Pablo Picasso is reputed to have said that ‘good artists copy, great artists steal’. There is no record of Picasso hosting accounting seminars, but I think today’s accountants can learn from this aphorism.

There are many ways to improve the readability of annual reports without paying for expensive consultants. All it takes is a willingness to steal good ideas from the tiny number of companies that are genuinely innovative.

There are often interesting nuggets buried in accounting policies

I have read thousands of annual reports and almost all of them have one thing in common: a complete lack of innovation. I am not talking about the front of the report, with the glossy photographs, but the financial statements. I know that the preparers have to comply with all the appropriate standards, but there is still lots of scope for creativity. As I wrote in AB recently, the starting point should be to look at the report from a user’s perspective.

Bin the boilerplate

Consider the statement of accounting policies. Most of this is uninformative boilerplate, which is both turgid and difficult to navigate. Nonetheless, it is a mistake for the reader to bypass it completely. There are often interesting nuggets buried in the text, such as the treatment of acquisitions or intangible assets.

I want to know whether a company capitalises development costs and the length of any amortisation period. For a company that sells its products via leases, I want to know exactly how the leases are treated in both the income statement and balance sheet. The problem for the reader is that the relevant information is usually split between the note on tangible fixed assets and the statement of accounting policies. The information is all there, but it’s difficult to process.

As with many reporting issues, there is a simple way for the report writer to address this without breaching any standards. Simply remove the text on leases from the accounting policy statement and put it into the note on tangible fixed assets. At a stroke, you have a much more complete and informative note that actually helps the reader understand what is going on. The note is also likely to be drafted better, as any errors or inconsistencies should be immediately obvious.

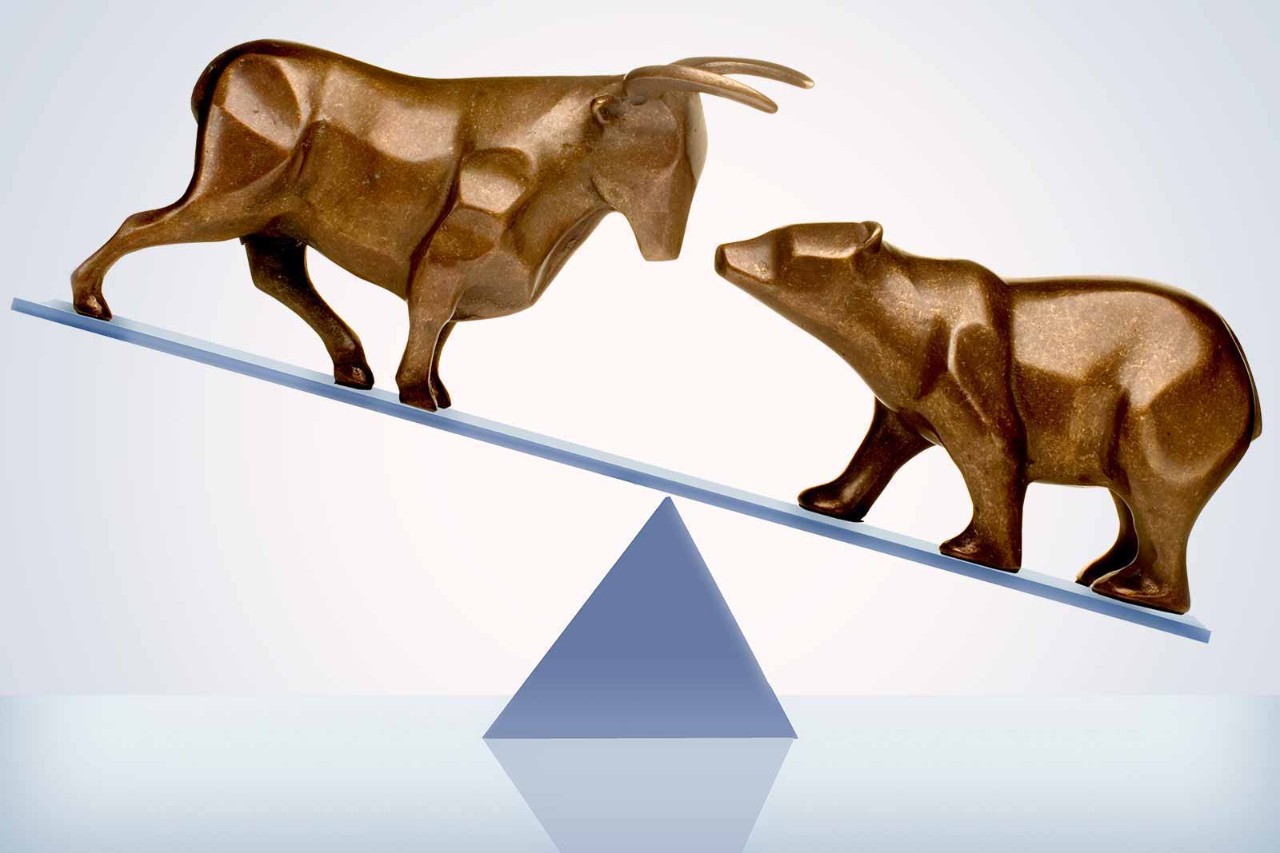

The gold star for innovation in financial statements goes to Volvo

A very similar point can be made about risks and critical judgments. As with accounting policies, risk statements tend to be 90% boilerplate and 10% informative. The interesting parts often relate to a specific element of the accounts. For example, a critical part of truck leasing is the treatment of residual value risk. This deserves to be very visible in the relevant note and not buried somewhere else.

It doesn’t have to be this way. Some companies have torn up the status quo and produce notes that are coherent, comprehensive, easy to read and informative.

Volvo gets it

My articles are frequently critical, but I am always happy to recognise excellence. The gold star for innovation in financial statements goes to Swedish truck-maker Volvo. Volvo has broken out many specific policies and risks and relocated them to the relevant note. This may be only a minor revolution, but it transforms the reader experience. Some of the issues are still complex – selling vehicles via leases is never going to be simple – but at least all the information you want is in one place.

For example, the note on revenue recognition starts with a detailed description of accounting policy regarding trucks that are sold with residual value guarantees. The note also discusses the main associated risks and judgments. I wouldn’t say it’s an easy read but it’s all there.

The moral is simple: skim lots of annual reports and shamelessly steal good ideas from other companies. You have Picasso on your side.

More information

Find more investor insights in this series of AB videos, including the impact of AI on corporate reporting, the jargon around investment styles, the key players in the capital markets and how investors value a stock