role, which she took up in 2023, fulfils a long-held ambition. ‘There were many sleepless nights, questioning whether it was the right decision,’ she admits, ‘but deep inside I knew it was answering a desire I’d had for a long time: to make an impact on people’s lives, to use my skills to help those less privileged, and to give back to Africa.’

CV

2023

Global CFO, Inkomoko, Kenya

2017

Director in global finance and Caribbean regional chief accountant, Scotiabank, Canada

2010

Manager in global finance, then various roles, Scotiabank

2009

IFRS Standards consultant, Resources Global Professionals, Canada

1997

Assurance associate, then assurance manager, PwC, Uganda

Top of her to-do list now is planning for 2025 and beyond, and putting in place processes to solidify the finance and IT functions. ‘Financial stability is key, so planning is top of my agenda right now,’ she says. ‘We need to narrow down our budgets, get them approved way ahead of time, and align them with our goals so we can kick off 2025 on a high note and maximise our impact by the year’s end.‘

Ensuring that Inkomoko is fully prepared to meet its ambitions is crucial, Rumanyika says. ‘2024 has already been a big year – we’ve expanded within Kenya, Ethiopia and South Sudan, and also entered into Chad, increasing the numbers of people we’re working with and the amount of funding we’re providing. As the organisation continues to scale, I want to implement processes and systems that improve efficiencies and impact the final beneficiary,’ she says.

‘I tend to think the straight path or easiest route is not the best’

Confronting challenges

A desire to face down challenges is a theme that runs throughout Rumanyika’s career. ‘I tend to think the straight path or easiest route is not necessarily the best,’ she says. ‘With accounting, I figured that there must be a good reason why it’s difficult. Then, over time, it started to make sense, and eventually it simply became really interesting.’

After her early experiences in her parents’ shop, at high school Rumanyika chose courses that would pave the way to a business degree and her first taste of accounting. However, this wasn’t without some teething problems.

‘The idea of debits and credits was completely new to me; it was a different world,’ she recalls. ‘But when it came to choosing a specialism after year two, I took accounting on as a personal challenge. I did find it interesting, but I also wanted to do something that I wasn’t entirely comfortable with.’

On completing her accounting degree at Makerere University in 1997, she was one of just eight out of hundreds of student applicants hired for a graduate position in audit and assurance with PwC in Uganda. At that time, the professional qualification of choice in Uganda was issued by the Institute of Certified Public Accountants of neighbouring Kenya, but Rumanyika had other ideas. ‘A few of us had heard of ACCA, so we lobbied to do it and got our way,’ she says.

Continent to continent

However, rather than study while working at PwC, Rumanyika opted to pursue the ACCA qualification on a full-time basis in London after a conversation with a friend. ‘I really liked the idea of this; it was a lot of pressure working full time then studying for exams,’ she recalls. ‘I really wanted to pass first time, so I resigned and moved to the UK in 1998 to study at Emile Woolf International – and I loved it.’

‘My clients were complex financial entities on Wall Street, so the ACCA training prepared me’

Armed with the ACCA qualification, two years later she returned to Uganda and to audit at PwC. But not for long; in 2003 she was seconded to New York, and the value of the qualification came to light once again. ‘My clients were complex financial entities on Wall Street, so the foundation, the knowledge and the training provided by ACCA prepared me well for such a change,’ she recalls.

Having completed the two-year secondment and returned to Uganda, Rumanyika figured that staying put for a while would be best for her young family. But then in 2009, a Canada-based friend alerted her to the country’s need for IFRS Standards-proficient professionals to help drive adoption, which was slated for 2011, and she was on the move again, unable to resist the opportunity.

Inkomoko

Inkomoko was founded in 2012 and currently operates with over 500 staff out of 30 offices in five countries – Chad, Ethiopia, Kenya, Rwanda and South Sudan. So far, it has provided US$20m in capital to 59,000 clients (creating 56,000 jobs), and the organisation’s ambition is to have helped 550,000 small businesses (creating 825,000 jobs) across eight countries by 2030.

Relocating proved smooth sailing. ‘ACCA had an agreement with the Certified General Accountants Association of Canada – now part of CPA Canada – and, after a little reading and an online test, I became a member. I landed my first job within three weeks of arriving,’ she says, with a satisfied air.

‘I was approaching 50 and asking the question: what do I want to do next?’

Rumanyika spent a year as an IFRS Standards consultant with Resources Global Professionals before landing a global finance role at Scotiabank, where she stayed for nearly 14 years and rose to director in global finance and regional chief accountant. Starting off in the accounting policy team at head office, she was part of an influx of finance professionals engaged to lead the adoption of IFRS Standards at the bank. ‘Being at head office was really interesting,’ she says. ‘I was working with corporations across Canada, the US, Latin America, the Caribbean and Asia.’

Time to reflect

During her time with Scotiabank there were many highlights, not just implementing IFRS Standards, but also systems, transactions, mergers and divestitures, and financial instruments reporting. Perhaps most noteworthy was her last role with the bank, when as regional chief accountant for the Caribbean, she oversaw around 17 countries.

Having already achieved so much, it would have been easy to stay on with Scotiabank. But Rumanyika realised she wanted more. ‘I’d done so many things – implemented systems and policies, worked in transactions and financial reporting,’ she says, ‘but something was lacking.

‘I was approaching 50 and asking the question: what do I really want to do before I retire? What impact do I want to make? And that’s when I started to increasingly think of Africa.’

Having made the move, she has no regrets. ‘It feels right to be back in Africa, and it is fulfilling to see the impact Inkomoko is having on communities. As I begin each day, I am motivated by the difference we are making, changing lives and getting people out of poverty.’