The CFO role across Africa has rarely been more demanding – or more influential. From navigating macroeconomic volatility and regulatory reform to embedding digital transformation and sustainability, today’s finance leaders are expected to be strategists, stewards and shapers of long-term value.

Insights from the winners of this year’s ACCA Africa CFO Awards, announced at the Africa Members Convention in Mombasa, Kenya in December, show that while their contexts differ, their definitions of excellence converge around a set of hard-won, experience-led qualities.

Rather than abstract theory, their reflections are grounded in lived reality – from public-sector accountability to financial inclusion, logistics, sustainability and micro, small and medium enterprise (MSME) growth.

‘Trust is the CFO’s real currency’

Custodians of confidence

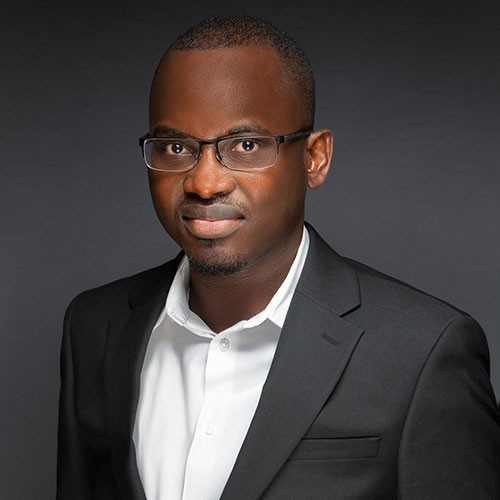

For CFO of the Year and Corporate CFO Award winner Ebrima B. Sawaneh FCCA from Gambia, integrity is not a line in a code of conduct but the bedrock of effective financial leadership. ‘Trust is the CFO’s real currency,’ he says. ‘It becomes even more critical when navigating uncertainty and competing priorities.’

The CFO/COO of Arise Ports & Logistics (Gabon and Côte d'Ivoire), Sawaneh frames the CFO as a custodian of confidence, particularly when difficult trade-offs must be made. ‘Outcomes are never achieved alone,’ he reflects, noting that strong governance, discipline and teamwork sit behind every result. In volatile environments, he argues, credibility is built through consistency: ‘You learn to stay close to cash, plan for multiple scenarios, report transparently to the board, make tough decisions early and build teams that can execute consistently even when conditions change.’

That trust, once earned, allows the CFO to influence strategy rather than simply report on it.

Beyond the back office

MSME CFO Award winner Obianuju Nwaobi Onyekwere FCCA from Nigeria is clear that technical competence alone no longer defines CFO effectiveness. ‘The CFO role has changed significantly over the years. Today, it’s no longer enough to be technically sound,’ she says. ‘The CFO is a strategic partner in growth, a co-pilot to the CEO, beyond the back-office function.’

Currently CFO of Manifold Computers, Onyekwere’s approach is rooted in confronting complexity head-on. ‘I am willing to tackle big, uncomfortable business problems – the ones that sit in the “white spaces”,’ she explains. These are issues that ‘get postponed, debated endlessly or quietly ignored’, yet often represent the greatest source of value leakage.

By introducing ‘structure, clarity and accountability into complexity’, she argues, CFOs can convert longstanding challenges into sustainable improvement – a mindset particularly critical for fast-growing African businesses.

‘I am willing to tackle big, uncomfortable business problems’

Commercial curiosity

For Financial Services Sector CFO Award winner Mark Muoki Mulatya ACCA from Kenya, a defining trait of the modern CFO is what he calls intrapreneurship. ‘A good CFO today must be fundamentally value driven – focused on long-term value creation rather than short-term financial outcomes,’ he says.

Mulatya, who is COO of Sanlam Investments East Africa, believes CFOs must think like business builders. ‘We are expected to challenge the status quo, identify opportunities for growth and value addition, enable innovation and deploy capital in ways that support sustainable outcomes,’ he explains. In his own context, that includes advancing financial inclusion through products that serve diverse African markets.

Crucially, he rejects the idea of the CFO as a passive risk manager. ‘The CFO should be a catalyst in shaping the organisation’s future, not merely responding to it,’ he says.

Calm judgment

Sustainable Finance Leadership CFO Award winner Mojtaba Siahkoohian FCCA highlights judgment as the CFO’s most tested skill. ‘The job now is about judgment in a fast-moving environment,’ says the Zambia CFO of Northern Coffee Company. ‘Costs shift, currencies move, standards evolve, stakeholder expectations change and risks show up without warning.’

For him, leadership is as much emotional as analytical. ‘When people feel pressure, numbers become emotional,’ he notes. ‘Empathy, fairness and consistency are not soft skills; they are leadership tools.’

Siahkoohian also points to the pace of everyday change as a defining challenge. ‘You can wake up to a currency swing that changes costs immediately, a sudden change in freight availability or new reporting requests from stakeholders,’ he says. The CFO’s task is to ‘respond fast without weakening governance or long-term thinking’.

‘When people feel pressure, numbers become emotional’

Digital fluency

For Public Sector CFO Award winner, Innocent Gumbochuma ACCA, digital transformation is now inseparable from the CFO remit. ‘Today’s CFO must be far more than a traditional financial custodian,’ he says. ‘Digital fluency is essential for improving insight, agility and accountability.’

Yet the CFO of the South African Qualifications Authority is equally clear that transformation must be controlled. ‘The opportunity is significant, but it must be matched with strong discipline around governance, cybersecurity and data integrity,’ he explains. His experience delivering clean audits in the public sector has reinforced that technology should strengthen trust, not undermine it.

‘Driving digital change in a context that resists it is a real challenge,’ he adds, ‘but sustaining excellence under tightening budgets requires smarter systems, not just harder work.’

‘The modern CFO bridges numbers with human stories’

People-centred leadership

Young CFO Award winner, Robinah Siima FCCA, CFO at Finca Uganda, places people at the centre of financial leadership. ‘The modern CFO bridges numbers with human stories,’ she says. ‘Empathy builds trusted relationships, and those relationships are what allow strategy to land.’

Working in microfinance, she sees first-hand how financial decisions affect lives. ‘My empathetic approach helps me connect with teams at every level, fostering high trust and collaboration,’ she explains. That human connection, she argues, directly improves compliance, performance and retention.

Siima also links leadership style to inclusion. ‘Heart-led leadership yields sustainable results,’ she says, particularly in environments serving vulnerable entrepreneurs. ‘Walking the journey with people turns financial strategy into real impact.’

Leadership with wider impact

What unites these award-winning CFOs is a shared belief that finance leadership carries responsibility beyond organisational boundaries. Whether strengthening public trust, supporting MSMEs, advancing sustainability or expanding financial inclusion, each sees the CFO role as a platform for long-term impact.

As Onyekwere puts it: ‘When finance is done right, it becomes a quiet but powerful force, unlocking opportunity and strengthening opportunities.’ Across Africa’s diverse economies, these CFOs demonstrate that technical excellence matters, but it is judgment, integrity and human leadership that ultimately define greatness.

More information

See AB coverage of sessions at ACCA’s Africa Members Convention: ‘Building a sustainable workforce’ and ‘Scrutiny-proof sustainability’